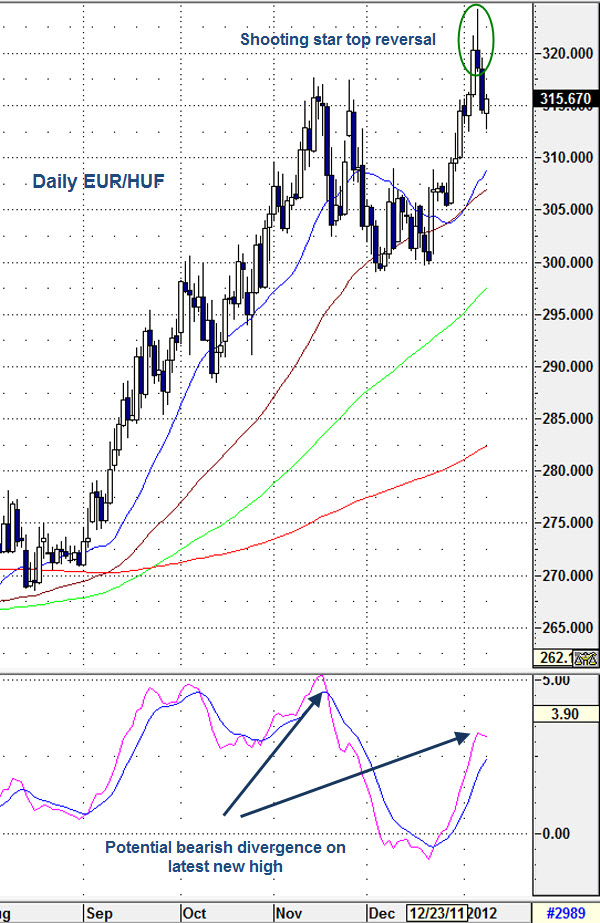

EUR/HUF has soared in recent weeks as the Hungarian government adopted legal changes that limited the central bank’s independence, among others features, which raised objections from the EU and IMF and threatened to derail an EU/IMF aid package. But this past weekend, Hungarian Prime Minister Orban indicated that there were no preconditions to the negotiations and indicated a willingness to revise or withdraw the objectionable legislation. Hungary desperately needs the EU/IMF aid package or it’ll be forced into default within a matter of months, so we think the government will be forced to retract the offending laws and open the door to a re-start of aid talks. We think this could happen in a matter of days and would very quickly lead to a sharp rebound in HUF as the prospects for a bailout improved.

On the EUR side, we only expect the EUR to weaken further on the back of deteriorating growth prospects and the ongoing debt saga. We would note the potential for weak demand at upcoming Italian and Spanish government debt auctions on Thursday Jan. 12 and also potential for a ¼% ECB rate cut on the same day. However, this strategy is currently counter-trend and subject to volatility from headline news, and so is considered higher risk.

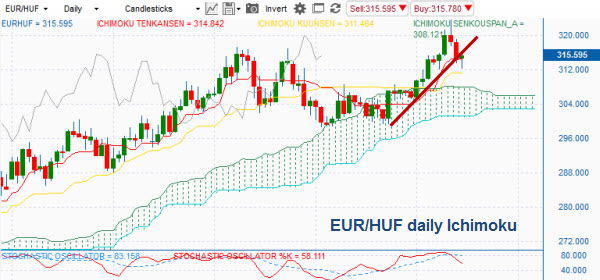

The strategy will be to sell 50% of a EUR/HUF short position at 316.50 (last approx. 315.80) and the second 50% at 319.50 for an average short rate of 318.00. A daily close below the 314.83 daily Tenkan line may suggest entering a short at the market. The stop will be on a daily close above 320.50 (just above the prior highest daily close), or if 321.50 ever trades, for a risk of around 250-350 pips or about 1%. The take profit strategy anticipates a substantial recovery in HUF, so our t/p targets are more aggressive at 303.00 (above daily cloud bottom) and 299.00 recent intra-day lows, for a potential pick-up of 1700 pips or just over 5%. We would trail stops lower beginning on a daily close below the Tenkan line.

EUR/HUF

Support

314.84 Daily Tenkan line

311.54 Daily Kijun line

308.23 Top of the daily Ichimoku cloud (21-day sma at 308.74)

Resistance

317.50 Prior daily highs

320.30 Highest daily close

324.17 Highest daily high EUR/HUF" title="Daily EUR/HUF" width="600" height="923">

EUR/HUF" title="Daily EUR/HUF" width="600" height="923"> EUR/HUF Ichimoku" title="EUR/HUF Ichimoku" width="600" height="286">

EUR/HUF Ichimoku" title="EUR/HUF Ichimoku" width="600" height="286">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Strategy-Selling EUR/HUF on EUR Woes, Hungary Relenting to Secure IMF Aid

Published 01/10/2012, 12:36 AM

Updated 05/18/2020, 08:00 AM

Weekly Strategy-Selling EUR/HUF on EUR Woes, Hungary Relenting to Secure IMF Aid

Brian Dolan, Chief Currency Strategist

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.