Coming into this week, a percentage of the market was perhaps expecting Draghi and company to be a tad more proactive next week and get back into that 'easing' cycle of theirs. However, with today's Euro inflation numbers and stellar German retail sales data a new strategy may need to be implemented. The arrival of month-end and geopolitical concerns with regard to the Ukraine was suppose to have left market risk appetite limited. Especially with the fixed income market reporting that month end consolidation had upset "flattener" attempts to search for new lows.

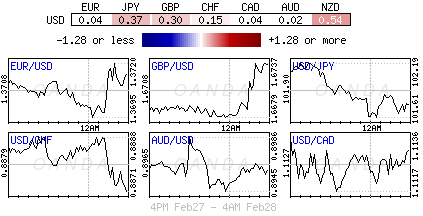

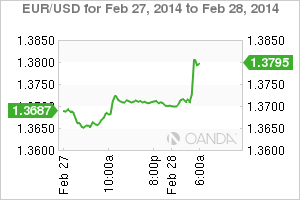

EUR CPI data has managed to put the squeeze on all those EUR short positions that have been waiting patiently for the dollar to take flight. So far, it's been an expensive exercise investing in the world's dominant currency that was supposed to garner some support from higher yields that have yet to appear in the long end of the US curve due to modest "tapering". For many, the EUR's move this morning has more to do with preserving some capital, the individuals with deeper pockets will argue that trading near new-year highs provides an interesting level to add to their already dollar long positions.

EUR/USD" title="EUR/USD" align="bottom" border="0" height="200" width="300">

EUR/USD" title="EUR/USD" align="bottom" border="0" height="200" width="300">

The 18-member single currency has maintained a hold above the psychological €1.37 level following the better German January Retail Sales data and even managed to surge to a new 2014 high €1.3808 (soon to be broken) after this months Euro-zone advance CPI data came in above expectations. German January retail sales jumped +2.5% from the previous month in adjusted terms, more than erasing the December dip (-2.1%). For Germany, low inflation, coupled with rising employment and rising income growth are the right ingredients for increased consumer consumption in Q1. Most of Germanys growth has been in the export sector, but with an increase in domestic consumer demand Q1 is looking good for the Euro-zones most dominant economy, this is also reflected in national consumer confidence levels at seven-year highs. All Draghi and fellow members require is that the regions potential hot spots continue to chip away and add to the bottom line.

EUR/USD" title="EUR/USD" height="200" width="300">

EUR/USD" title="EUR/USD" height="200" width="300">

Italy is one of the areas that are politically and economically on the back-foot. Despite being the world's ninth-largest economy, the fourth largest in Europe and the third largest in the Euro-zone, its unemployment rate is scaling frightening heights. In January, it rose to its highest level in 40-years. Despite more individuals joining the workforce, the hefty losses were among prime age adults. This is in stark contrast to the wealthier north members. Italy's official jobless rate rose to +12.9%, however, much more frightening is the youthful jobless rate climbing to +42.4% from +41.7% in December.

With the Euro-zone inflation reported unchanged this morning for February has certainly eased some pressure on the ECB to take immediate further action to support the financial system and regional growth. Draghi and his fellow cohorts historically when in doubt leave rates well alone – ECB members are not know to be aggressively proactive, instead they have been relying on Draghi's post rate announcement press conference to get that their message across. The market should be expecting more dovish rhetoric come next Thursday.

Where has this left the immediate EUR? With a new record 2014 high now in the bag some technical analysts believes the outlook seems to have flipped from "bearish the EUR to bullish" above resistance (€1.3805), if that the case then €1.39-1.40 are very much in many investors cross hairs. This will have the weaker of the EUR shorts a tad more worried despite heading into a geopolitical charged weekend. European leaders are surely not happy that their legal tender straddles such heights.