WEC Energy Group (NYSE:WEC) reported third-quarter 2016 adjusted earnings of 69 cents per share, beating the Zacks Consensus Estimate of 60 cents by 15%. Quarterly earnings also surged 19% year over year.

Thanks to the Integrys acquisition and above-average temperatures in its service territories, the company was able to deliver a strong performance in the reported quarter.

GAAP earnings in the quarter came in at 68 cents per share, compared with 58 cents recorded a year ago. The difference between GAAP and adjusted earnings is due to acquisition costs of a penny per share.

Revenues

WEC Energy’s total revenue amounted to $1,713 million, slightly below the Zacks Consensus Estimate of $1,719 million.

However, reported revenues surpassed the year-ago figure of $1,699 million.

Highlights of the Release

Residential use of electricity in third-quarter 2016 climbed 8.1% year over year. Electricity used by small commercial and industrial customers increased 3.6%. Electricity used by large commercial and industrial customers – excluding the iron ore mines in Michigan's Upper Peninsula – inched up 0.8%.

Total operating expenses in the quarter under review fell nearly 3% year over year to $1,314 million, mainly due to lower operation and maintenance expenses, and cost of sales.

Operating income in the reported quarter was $399 million, up 15.3% from $346 million a year ago.

The company’s interest expenses in the third quarter decreased 4% to $99.1 million.

At the end of the third quarter, WEC Energy Group's utilities expanded its customer base by 38,000. Wisconsin utilities added about 7,000 electric customers and 13,000 natural gas customers. The company's natural gas utilities in Illinois, Michigan and Minnesota increased its customer count by nearly 18,000.

Financial Position

As of Sep 30, 2016, WEC Energy had cash and cash equivalents of $25 million, compared with $49.8 million as of Dec 31, 2015.

As of Sep 30, 2016, WEC Energy had long-term debts of $9.1 billion, almost flat with the 2015-end level.

In the first nine months of 2016, cash flow from operating activities was $1,722 million, up 60.3% from $1,074.4 million in the year-ago period.

WEC Energy’s capital expenditure in the first nine months of 2016 was $1,000.1 million, up 26.3%.

Upcoming Peer Releases

American Electric Power (NYSE:AEP) is set to report third-quarter 2016 results on Nov 1. The Zacks Consensus Estimate for the quarter stands at $1.19.

CMS Energy (NYSE:CMS) is set to report third-quarter 2016 results on Oct 27. The Zacks Consensus Estimate for the quarter stands at 60 cents.

PG&E Corporation (NYSE:PCG) is set to report third-quarter 2016 results on Nov 4. The Zacks Consensus Estimate for the quarter stands at $1.17.

Zacks Rank

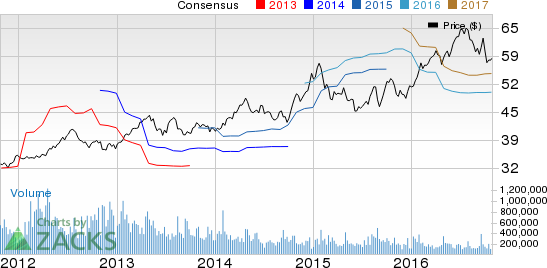

WEC Energy currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AMER ELEC PWR (AEP): Free Stock Analysis Report

WEC ENERGY GRP (WEC): Free Stock Analysis Report

CMS ENERGY (CMS): Free Stock Analysis Report

PG&E CORP (PCG): Free Stock Analysis Report

Original post

Zacks Investment Research