Watsco, Inc. (NYSE:WSO) declared that its board of directors has approved a 19% hike in the company’s annual dividend.

As of the closing price of Jul 3, Watsco’s new dividend yield would be 3.22%, up from the current yield of 2.72%. The new dividend yield is also much higher than the Building Products - Air Conditioner and Heating sub industry’s dividend yield of 0.76%.

Notably, the company declared a new annual dividend of $5.00 per share and a regular quarterly cash dividend of $1.25 on each outstanding share of its Common and Class B common stock. The increased dividend will be paid on Jul 31 to shareholders on record as of Jul 17, 2017.

Watsco’s strategy is to share increasing amounts of cash flow through higher dividends, while maintaining a conservative balance sheet with consistent capacity to build its distribution network. The company’s balance sheet remains conservative with a debt-to-EBITDA of under 1x and continues to look for M&A opportunities. Watsco expects that its cash flow will exceed net income for full-year 2017.

Watsco has immense growth potential in the replacement market, given an aging stock of air conditioners and heating systems in the U.S. The company will benefit from the expansion of its product offering, as well as logistical and productivity improvements.

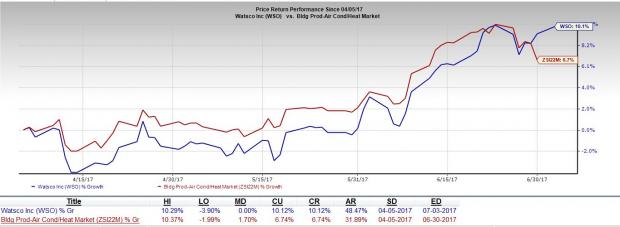

Watsco has, thus, outperformed the Zacks classified Building Products - Air Conditioner and Heating sub-industry with respect to price performance in the past three months. The stock gained around 10.1%, while the industry gained 6.7% over the same time frame.

Watsco currently carries a Zacks Rank #2 (Buy).

Other stocks worth considering in the same sector include NCI Building Systems, Inc. (NYSE:NCS) , Tecogen Inc. (NASDAQ:TGEN) and Owens Corning (NYSE:OC) . All three stocks flaunt a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NCI Building Systems has an average positive earnings surprise of 11.28% for the trailing four quarters. Tecogen generated an average positive earnings surprise of 112.50% over the past four quarters, while Owens Corning has an average positive earnings surprise of 29.81% for the last four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

NCI Building Systems, Inc. (NCS): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Watsco, Inc. (WSO): Free Stock Analysis Report

Tecogen Inc. (TGEN): Free Stock Analysis Report

Original post

Zacks Investment Research