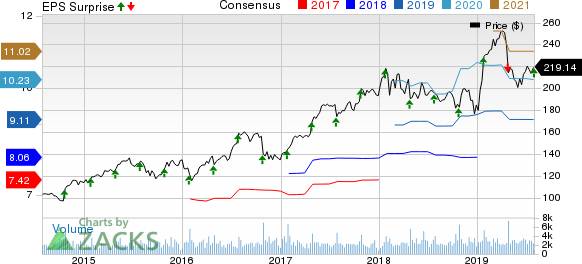

Waters Corporation (NYSE:WAT) delivered second-quarter 2019 non-GAAP earnings of $2.14 per share, beating the Zacks Consensus Estimate by 3 cents. The figure improved 10% on a year-over-year basis and 33.7% sequentially.

Net sales came in $599.2 million, up 0.5% from the year-ago quarter and 16.6% from the previous quarter. This was driven by strengthening momentum across the United States and China. Further, improved performance in the pharmaceutical market contributed to the results.

However, the figure lagged the Zacks Consensus Estimate of $602.2 million.

The company suffered from adverse effects of foreign exchange fluctuations, which had an impact of 2% on the top line. Further, weak performance in the industrial, academic and governmental market weighed on the results.

Nevertheless, the company remains optimistic about its strengthening growth initiatives and new product introductions which are likely to aid it in gaining investors’ confidence in the near term.

Top Line in Detail

Waters’ net sales figure can be categorized in four ways:

By Operating Segment: The company operates in two organized segments — Waters and TA.

Waters segment (88.6% of net sales) generated $531.12 million of sales, up 1% from the year-ago quarter. Sales in TA segment came in $68.04 million and accounted for 11.4% of the net sales. The figure reflected year-over-year decline of 1%.

By Products & Services: This division comprises three segments — Instruments, Services and Chemistry.

Instruments sales (47.9% of sales) came in $286.97 million, down 1% on a year-over-year basis.

Service sales (35.4% of the sales) were $211.89 million, improving 2.2% year over year.

Chemistry sales (16.7% of the sales) were $100.29 million, advancing 1.2% from the year-ago quarter.

Moreover, service and chemistry sections together generated recurring revenues of $312.19 million, up 2% from the year-ago quarter.

By Markets: The company serves three end markets — Pharmaceutical, Industrial and Governmental & Academic.

Pharmaceutical market (58.4% of net sales) generated sales of $350.14 million, up 3.5% on a year-over-year basis.

Industrial market (29.4% of sales) sales came in $176.11 million, down 4% from the year-ago quarter.

Governmental & Academic (12.2% of sales) generated $72.91 million of sales. The figure decreased 1.7% year over year.

By Geography: This company’s operating regions include Asia, Americas and Europe.

Asia (39.9% of net sales) generated $238.83 million of sales, up 1% on a year-over-year basis.

Americas (34.5% of sales) generated $206.77 million of sales, improving 4.4% year over year.

Europe (25.6% of sales) generated $153.55 million of sales, down 4.7% from prior-year quarter.

Asure Software Inc (ASUR): Free Stock Analysis Report

Rosetta Stone (RST): Free Stock Analysis Report

Waters Corporation (WAT): Free Stock Analysis Report

Alteryx, Inc. (AYX): Free Stock Analysis Report

Original post

Zacks Investment Research