Wall Street indices were in freefall yesterday, posting losses of around 5%, as CoVid-19 spread more quickly outside China. The state of California reported its first confirmed case of community transmission, while more companies are warning of performance hits in Q1.

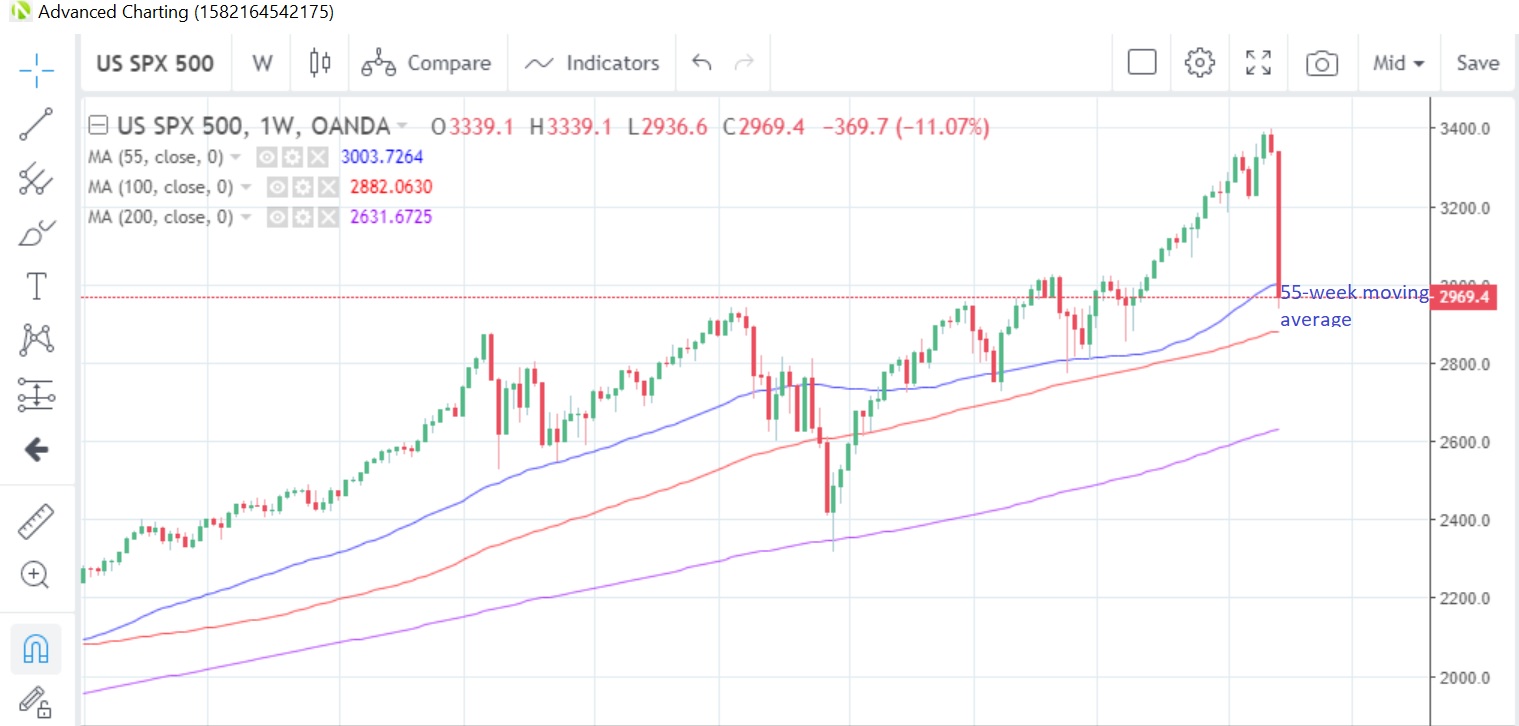

US30USD Weekly Chart

The US30 index hit the lowest since Oct. 10 early this morning after extending losses to a sixth day yesterday. It’s on track for the biggest weekly loss since October 2008.

The index looks set to close below the 55-week moving average at 3,003.7 for the first time since May last year

U.S. personal income and spending probably both rose 0.3% in January, according to the latest survey. The Chicago PMI for February is expected to improve to 45.9 from 42.9 last month.

DE30EUR Daily Chart

The Germany30 index looks set to extend the recent losing streak to a seventh day today amid virus fears.

The index has touched the lowest since Oct. 10 since the U.S. close and is facing the biggest weekly loss since the October 2008 crash

German consumer prices are seen holding steady at +1.7% y/y in February, according to the latest survey.

XAU/USD Daily Chart

Despite the slump in equity markets, gold has not been able to benefit as a safe haven as a firmer U.S. dollar works against the trend

That said, gold is on a three-day uptrend and is working to recoup Tuesday’s losses. Monday’s high of 1,690 remains an upside barrier

The lust for safe-haven assets has pushed US Treasury yields to record lows and futures markets are now pricing in the possibility of three Fed rate cuts by year end.