Voya Financial, Inc.’s (NYSE:VOYA) second-quarter 2019 net operating income of $1.52 per share beat the Zacks Consensus Estimate by 3.4%. The bottom line improved 34.5% year over year. The results reflect continued strong organic growth in each of its core businesses.

The company’s revenues of $278 billion increased 16.8% from the year-ago quarter. However, the top line missed the Zacks Consensus Estimate by 11.5%.

Assets under management and administration were $560 billion as of Jun 30, 2019.

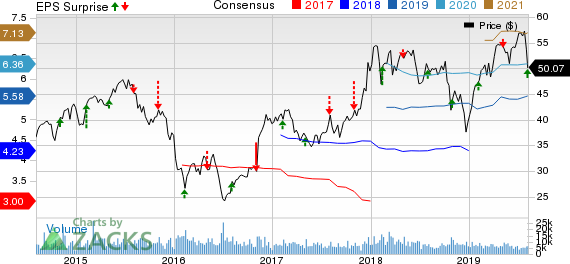

Voya Financial, Inc. Price, Consensus and EPS Surprise

Segmental Update

Retirement’s adjusted operating earnings of $180 million increased 7% year over year on the back of positive DAC/VOBA and other intangibles, higher fee-based margin primarily due to equity market growth and higher investment income, partially offset by higher administrative expenses.

Investment Management posted adjusted operating earnings of $41 million, down 21.2% year over year due to lower fee-based margin and higher expenses, partially offset by higher investment capital revenues

It generated $772 million of institutional net flows, reflecting strong commercial growth in the business and recorded the 14th straight quarter of positive institutional net flows.

Employee Benefits’ adjusted operating earnings were $49 million, up 40% year over year on the back of higher underwriting results primarily driven by growth in the Voluntary block as well as improvement in loss ratios of Group Life and Stop Loss, and higher investment income, partially offset by higher administrative expenses.

Individual Life’s adjusted operating earnings were $47 million, up 14.6%year over year on lower negative DAC/VOBA and other intangibles unlocking, higher investment income, partially offset by lower net underwriting gain.

Corporate incurred adjusted operating losses of $39 million, narrower than the year-ago quarterly loss of $59 million owing to a decline in stranded costs that resulted from the company's sale of substantially all its individual annuities businesses on Jun 1, 2018.

Financial Update

Voya Financial exited the second quarter with $540 million in excess capital.

In the quarter under review, the company completed its $236-million accelerated share repurchase deal and entered into a new $200-million accelerated share repurchase agreement.

Year to date, the company has bought back shares worth $646 million.

The company hiked its dividend to 15 cents, up from the prior payout of 1 cent. This is in line with the company's plan to increase the dividend yield to at least 1%.

Zacks Rank

Voya Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Life Insurers

Second-quarter earnings of Lincoln National (NYSE:LNC) and Torchmark (NYSE:TMK) surpassed the Zacks Consensus Estimate while that of Sun Life Financial (TSX:SLF) missed the same.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

Voya Financial, Inc. (VOYA): Free Stock Analysis Report

Lincoln National Corporation (LNC): Free Stock Analysis Report

Torchmark Corporation (TMK): Free Stock Analysis Report

Original post

Zacks Investment Research