Vishay Intertechnology, Inc. (NYSE:VSH) is leaving no stone unturned to enhance its product offerings to the optoelectronics customers.

The company’s latest launch of new series of optocouplers — VOT8025A and VOT8125A — reflects its efforts in this regard. Vishay aims at offering robust noise isolation for home appliances and industrial equipment with the help of the compact DIP-6 and SMD-6 packages, and high off-state voltage in these optocouplers.

Moreover, both optocoupler series are well equipped to strengthen safety margins in one-phase applications, while maintaining required level of voltage headroom for three-phase applications with the aid of their high off-state voltages.

The new optocouplers can be primarily utilized in many applications such as power TRIAC drivers in solid-state relays, valve control in household appliances, three-phase air conditioners, boilers, thermostats and industrial motor control, to name a few.

Growth Opportunities

Vishay’s latest move positions it well to capitalize on the increasing demand for factory automation systems, and growing proliferation of electric and hybrid vehicles across the world.

Per ReportLinker, the global market for optocouplers is expected to hit $2.1 billion by 2023, at a CAGR of 4.5% between 2018 and 2023.

Further, a report by MarketsandMarkets shows that the booming global optoelectronics market is anticipated to reach $9.8 billion by 2025, witnessing a CAGR of 14.13% between 2018 and 2025.

We believe that Vishay will be able to rapidly penetrate into these potential markets with its new optocouplers, which are capable enough to control resistive, inductive and capacitive loads such as solenoids, high current thyristors, relays and motors by isolating low voltage logic from 120 VAC, 240 VAC and 380 VAC lines.

Expanding Product Portfolio

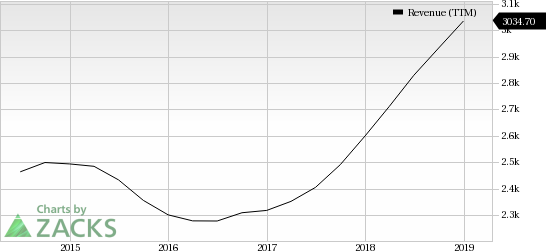

Vishay’s optoelectronics portfolio expands with its latest launch. This is likely to boost the performance of the company’s optoelectronics product segment, which in turn will drive the top line.

Apart from its optoelectronics initiatives, Vishay recently unveiled new Power Metal Strip shunt resistors, which expands its resistors portfolio.

Further, the company introduced IHLP-5050EZ-5A, which enhanced its Automotive Grade IHLP low profile and high-current inductors offerings.

We believe that strengthening product portfolio is a key growth driver for the company. This continues to help Vishay in expanding customer base and enhancing end-market performance.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Garmin (NASDAQ:GRMN) , Universal Electronics (NASDAQ:UEIC) and Trimble (NASDAQ:TRMB) . While Garmin sports a Zacks Rank #1 (Strong Buy), Universal Electronics and Trimble carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings growth rate for Garmin, Universal Electronics and Trimble is currently pegged at 7.35%, 15% and 10.5%, respectively.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Garmin Ltd. (GRMN): Free Stock Analysis Report

Trimble Inc. (TRMB): Free Stock Analysis Report

Universal Electronics Inc. (UEIC): Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH): Free Stock Analysis Report

Original post

Zacks Investment Research