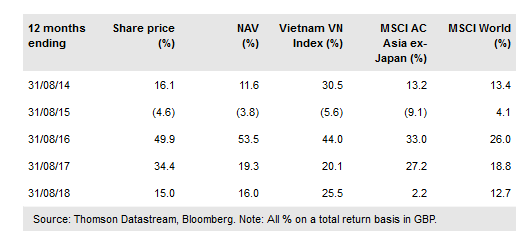

Vinacapital Vietnam (OTC:VCVOF) is one of the oldest and largest Vietnam specialist investment companies and is now a FTSE 250 index constituent. Investing across asset classes – listed and unlisted equity, private equity and real estate – VOF’s approach is differentiated by its focus on private deal sourcing, where its investment team has extensive experience. In sterling terms, VOF’s NAV total returns have been strong over the last three years. While lagging the Vietnamese stock market over one year, VOF’s NAV held up well during the 2018 market correction. The US-China trade dispute has weighed on market sentiment, but the manager believes that fundamentals remain strong and the current market level presents an opportunity for investors taking a medium-term view.

Investment strategy: Focused on private deal sourcing

VOF invests across a range of asset classes, including listed, unlisted and private equity, real estate and fixed income, preferring to invest via privately negotiated deals to secure higher potential returns. Listed equities make up two-thirds of the portfolio, but most of these holdings originated from private equity or privatisation deals. The manager takes a medium-term view, favouring a concentrated, high-conviction approach to investment selection. While focused on exposure to the domestic economy, the portfolio is well diversified by sector.

To read the entire report Please click on the pdf File Below: