US Mobility (USMO) is a cash cow. While paging use is in definite decline thanks to mobile phones, there are certain niche segments (e.g. in healthcare) where customers count on its reliability and low costs. As such, USMO generates free cash flow of over $70 million per year, against a market cap of just over $300 million. The company is also debt free, with a net cash position of almost $35 million.

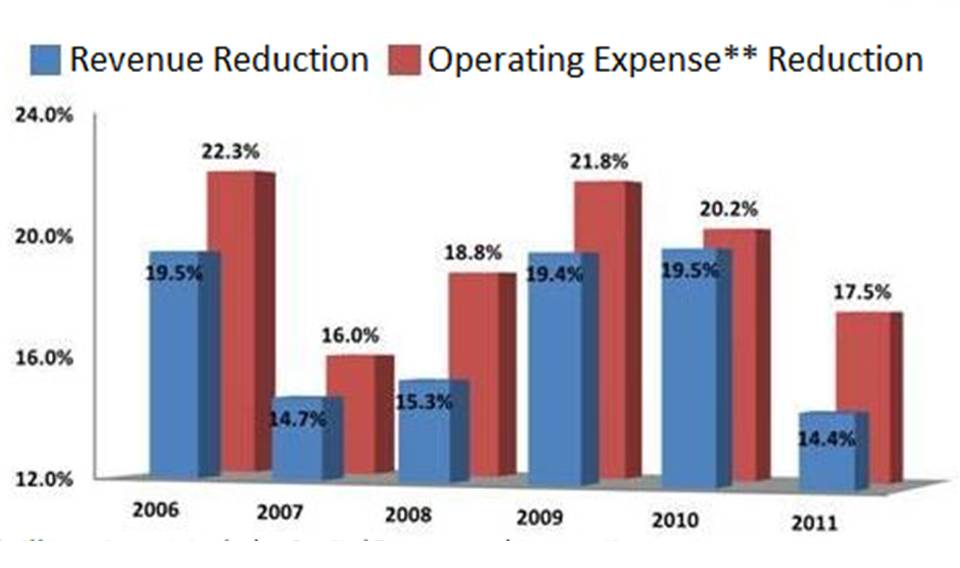

One of the reasons Mr. Market hates this company undoubtedly has to do with the declining use of this old technology. Revenue has fallen by over 15% per year for the last three years. But give management credit here, as costs have fallen faster than revenues:

This has allowed the company to generate substantial free cash flows of over $310 million (which is currently the company's market cap) in just the last four years. If management was just returning all this cash in the form of buybacks and/or dividends, this might be a no-brainer. But it's not.

Combined, insiders own less than 1% of the company, meaning management is probably more interested in its employment situation than it is in delivering shareholder value. A manager's greatest fear might just be allowing his company to shrink into oblivion, even if that might be what's best for shareholders. Management's actions in this case support this theory.

A year ago, the company dropped $140+ million on a software company to help stem the company's decline. Goodwill and intangibles of this transaction comprised a whopping $173 million (bigger than the purchase price!). This newly acquired company managed to deliver negative segment earnings for 2011, and so far has lost half a million dollars through one quarter in 2012. In addition, this is the case even though it appears the company recently shifted some revenue from its cash cow segment into this new segment, perhaps to make it look better. More recently, some management reshuffling has taken place at the newly acquired company, suggesting things aren't going well.

Unfortunately, this is a scary situation for shareholders. While the company continues to generate cash flow, who's to know what this cash flow will be used for? Management appears intent on throwing good money after bad, as sadly, their incentives are totally out of whack with what they should be.

Disclosure: No position

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USMO Purchases, MO' Problems

Published 07/18/2012, 06:52 AM

Updated 07/09/2023, 06:31 AM

USMO Purchases, MO' Problems

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.