USD/CHF Inverse Head and Shoulders?

The USD/CHF increased and is trying to recover after the last downside movement.Is trading in the green and looks determined to resume the Friday’s bullish candle. Price was rejected by a strong dynamic support and now is approaching an important dynamic resistance.

However, we may still need a confirmation that will increase further in the upcoming period. USD/CHF increased as the USDX is trading in the green after the Friday’s drop. The dollar index stays right below a dynamic resistance and below the 93.81 static resistance, only a valid breakout above these levels will confirm a large rebound.

We have a poor economic calendar today, so the rate is will be driven by the technical factors. Technically the USDX is somehow expected to increase further in the upcoming period because the behavior has changed (higher lows).

You can see that has found strong support above the second warning line (WL2) of the major ascending pitchfork and now could approach the median line (ml) of the minor descending pitchfork. A valid breakout above the median line (ml) will confirm a further increase in the upcoming period. The failure to close on the warning line (WL2) has signaled a bullish pressure, but the rate could still retest this level before will increase further. Looks like that the rate is developing an Inverse Head and Shoulders pattern, but is far from being confirmed.

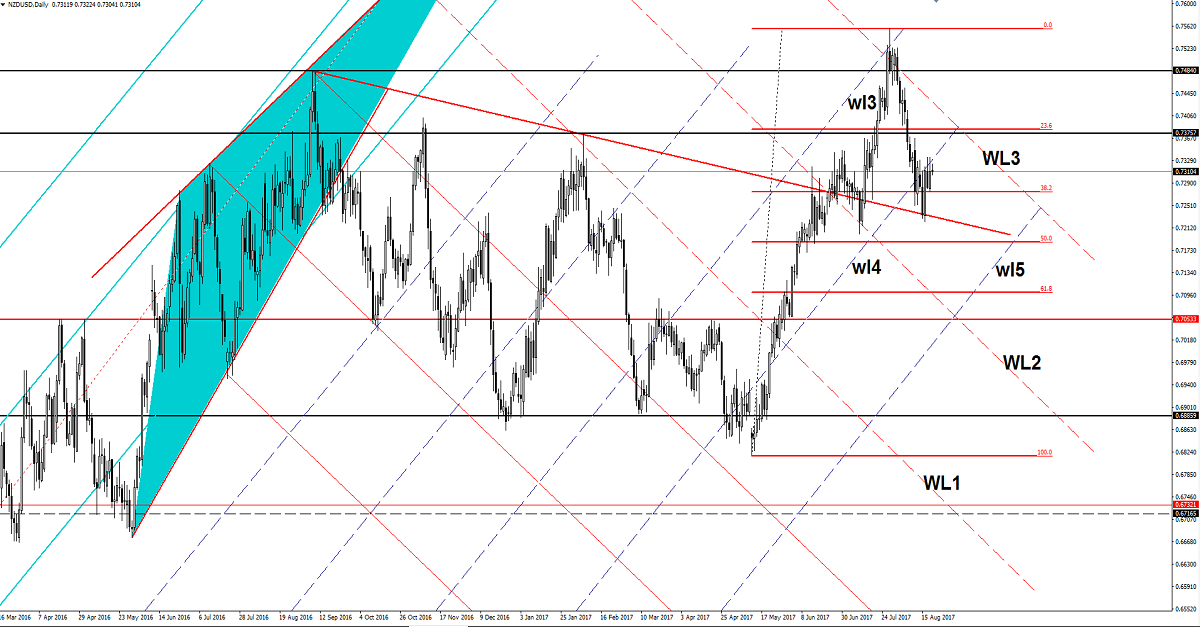

NZD/USD Downside Still In Cards

Price could drop again in the upcoming period after the retest of the fourth warning line (wl4). The USD will take the lead again if the USDX will breakout above the 93.81 static resistance. I’ve said in the previous article that we may have a further drop if will retest the warning line (wl4).

Only a valid breakdown below the 38.2% retracement level will confirm broader corrective phase, the next major downside target will be at the fifth warning line (wl5). We may have a Head and Shoulders pattern if the rate will close below the 0.7222 previous low.

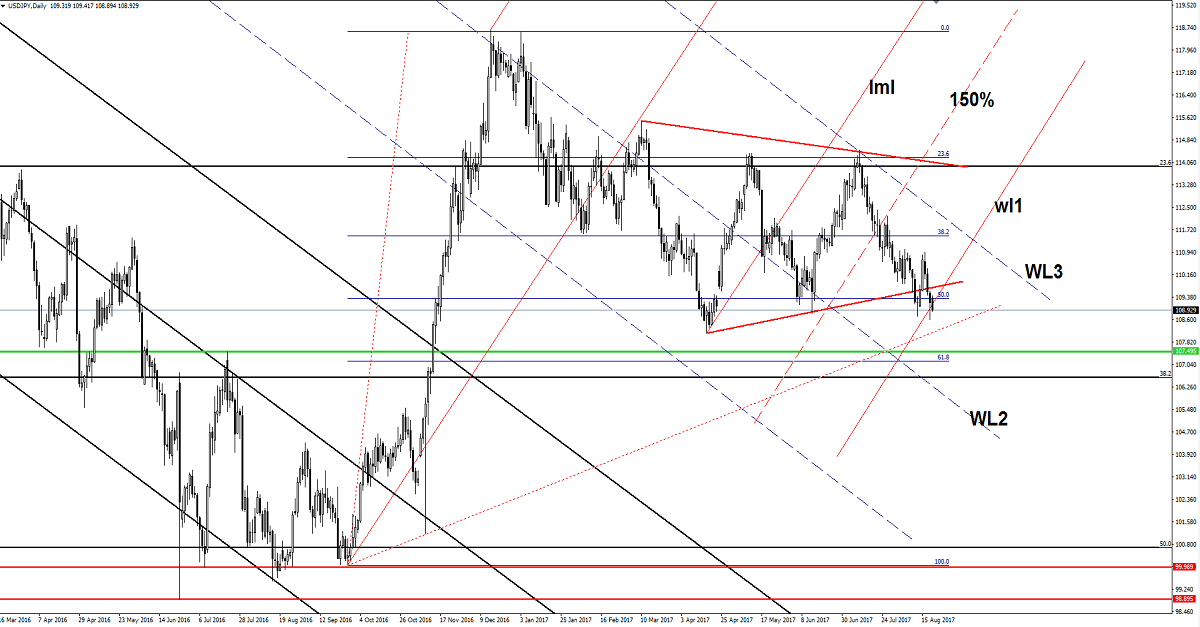

USD/JPY is this a valid breakdown?

USD/JPY is trading in the red right now and looks determined to take out the dynamic support from the first warning line (wl1) of the ascending pitchfork. The breakdown will attract more sellers on the short term, which will lead the rate towards the 61.8% and lower towards the 38.2% retracement levels.

Risk Disclaimer:Trading, in genera,l is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.