With price pressures still running at a subdued level throughout the developed world, hotter-than-expected inflation readings have been hard to come by of late. Perhaps today’s Canadian inflation data marks a turning point for that trend.

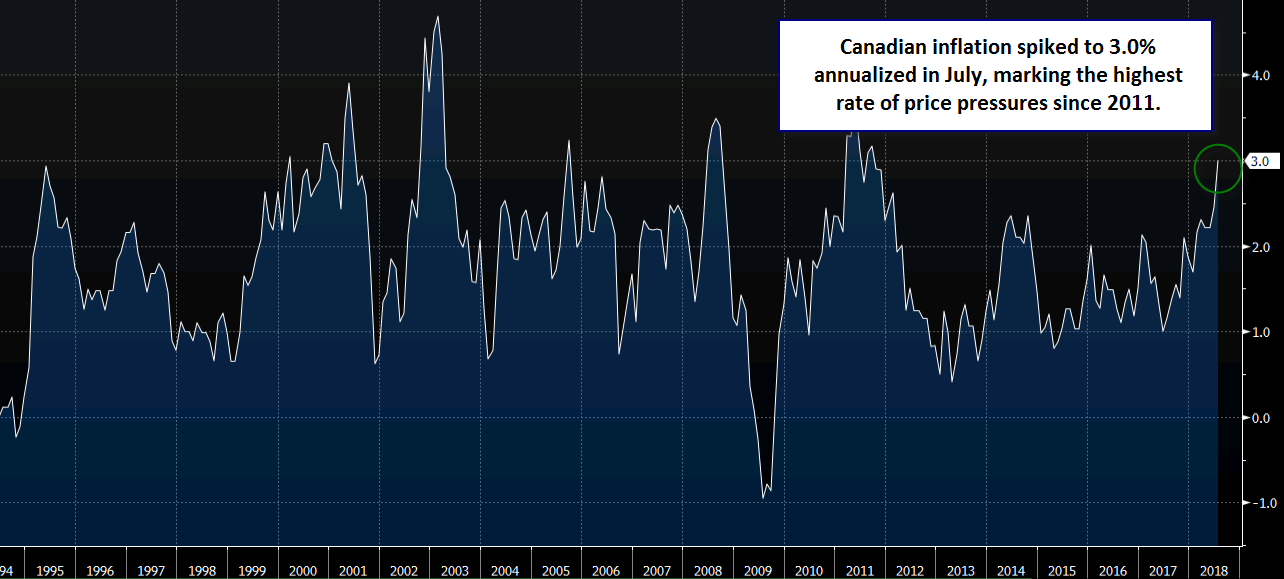

The just-released July CPI reading from Canada printed at 0.5% month-over-month (3.0% year-over-year), crushing economists’ expectations of just a 0.1% (2.5% y/y) gain. This represents the highest headline reading for the indicator since 2011:

Source: Bloomberg, FOREX.com

While the headline figure was impressive, it’s worth noting that the three “core” measures of inflation came in at 1.9-2.1% y/y, roughly in-line with last month’s readings. In other words, volatile energy prices accounted for majority of the strength in the headline reading, so loonie bulls may want to wait to see if the strength is maintained before fulling pricing in another interest rate hike from the Bank of Canada next month.

Speaking of the BOC, traders were pricing in a 23% chance of a rate hike prior to today’s data; those odds have now jumped to 33% as of writing. Furthermore, the market-implied odds of an interest rate increase by October have ticked up from 73% earlier this morning to 80% now. While the recent economic data would seem to support another interest rate rise, concerns over the ongoing NAFTA negotiations may still prompt the BOC to exercise caution, analogous to the situation the BOE faces with Brexit.

Technical View

Not surprisingly, we’ve seen the loonie surge higher on the back of the strong CPI reading. Heading into the release, USD/CAD was testing the top of its near-term bearish channel in the mid-1.3100s, but rates have since fallen off sharply. As of writing, the North American pair is trading off by 80 pips to the 1.3070 area. With fundamental and near-term technical considerations both pointing toward potential weakness in the pair, bears may now look to target the 1.2960 area, where this month’s low converges with the 50% Fibonacci retracement of the Q2 rally. If that level breaks, it could open the door for a move down toward 1.2855, the 61.8% Fibonacci retracement next. Only a break above this week’s high near 1.3170 would reverse the near-term bearish bias.

Source: TradingView, FOREX.com

Cheers