Market Brief

The Greek parliament voted in favour of bailout plan as the package was approved with 229 "yes" votes while there were 64 votes against and 6 abstentions. Prime Minister Alexis Tsipras had to count on the support of opposition parties to pass the measure as its own party turned its back on him. The future of the actual government is therefore in jeopardy as 32 members of Syriza voted against the new austerity measure, shifting from a coalition government to a minority government. The market will now focus to the European Central Bank meeting where we anticipate an increase in the threshold for ELA to Greek banks. Now that tensions surrounding the Greek situation had eased, the market will now look again at US data and try to guess when the Fed will start to rise rates.

Yesterday, Fed Chairwoman Janet Yellen testified before the House of Representatives and delivered optimistic comments, as usual, about the US economy. Unsurprisingly, Janet Yellen reiterated that a rate hike in 2015 is still on the table if economy evolves as expected. EUR/USD is testing 1.0919 support level this morning as market participants weigh the consequences of the Greek deal. However, given the lacklustre US data, we think that traders will wait for stronger signal from the US to reload long position. Philadelphia Fed Business outlook is due this afternoon, June CPI tomorrow while Janet Yellen will deliver testimony to Senate later today.

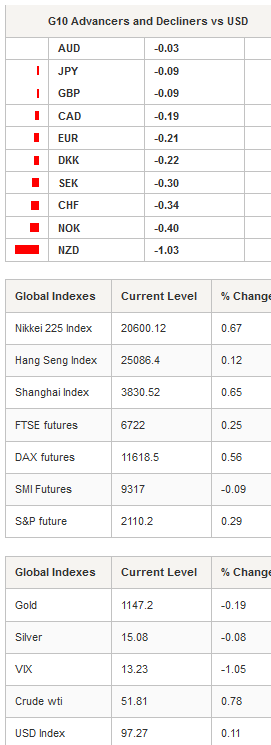

In Asia, equity markets are trading broadly into positive territory with Japan’s Nikkei adding 0.67%, Hong Kong’s Hang Seng 0.12% while Chinese shares recover from yesterday’s loss. The Shanghai Composite is up 0.65% while its tech-heavy counterpart, the CSI300, adds 1.29%. USD/JPY is testing the 124 resistance but will need fresh boost to awake buying interest above that level.

In Australia, consumer inflation expectation rose to 3.4% in July from 3% in June. The S&P/ASX 200 is up 0.59% while the Aussie reverses partially yesterday’s losses and jumped back to 0.7390 after having lost more than 1.60% in the European session yesterday amid Yellen’s upbeat speech.

In New Zealand, the Kiwi suffered further losses versus the dollar amid sharp fall in Whole Milk Powder (WMP) prices and weak CPI figures. WMP prices dropped more than 13% at the Fonterra auction to the lowest level since July 2009 as global demand collapses. Q2 2015 CPI surprised to the downside with quarter-over-quarter CPI printing at 0.4% versus 0.5% median estimate and -0.3% previous read while annualised inflation matched median forecast and rose 0.3%. We anticipate the RBNZ to ease further its monetary policy by cutting its official cash rate by another 25bps to 3% at its next meeting, in an attempt to bring inflation closer to its 2% target rate.

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.0929

S 1: 1.0819

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5627

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 125.86

R 1: 124.45

CURRENT: 123.87

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9719

CURRENT: 0.9551

S 1: 0.9151

S 2: 0.9072