The UK's retail sales data showed a larger than expected decline. Retail sales in March fell sharply 1.2% on the month. This was larger than the expected decline of 0.5% that was forecast by economists. The declines also reversed the 0.8% increase from the previous month.

Data from the U.S. showed that the Philly Fed manufacturing index of 23.2. This was weaker than the expected forecast of 20.8 and higher than the previous month's increase of 22.3.

Looking ahead, the economic calendar will see the release of the Canadian inflation data. Forecasts point 0.4% increase on the month. This was slower than the 0.6% increase compared to the previous month. Retail sales data is also expected to be released today. Economists forecast that retail sales rose at a slower pace of 0.4% compared to 0.9% increase compared to the month before.

Later in the day, the FOMC Member, Williams is also expected to speak.

EUR/USD intra-day analysis

EUR/USD (1.2340): The EUR/USD was seen giving up the gains after another test to 1.2385 failing to push prices higher. The euro currency gave up the gains and is seen pushing lower in the near term. The support level at 1.2300 is likely to be the downside target. However, in the medium term, EUR/USD could remain range bound within the current price levels. To the downside, a breakdown below 1.2300 could signal further losses.

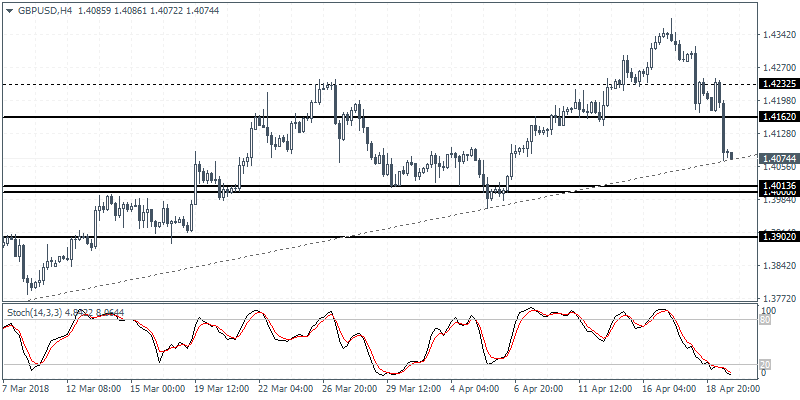

GBP/USD intra-day analysis

GBP/USD (1.4074): The British pound briefly consolidated below the 1.4232 and 1.4162 levels before giving up the gains. Price action was seen closing strongly below the main support at 1.4162. We expect the bearish trend to push prices lower towards testing the support level at 1.4013 - 1.4000 level. In the near term, any reversals are likely to be a pullback to the decline. There is a possibility for GBPUSD to retrace the losses to test the price level at 1.4162. With prices at the rising trend line, we expect to see a modest rebound in the near term with the downside bias holding strong.

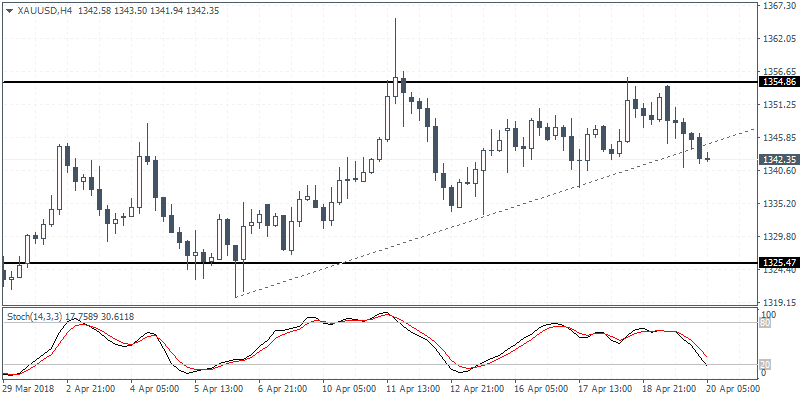

XAU/USD intra-day analysis

XAUUSD (1342.35): Gold prices were trading weak yesterday as the intraday rally to test the resistance level at 1354 failed. On the 4-hour chart, the rising trend is currently being breached. A convincing close below the minor rising trend line could signal a move to the downside. Gold prices could be seen testing the lower main support at 1325 level. However, given the ranging conditions in the markets, we expect to see some consolidating taking place. To the upside, further gains can be expected only on a breakout above 1354 level of resistance.