- The US dollar is under pressure due to mixed domestic economic data and external factors, such as China's potential support for its housing sector and a global stock market rally.

- Technical analysis shows a weakening trend in the dollar index, with key resistance at 105.00 and major support around 104.30.

- Today's CPI report is crucial for determining the dollar's short-term direction, with analysts expecting a slight moderation in inflation.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The US dollar has come under pressure ahead of the release of the US Consumer Price Index (CPI) later today owing to various factors, both domestic and external.

Tuesday’s publication of hotter PPI data for April (+0.5% m/m) failed to lift the greenback thanks largely to a sharp downward revision for March, while some price components of the PPI that feed into the Fed’s preferred core PCE measure of inflation fell.

Externally, news of China's potential support for its housing sector has supported the yuan and the likes of the Aussie, adding to the dollar’s selling pressure.

The greenback has also been held back by the ongoing global stock market rally benefitting the more risk-sensitive currencies. However, the dollar is not in a free-fall and maintains its longer-term higher highs and higher lows for now. It could easily bounce back should inflationary pressures do not come down as expected by markets.

Before discussing today’s the upcoming CPI release and its impact on the markets, let’s have a quick look at the chart of the Dollar Index first.

Dollar index technical analysis and trade ideas

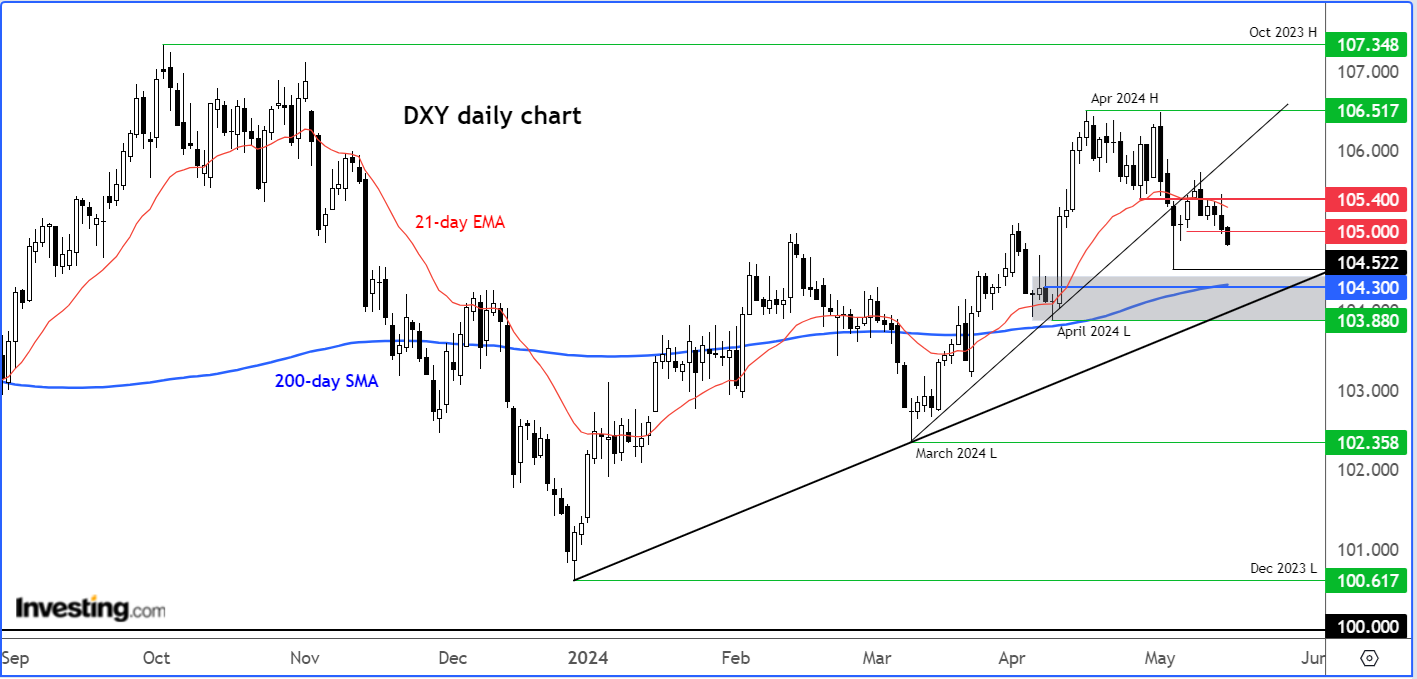

The trend on the dollar index is weakening, following the breakdown of the short term bullish trendline that had been in place since March. More recently, the dollar index has broken below its 21-day exponential moving average, which is an objective way of identifying the short-term trend.

So, the fact that we're below it means that the path of least resistance is to the downside – unless and until unless we go back above it.

In terms of resistance, 105.00 is the first level that needs to be monitored closely today. And if that level breaks, then 105.40 could be the next target for the bulls.

On the downside, the longer-term moving average, the 200-day, remains below market at around 104.30 area, where we also have a bullish trendline going back to December. The convergence of these technical factors makes the area around or near 104.30 a major support area to watch.

Meanwhile, for the longer-term trend to align with the short-term bearish view, we need to see the formation of a lower low now. This puts April's low at 103.88 into focus. This level is now the line in the sand for bullish traders. A potential break below that will create a lower low, putting the longer-term technical outlook on a bearish path.

US dollar drops ahead of CPI

Ahead of today’s publication of CPI data, a gauge of producer inflation rose more than expected as we saw on Tuesday. But downward revisions to the prior month’s data as well as more muted key categories that feed into the Fed’s preferred inflation measure – i.e., Core PCE Price Index – meant the market largely ignored the headline jump.

On a month-over-month basis, PPI increased 0.5% both on the headline and core fronts, which was stronger than expected. The hotter data was driven largely by services and follows a sharp downwardly revised 0.1% drop in March (initially +0.2%). The revisions meant that the year-over-year rate would come in line with the expectations, rising from 2.1% to 2.2%, to match its highest reading since last May. What’s more, a few of the categories in the PPI report that are used to calculate the core PCE index eased.

The mixed signals from the PPI report means it is up to the CPI report to deliver a more conclusive inflation picture on Wednesday.

What to expect from today’s CPI report?

Analysts expect CPI to have moderated in April for the first time in six months. If so, it will offer hope that price pressures will start to ease again after back-to-back upside surprises throughout 2024. CPI is projected to have eased to 3.4% year-on-year in April, down from 3.5% the previous month. On a month-over-month basis, a 0.4% increase is anticipated. The Core CPI, which excludes food and fuel, is seen rising 0.3% m/m and 3.6% y/y.

Investors are keenly awaiting the consumer inflation data to gain a clearer understanding of when and to what extent the Fed might adjust interest rates. Ahead of it, Jerome Powell reiterated that although there was little inflation progress in the first quarter, he anticipates prices will gradually decline on a monthly basis.

If he is correct, we could see a more meaningful drop in the dollar, and this could only be good news for major FX pairs like the EUR/USD and AUD/USD, as well as gold and silver. Elsewhere, the dollar bears will need to remain patient until more evidence emerges in the months ahead that inflation is on a downward trajectory towards the Fed’s 2% target.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.