In order to expands its industrial product capacity and services in the Midwest region, Universal Forest Products, Inc.’s (NASDAQ:UFPI) affiliate has acquired Pallet USA, LLC — a Hartford, WI-based wooden pallets manufacturer and supplier. However, financial terms of the deal are not yet disclosed.

Pallet USA manufactures pallets and crates, as well as provides services like heat treating, pallet removal and recycling, custom product design, delivery and managed inventory programs. Also, it distributes industrial lumber and sheet stock.

This deal will boost Universal Forest's presence in the Milwaukee area and help it serve manufacturers that have a larger worldwide presence. Notably, Pallet USA’s cost-effective wood pallet solutions will enhance Universal Forest's existing offerings.

Universal Forest's Buyout Strategy Bodes Well

Acquisitions have been strengthening Universal Forest's performance over the past several years. The company has been solidifying the product portfolio and leveraging new business opportunities with the recent buyouts. Notably, it closed one acquisition in the first half of 2019 and seven in 2018.

On Aug 15, the company acquired Northwest Paintings Inc. — a leading supplier of pre-painted building materials — and its affiliates. This deal will enable Universal Forest to expand its capacity to produce value-added siding and trim for customers in Northwest and Mountain West regions. Additionally, with the acquisition, the company will be able to strengthen its position in Northwest markets.

Going forward, these buyouts are anticipated to collectively generate additional revenues. Apart from adding businesses to its portfolio, the company believes in disposing non-core assets. Aiming at operational efficiency and making optimum use of resources, the company had divested the Medley, FL-based property in January 2018.

Our Take

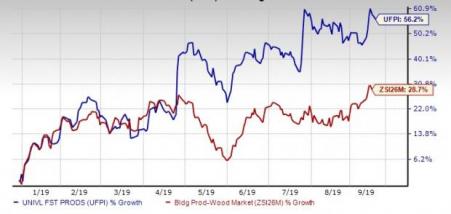

On the back of improving U.S. construction market and solid demand for repair and remodeling activities, the stock has surged 56.2% so far this year compared with the industry's 28.7% rally. The innate strength of Universal Forest — which shares space with Weyerhaeuser Company (NYSE:WY) , Louisiana-Pacific Corporation (NYSE:LPX) and Norbord Inc. (NYSE:OSB) in the same industry — is further ascertained by its Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We believe that consistent acquisitions will enable Universal Forest to strengthen the top line in the coming quarters. Overall, acquisitions contributed 1% and 3% to total unit sales growth in the second and first quarters of 2019, respectively. Notably, during the second quarter, acquisitions contributed 6% to unit sales growth in the Industrial market.

The Zacks Consensus Estimate for 2019 — which is currently pegged at $2.86 per share — has moved north over the past 60 days, depicting analysts’ optimism surrounding the company’s bottom-line growth potential. Notably, the estimate indicates 22.5% improvement from the year-ago figure of $2.33.

5 Stocks Set to Double

Zacks experts released their picks to gain +100% or more in 2020. One is a famous cutting-edge food company that is “hiding in plain sight.” Swamped with competitors and ignored by Wall Street, its stock price floundered. Now, suddenly, it acquired a company that gives it an advantage none of its peers have.

Today, see all 5 stocks with extreme growth potential >>

Weyerhaeuser Company (WY): Free Stock Analysis Report

Universal Forest Products, Inc. (UFPI): Free Stock Analysis Report

Norbord Inc. (OSB): Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX): Free Stock Analysis Report

Original post