Univar Inc. (NYSE:UNVR) logged a profit (on a reported basis) of $2.5 million or a penny per share in third-quarter 2019, down around 94.9% from a profit of $49.6 million or 35 cents per share a year ago.

Barring one-time items, earnings were 36 cents a share in the quarter, down from 40 cents a year ago. However, the same surpassed the Zacks Consensus Estimate of 35 cents.

The chemical maker’s revenues were $2,387.3 million in the quarter, up roughly 12% year over year. However, it lagged the Zacks Consensus Estimate of $2,503.1 million.

On a constant currency basis, revenues rose around 13% year over year. Contribution from the Nexeo buyout and strong performance in the Canada core industrial chemical business were offset by softness in the Canada energy sector and weaker demand for chemicals and ingredients from global industrial end markets.

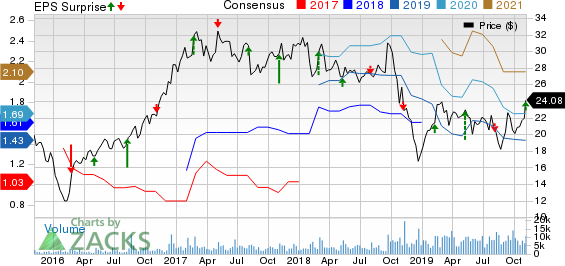

Univar Inc. Price, Consensus and EPS Surprise

Segment Review

Revenues at the USA division improved around 21.1% year over year on a reported basis to $1,591.6 million in the quarter, driven by the impacts of the Nexeo acquisition. Gross profit rose around 26.1% year over year, owing to favorable product and end-market mix.

Revenues at the Canada segment increased roughly 2.9% year over year to $284.7 million. Gross profit rose around 14.6% year over year. The segment witnessed strong performance in the industrial chemical business and certain commodity products. This was partly offset by lower volume in the energy sector.

The EMEA segment raked in revenues of $425.6 million, down around 10% year over year. Gross profit was down around 9% year over year.

Revenues from the LATAM unit rose roughly 17.7% to $117.2 million. Gross profit rose around 14.3% year over year. The segment gained from the Nexeo acquisition, strong performance in Mexico energy markets and the Brazilian agriculture sector, and cost control actions, partly offset by soft industrial demand in Brazil.

Balance Sheet

Univar ended the quarter with cash and cash equivalents of $134.6 million, up around 56.7% year over year. Long-term debt was $2,977.1 million, up around 17% year over year.

Outlook

For 2019, Univar revised its adjusted EBITDA forecast, factoring in lower-than-expected demand for chemicals and ingredients. The company now expects adjusted EBITDA of $700-$725 million compared with $725-$740 million mentioned earlier.

Moreover, Univar expects adjusted EBITDA of $155-$180 million for the fourth quarter of 2019, suggesting rise from $144 million earned a year ago.

Price Performance

Univar’s shares have gained 8.5% over a year against roughly 24.2% decline recorded by its industry.

Zacks Rank & Stocks to Consider

Univar currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kinross Gold Corporation (NYSE:KGC) , Franco-Nevada Corporation (TSX:FNV) and Agnico Eagle Mines Limited (NYSE:AEM) , each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an expected earnings growth rate of 210% for 2019. The company’s shares have surged 77% in the past year.

Franco-Nevada has a projected earnings growth rate of 39.3% for 2019. The company’s shares have rallied 46.1% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 64% in the past year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Univar Inc. (UNVR): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Original post