UK’s PM May balancing between camps

- According to media, UK’s PM May's Brexit plans could be rejected by the House of Lords on Monday, setting the stage for Wednesday’s parliamentary confrontation between Brexit hard liners and pro EU conservative rebels.

- PM May stated yesterday, that parliament should not be able to block Brexit and overturn the outcome of the referendum.

- On the other hand, a pro EU conservative lawmaker warned that the government could collapse over the issue.

- Should there be further negative headlines about Brexit, ahead of BoE’s interest rate decision we could see the pound weakening.

US-Sino trade tensions could escalate

- On Friday, President Trump unveiled a list of more than 800 strategical imports from China that would be subject to a 25% tariff, effective from July 6th escalating tensions.

- Chinese officials stated that China will respond with tariffs “of the same scale and strength” and that any previous trade deals with the US were “invalid”, as per news media.

- According to analysts, the market’s reaction was limited until now, as both US tariffs and Chinese retaliation acts were expected.

- Also, they noted that the current escalation limited USD gains and should there be further escalation, as well as a spillover of the issue, we could see world trade dampening.

- Today’s other economic highlights

- We have two speakers, namely FOMC (retiring) member William Dudley and ECB’s president Mario Draghi.

As for the rest of the Week:

- On Tuesday, RBA’s meeting minutes are to be released, as well as ECB’s economic Forum is still ongoing.

- On Wednesday, the US Current account balance for Q1 is due out.

- On Thursday, we get New Zealand’s GDP growth rate for Q1 and the star of the week, BoE’s interest rate decision.

- On a busy Friday, we get Japan’s inflation data for May, France’s, Germany’s and the Eurozone’s preliminary PMI’s for June as well as Canada’s inflation rates for May and retail sales growth rate for April.

- Please be advised that the OPEC meeting will be taking place in Vienna during Thursday and Friday and could create volatility for oil prices.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

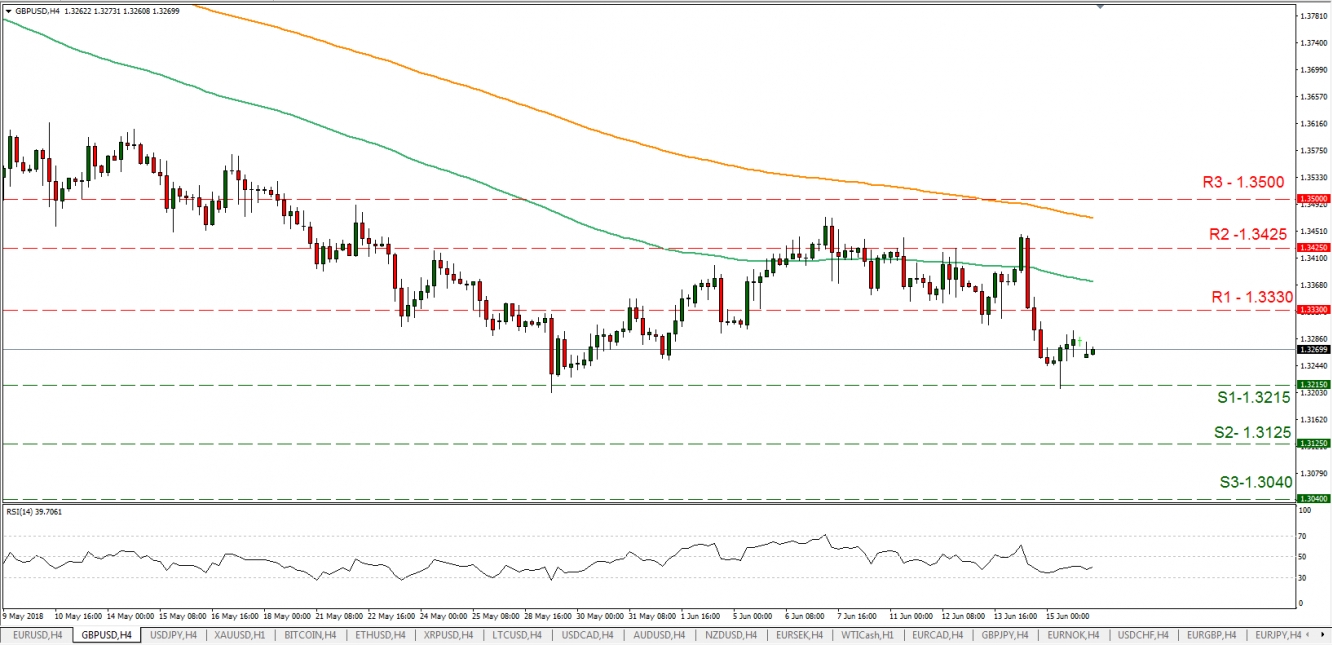

GBP/USD

·Support: 1.3215(S1), 1.3125(S2), 1.3040(S3)

·Resistance: 1.3330(R1), 1.3425(R2), 1.3500(R3)

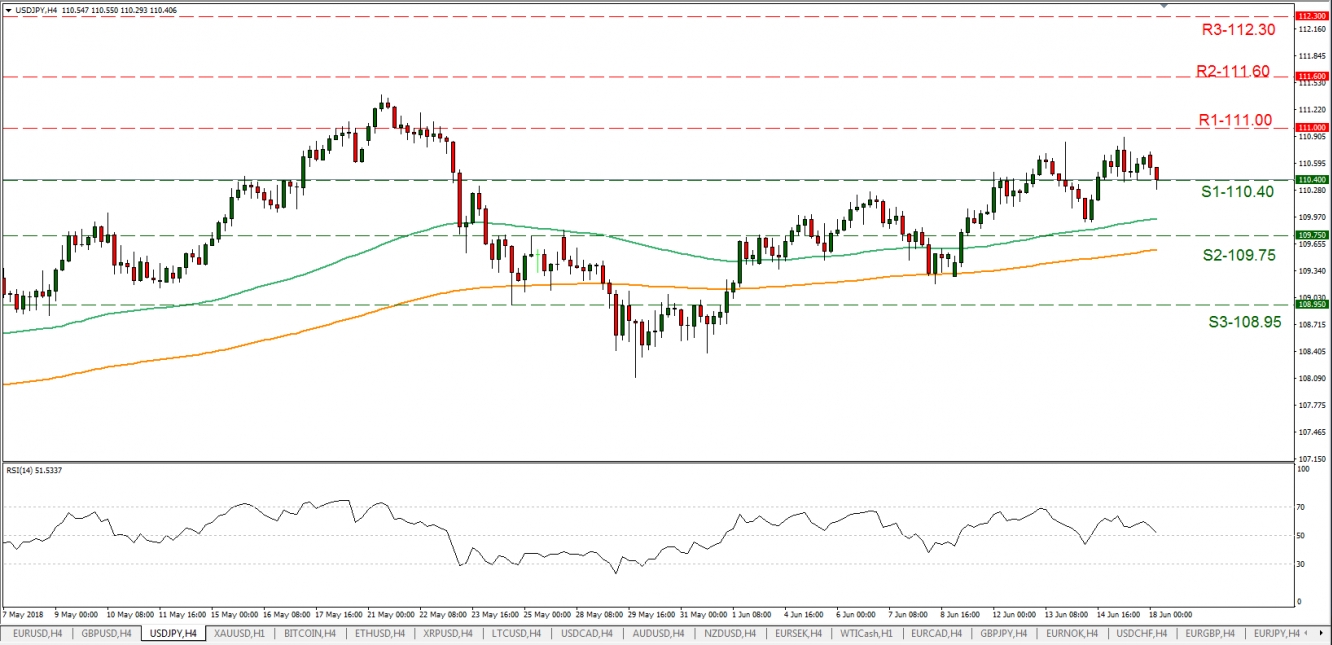

USD/JPY

·Support: 110.40(S1), 109.75(S2), 108.95(S3)

·Resistance: 111.00(R1), 111.60(R2), 112.30(R3)