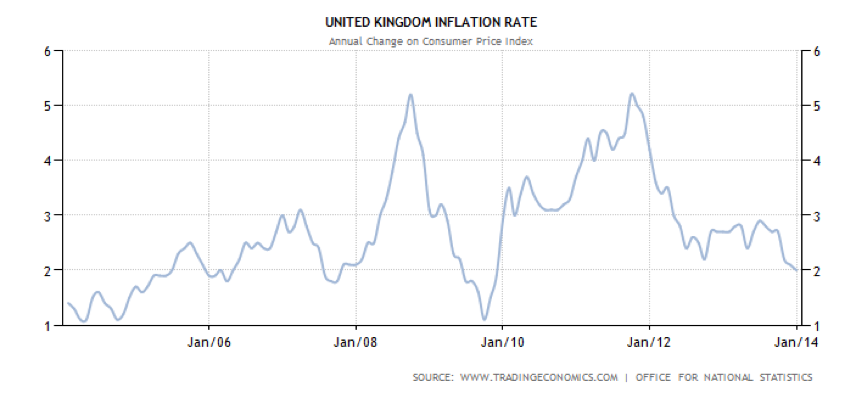

CPI in the UK dipped lower in December to 2.0%, the lowest since December 2009. The slip from 2.1% in November 2013 was primarily due to a fall in food prices from 2.8% to 1.9% in the last month.

Considering the recent price wars within the retail space, discounts in the lead up to Christmas would have been a major factor in lowering inflation.

Bank of England governor Mark Carney and his forward guidance policy plays a major part in the forward looking economy, however this dovish note will having policy makers agenda for an increase in interest rates decelerated.

In addition to this unemployment, currently at 7.4%, needs to fall to 7%, however some traders have been factoring in 6.5% before considering an interest rate rise.

Things to consider looking forward are increasing prices for gas and electricity and rising prices at the pump despite oil prices dropping. These rising prices will have a strong impact on increasing inflation. However retailers are trying to entice customers by price freezes. Households could start to feel at ease as average pay rises could start exceeding inflation.

The markets reacted as one would have expected with a sharp drop in sterling, however this has recovered since then. The GBP/USD and EUR/GBP bounced from the 1.6400 and 0.8300 handles respectively.

Overall, I feel this is hugely positive for the UK, providing this stabilises and doesn’t fall to 1.8% or below. It shows the Monetary Policy Committee is going about things in the correct way. Timescales are often overlooked, it was never going to happen overnight and this is starting to create solid confidence in Threadneedle Street. The balance in labour markets and inflation will need to be closely monitored and ensure balance is maintained.

Looking across the waters, inflation has been decreasing in many developed economies, such as the Euro. This week we have European and US CPI.

The US inflation expectations have increased significantly to 1.5%, up from 1.2% in November 2013 and highest since May 2013. This is based on the improving American economy, which is leading the way by commencing its tapering program.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UK Inflation Slips To BoE Target

Published 01/16/2014, 01:43 AM

Updated 07/09/2023, 06:31 AM

UK Inflation Slips To BoE Target

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.