UDR Inc. (NYSE:UDR) is slated to report second-quarter 2017 results on Jul 26, after the market closes.

Last quarter, the Denver, CO-based residential real estate investment trust (“REIT”) delivered in-line result with respect to funds from operations (“FFO”) per share. Results were driven by growth in revenue from same-store properties and stabilized, non-mature communities.

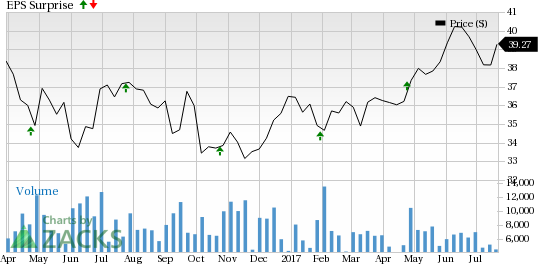

Over the trailing four quarters, the company beat the Zacks Consensus Estimate in one occasion and met estimates in the other three, with an average beat of around 0.6%. The graph below depicts this surprise history:

For the second quarter, the company projects FFO per share in the range of 45–47 cents. The Zacks Consensus Estimate for the same is currently pegged at 47 cents.

Let’s see how things are shaping up for UDR prior to this announcement.

Factors to Consider

UDR has a vast experience in the residential real estate market. The company’s superior portfolio in targeted U.S. markets and disciplined capital allocation are likely to drive results in the to-be-reported quarter.

The company is anticipated to benefit from favorable demographic trends. There is a demand for rental apartments from both new millennial households and empty nesters. Along with this, the healthy job market will likely drive demand for apartments.

However, we remain apprehensive about UDR’s performance as the company has been dealing with elevated deliveries in a number of its markets. This remains a concern as elevated levels of supply curtail a landlord’s ability to demand higher rents and result in lesser absorption. As such, concession levels are likely to remain elevated, while pricing power of UDR is expected to remain limited in the quarter.

Hence, prior to the second-quarter earnings release, there is lack of any solid catalyst for becoming overtly optimistic about the company’s business activities and prospects. As such, the Zacks Consensus Estimate of FFO per share for the to-be-reported quarter remained unchanged over the past 30 days.

Earnings Whispers

Our proven model does not conclusively show that UDR will likely beat estimates this season. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, that is not the case here as you will see below.

Zacks ESP: The Earnings ESP for UDR is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 47 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: UDR’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of an earnings beat.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that they have the right combination of elements to report a positive surprise this quarter:

Liberty Property Trust (NYSE:LPT) , slated to release second-quarter results on Jul 25, has an Earnings ESP of +1.61% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CyrusOne Inc. (NASDAQ:CONE) , scheduled to release earnings on Aug 2, has a Zacks Rank #2 and an Earnings ESP of +2.70%.

Piedmont Office Realty Trust, Inc. (NYSE:PDM) , slated to release earnings on Aug 2, has an Earnings ESP of +2.27% and a Zacks Rank #3.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

United Dominion Realty Trust, Inc. (UDR): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Liberty Property Trust (LPT): Free Stock Analysis Report

Original post

Zacks Investment Research