U.S. Steel (NYSE:X) swung to a profit in second-quarter 2017, helped by strong results from its Flat-Rolled unit. The Pittsburgh-based steel giant recorded a profit of $261 million or $1.48 per share in the quarter compared with a loss of $46 million or 32 cents per share a year ago. The results in the reported quarter include a gain of $72 million or 41 cents related to the company’s retained interest in U.S. Steel Canada Inc.

Barring one-time items, earnings came in at $1.07 per share for the reported quarter that trounced the Zacks Consensus Estimate of earnings of 40 cents.

Revenues rose roughly 22% year over year to $3,144 million in the quarter, also surpassing the Zacks Consensus Estimate of $2,975 million.

The company’s shares shot up as much as around 11% in extended trading yesterday, reflecting the forecast-topping second-quarter results.

Segment Highlights

U.S. Steel’s Flat-Rolled segment recorded a profit of $218 million in the reported quarter, a significant increase from $6 million in the year-ago quarter. Results also improved sequentially on the back of improved results in mining operations as well as higher pricing and shipments. Mining operations gained from the restart of the Keetac facility.

The U.S. Steel Europe (USSE) segment posted a profit of $55 million in the reported quarter, flat year over year. The results, however, declined sequentially due to unfavorable inventory impact.

U.S. Steel’s Tubular segment registered a loss of $29 million in the quarter, lower than a loss of $78 million a year ago. The results also improved sequentially due to higher prices, increased shipments and operational efficiency.

Financials

U.S. Steel exited second-quarter 2017 with cash and cash equivalents of $1,522 million, almost a two-fold year-over-year increase.

Long-term debt decreased 10% year over year to $2,752 million. The company generated positive operating cash flow of $242 million during the first half of 2017.

Outlook

U.S. Steel has provided an optimistic view for 2017. The company is seeing positive sentiment in the markets served by Flat-Rolled and USSE units. Its Tubular unit is also gaining from operational and cost improvements and strong market conditions.

If market conditions remain at their current levels, U.S. Steel expects net earnings of around $300 million or $1.70 per share (up from $260 million or $1.50 per share expected earlier), and EBITDA (earnings before interest, tax, depreciation and amortization) of roughly $1.1 billion for 2017.

The company believes market conditions will change in 2017 and it expects these changes to be reflected in adjusted EBITDA and net earnings.

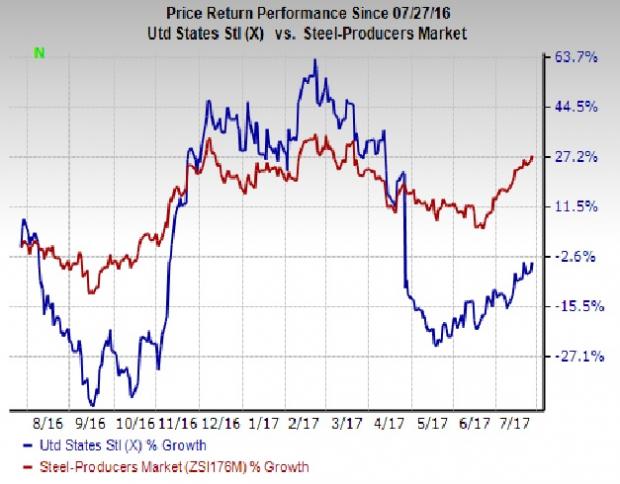

Price Performance

U.S. Steel’s shares lost roughly 4% over the past year, underperforming the 28% gain of the industry it belongs to.

Zacks Rank & Key Picks

U.S. Steel currently carries a Zacks Rank #3 (Hold).

Better-placed companies in the basic materials space include Ternium S.A. (NYSE:X) , POSCO (NYSE:PKX) and Westlake Chemical Corporation (NYSE:WLK) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ternium has an expected long-term earnings growth of 18.4%.

POSCO has an expected long-term earnings growth of 5.5%.

Westlake has an expected long-term earnings growth of 7.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

United States Steel Corporation (X): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

Original post

Zacks Investment Research