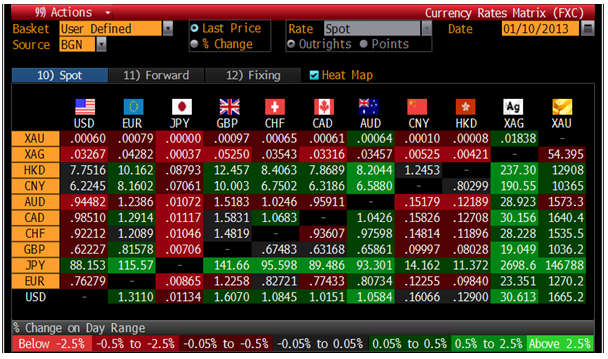

- Thursday’s AM fix was USD 1,663.00, EUR 1,269.37 and GBP 1,036.65 per ounce.

- Wednesday’s AM fix was USD 1,663.50, EUR 1,272.37 and GBP 1,035.35 per ounce.

Gold edged off $0.80 or 0.05% in New York Wednesday and closed at $1,657.40/oz. Silver climbed to $30.57 in Asia then slipped back to $30.05 by late morning in New York, but it also rallied back higher in afternoon trade and finished with a loss of just 0.07%.

President Barack Obama nominated White House Chief of Staff Jack Lew on Thursday as his choice for Treasury secretary, replacing Timothy F. Geithner. Lew’s nomination as Treasury secretary is subject to Senate confirmation.

Gold inched higher on Wednesday, as market watchers await a rate decision by the European Central Bank at 12.45 GMT. European Bank Chief, Mario Draghi’s news conference is at 1330 GMT. Investors will also view the Bank of England rate decision at 1200 GMT.

U.S. weekly Initial Jobless Claims are out at 1330 GMT. Most economists feel that the ECB will leave rates unchanged and continuing ultra loose monetary policies for gold bullish, especially in euros.

German industrial output figures came in less than forecast and rose less than forecast which showed contraction in Europe’s largest economy in Q4.

The Japanese yen was at a 2 1/2-year low Thursday on expectations that the Bank of Japan policy will take a new approach to boost inflation later this month.

The U.S. government may default on its debt in 38 days or as soon as February 15, half a month earlier than widely expected, according to a new analysis adding urgency to the debate over how to raise the federal debt ceiling.

The analysis came courtesy of the Bipartisan Policy Center (BPC), which released a revised “debt limit analysis.”

"If we reach the X Date and Treasury is forced to prioritize payments, handling payments for many important and popular programs will quickly become impossible, causing disruption to an already fragile economic recovery," said Steve Bell, Senior Director of the Economic Policy Project at BPC.

The government hit the $16.4 trillion statutory debt limit on December 31, but the Treasury Department is able to undertake a number of accounting schemes to delay when the government runs into funding problems.

The Treasury has said that the accounting schemes, known as “extraordinary measures,” ordinarily would forestall default for about the first two months of the year, though officials were clear that they could not pinpoint a precise date because of an unusual amount of uncertainty around federal finances.

If Congress does not raise the debt ceiling by the deadline, the White House has said that the nation probably will default. In a previous episode — in the summer of 2011 — officials determined that the best course would be to withhold all of a given day’s federal payments until enough money became available to pay them.

The consequences of an immediate 40% cut to government services would be brutal. Practically all government employees would suddenly see their pay checks go to zero. The government would only have enough money to pay Social Security checks and Medicaid providers on certain days. The U.S. defence budget would collapse which could lead to considerable geopolitical uncertainty.

The risk of a U.S. default next month or in the coming months and more importantly the appalling U.S. fiscal situation and indeed the appalling fiscal situation of Japan, the UK and many European nations shows the importance of having an allocation to gold in a portfolio.