Technical analyst Clive Maund explains why he has rated this gold developer an "immediate strong buy."

This morning I wrote a quick update on Lion One Metals Limited (AX:LLO; V:LIO) C$0.55, $0.448:

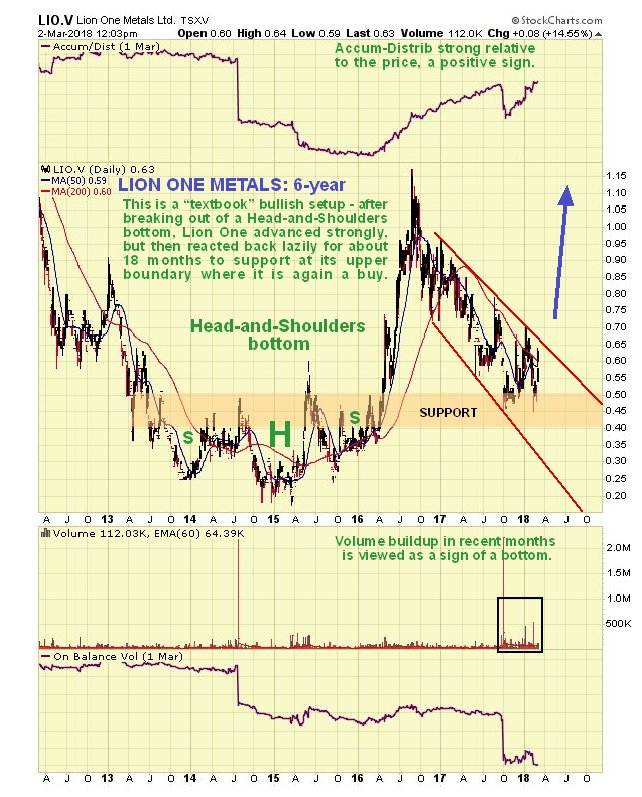

"Lion One, is still at a great entry point here after it announced a couple of days ago that a surface sample from the Jomaki prospect returned 502 gram/ton gold over 0.70 meters, which is very rich mineralization. The stock broke sharply higher on this news but gave back 5% yesterday, and is still very near to base support thanks to the sector being battered again in recent days. PM sector newsletter writer Brien Lundin really likes Lion One here and we will be linking to his comments in an upcoming article. The long-term chart shows that Lion One is at an excellent entry point after a long corrective downtrend back to the support at the upper boundary of a large Head-and-Shoulders top. IMMEDIATE STRONG BUY."

It gapped up at the open and continued higher and is currently up 14.5% so far today.

Lion One is a gold stock that we have liked for some time, and it was last recommended on by me at the beginning of February at the same price as it was before the open today. We will briefly review the updated charts below. Note that a very long-term 17-year chart is included in the early February article on it.

The 6-year chart shows a "textbook" bullish setup, with Lion One having broken out of a fine large Head-and-Shoulders bottom early in 2016 to mount a steep and substantial advance, which got it ahead of its fundamentals. It then went into a long, lazy reaction that dragged on for 18 months or so, which brought it back to strong support at the upper boundary of the Head-and-Shoulders bottom, where it is believed to have been basing ahead of renewed advance, that we can expect to synchronize with a new sector bull market.

Moving on, we can see this long reaction in its entirety and in more detail on the 2-year chart. It looks like it has just risen off a Double Bottom with its lows of last September–October, with the increased volume since the first low and the strong Accum-Distrib line which is already at new highs strongly suggesting that it was indeed a Double Bottom and that it is readying for a major bull market advance. We can also see that it is now not far off breaking out of the downtrend.

On the 3-month chart we can see recent action in more detail, and how a prominent high volume bull hammer in mid-February marked the final low. This chart shows us how closely bunched the price is with its main moving averages, a frequent precondition for a breakout into a new bull market, and it wouldn't take much of a move for a bullish moving average cross to occur, after which the 200-day moving average would quickly turn up. Finally, we can see on this chart where we went for it a month ago, and where it was recommended before today's open.

Now some fundamental news, which is most encouraging. You can read a little about the discovery of a rich deposit on the company's properties in MINE DEVELOPER IN FIJI FINDS OFF-THE-CHARTS MINERALIZATION, and also read what Brien Lundin has to say about the company in Brien Lundin Reveals his Next Picks.

So, both fundamentally and technically, Lion One looks good to go, and is rated a strong buy ahead of its breaking out from its 18-month downtrend. Brien Lundin is considered to be conservative in his assessment of this stock's upside potential given what we know is likely to happen to the gold price.

Lion One Metals Ltd, LIO.V, LOMLF on OTC, trading at C$0.63, $0.49 at 2.11 pm EST on 2nd March 2018.

Disclosure: 1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.