The Q3 earnings season is in full swing with quarterly reports of 364 S&P 500 members or 72.6% of the total index members already on board. The overall financial picture that has emerged so far is quite impressive. Although earnings and revenues have increased only 1.6% each on a year-over-year basis, our Earnings Preview report dated Nov 2, 2016, reveals that this is likely to be the first quarter to show bottom-line improvement after five consecutive quarters of earnings decline.

According to the report, S&P 500 companies are projected to end Q3 with earnings and revenue growth of 1.4% and 2.4%, respectively. In fact, 12 of the 16 Zacks sectors are projected to end Q3 with bottom-line expansion.

As was the case in the past few quarters, the oil and energy sector is expected to be the worst performer out of the four sectors that are expected to see earnings contraction. The bottom line is expected to plunge 65.4% for this beleaguered sector. The transportation sector too is projected to end Q3 with earnings deterioration, thanks to the plethora of headwinds like declining travel demand, weak pricing environment and declining coal shipments to name a few.

In view of the varied challenges, let’s see how transportation companies, such as Hertz Global Holdings Inc. (NYSE:HTZ) , Matson Inc. (NYSE:MATX) and Tidewater Inc. (NYSE:TDW) are likely to fare when they report Q3 numbers on Nov 7.

Florida-based Hertz Global Holdings, is a car rental company. Our proven model does not conclusively show that Hertz Global is likely to beat the Zacks Consensus Estimate this quarter. According to our quantitative model, a company needs the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better – to increase the odds of an earnings surprise. Hertz Global has a Zacks Rank #4 (Sell) and an Earnings ESP of -6.76% (as the Most Accurate estimate is 19 cents below the Zacks Consensus Estimate of $2.81 per share). This makes an earnings beat unlikely for the company. Please note that we caution against Sell-rated (#4 or 5) stocks going into the earnings announcement.

Matson, Inc.operates as an ocean transportation and logistics company. An earnings beat is likely for the company in Q3 as it holds a Zacks Rank #2 (Buy) and has an Earnings ESP of +2.90% (as the Most Accurate estimate is 2 cents higher than the Zacks Consensus Estimate of 69 cents). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

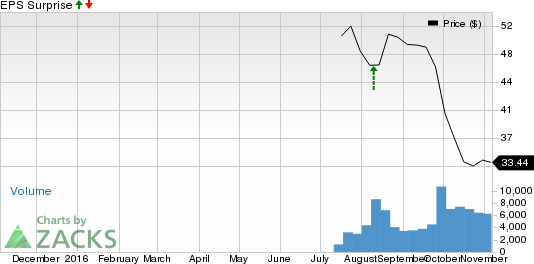

Tidewater Inc. owns and operates one of the world's largest fleet that serves the international offshore energy industry. The company has a Zacks Rank #4 and an Earnings ESP of 0.00% (as both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of $1.11). The unfavorable combination makes an earnings beat unlikely for the company.

Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Zacks' Best Investment Ideas for Long-Term Profit

Today you can gain access to long-term trades with double and triple-digit profit potential rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

TIDEWATER INC (TDW): Free Stock Analysis Report

HERTZ GLBL HLDG (HTZ): Free Stock Analysis Report

MATSON INC (MATX): Free Stock Analysis Report

Original post

Zacks Investment Research