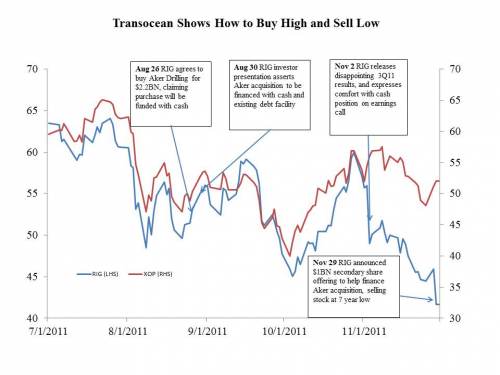

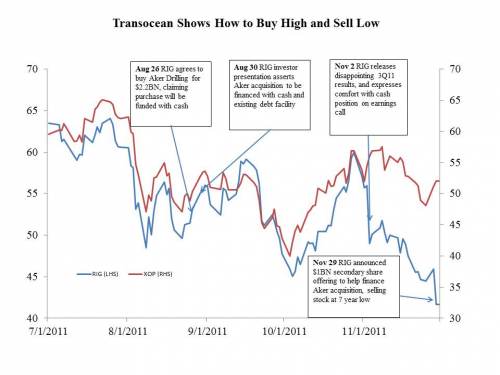

Transocean (RIG), the world’s largest operator of deepwater drilling rigs, has just provided a breathtaking example of how to destroy shareholder value. As I pointed out yesterday, when they bought Aker Drilling in August at a substantial premium they expressed confidence that they could finance the acquisition without diluting shareholders. They reaffirmed this a few days later in a presentation and as recently as November 2 during their earnings call chose to downplay any possibility of issuing equity. In fact, the company asserts that their shareholders want management to invest capital in accretive projects.

So the way they’ve managed their shareholders’ capital is to invest $2.2BN in a high-priced acquisition when their stock price was above $50, and then finance it by issuing equity three months later at the lowest price RIG has traded in 7 years. But they are still paying a dividend, although the secondary offering of shares just about covers it (not including an investor’s taxes).

The chart below tells the story. So we own a small position in RIG, because we think the value of their assets is north of $70 but in spite of the people who run the company. In fact the stock dropped yesterday far more than was warranted by the dilution from the new shares (after all, they did receive over $1BN for them). We calculate that the share price should have only dropped by $0.40, to $45.50 using Monday’s closing market cap and then adjusting for the increased share count plus cash received. The further $5 discount that was required to place the new shares is now added to the “Newman Discount” (Steve Newman is the CEO). In the months ahead we’ll see if the value of the business is up to the challenge presented by its stewards.

So the way they’ve managed their shareholders’ capital is to invest $2.2BN in a high-priced acquisition when their stock price was above $50, and then finance it by issuing equity three months later at the lowest price RIG has traded in 7 years. But they are still paying a dividend, although the secondary offering of shares just about covers it (not including an investor’s taxes).

The chart below tells the story. So we own a small position in RIG, because we think the value of their assets is north of $70 but in spite of the people who run the company. In fact the stock dropped yesterday far more than was warranted by the dilution from the new shares (after all, they did receive over $1BN for them). We calculate that the share price should have only dropped by $0.40, to $45.50 using Monday’s closing market cap and then adjusting for the increased share count plus cash received. The further $5 discount that was required to place the new shares is now added to the “Newman Discount” (Steve Newman is the CEO). In the months ahead we’ll see if the value of the business is up to the challenge presented by its stewards.