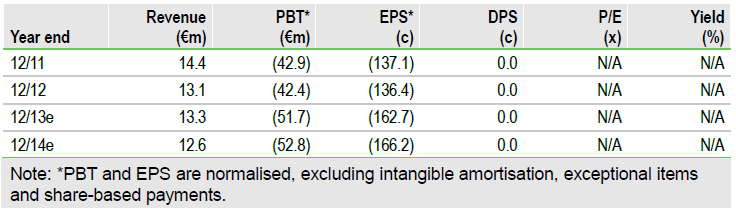

Transgene’s (TNG) two lead products, TG4010 and Pexa-Vec, could enter Phase III development in FY14 depending on clinical data in H213. Results from the first part of the Phase II/III TIME study due in Q313 are particularly important as they could lead to Novartis exercising its licensing option on TG4010 and paying Transgene a substantial upfront fee in Q413. The data from the Phase II TRAVERSE trial in Q413 could also trigger a major re-rating of the shares. We value Transgene at €480m or €15.08 per share.

Data from Phase II/III TIME trial due in Q313

Over 70% of patients for initial stage of the Phase II/III TIME trial have been recruited to date, so that the study remains on schedule to report the PFS data (primary endpoint for the Phase II stage) in Q313. After receipt of this data, Novartis has 90 days to exercise its option to in-license the global rights to TG4010, which would trigger a significant upfront payment to Transgene.

Pexa-Vec Phase II TRAVERSE data due in Q413

In a Phase IIa study in hepatocellular carcinoma (HCC), patients receiving a high dose of Pexa-Vec (JX594/TG6006) had a median overall survival of 13.8 months compared to 6.7 months in those receiving a low dose. If this level of efficacy is repeated in the Phase II TRAVERSE trial, data due in Q413, and Pexa-Vec is still well tolerated, it could enter Phase III development in FY14.

Cautious about prospects for TG4040 despite data

The final data from the Phase II trial with TG4040 in patients with chronic HCV infections, reported at the EASL conference in April, suggests that TG4040 is an efficacious and safe treatment for HCV. But we consider the further development of TG4040 is unlikely due to commercial considerations. Novel HCV products are targeting the creation or oral-only treatments and TG4040 needs to be injected.

Valuation: DCF valuation of €480m

We have reduced our valuation by €95m to €480m, as we no longer include potential royalties for TG4040. However, there is still over 70% upside and our valuation could increase to €630m in FY13 if there is positive data on TG4040, Pexa-Vec and Novartis in-licenses TG4010. Transgene had €80.1m in cash at Q113, which should allow it to operate until Q414 and potentially into FY16 if TG4010 is partnered to Novartis or another company.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Transgene Corporate Outlook: Key TIME Approaches

Published 05/09/2013, 08:29 AM

Updated 07/09/2023, 06:31 AM

Transgene Corporate Outlook: Key TIME Approaches

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.