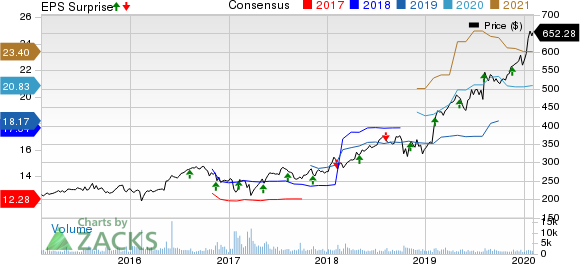

TransDigm Group Incorporated (NYSE:TDG) reported first-quarter fiscal 2020 adjusted earnings of $4.93 per share, which surpassed the Zacks Consensus Estimate of $4.56 by 8.1%. Moreover, the bottom line improved 28.1% from the prior-year quarter figure of $3.85.

Barring one-time items, the company reported GAAP earnings of 83 cents per share compared with $3.05 in the year-ago quarter. The year-over-year bottom-line decline can be attributed to payments made in the quarter under review.

Sales

Net sales amounted to $1,465 million, reflecting year-over-year growth of 47.5% from the prior-year quarter. The top line also outpaced the Zacks Consensus Estimate of $1,458 million by 0.5%. Meanwhile, organic sales improved 8.7%.

Acquisition sales from the Esterline takeover contributed $385 million to total sales.

Zacks Rank

Transdigm currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Teledyne Technologies (NYSE:TDY) reported fourth-quarter 2019 adjusted earnings of $2.90 per share, which surpassed the Zacks Consensus Estimate of $2.76 by 5.1%. The bottom-line figure came above the guided range of $2.71-$2.76 for the reported quarter.

Lockheed Martin (NYSE:LMT) reported fourth-quarter 2019 earnings of $5.29 per share, which surpassed the Zacks Consensus Estimate of $4.99 by 6%. The bottom line also improved 20.5% from $4.39 in the year-ago quarter.

General Dynamics’ (NYSE:GD) fourth-quarter earnings from continuing operations of $3.51 per share beat the Zacks Consensus Estimate of $3.46 by 1.45%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.7% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

Transdigm Group Incorporated (TDG): Free Stock Analysis Report

Original post

Zacks Investment Research