On track and moving forward

Trans Atlantic Petroleum Ltd (AMEX:TAT) has reported record revenues of US$41.1m for Q214, which together with previously released sales volumes of 5.0mboe/d for the quarter, begin to frame an encouraging trend that the company is well on track to meet targeted exit rate of 6.3mboe/d by year-end 2014. Based on the year-to-date successes of the 33-well drilling programme, we are modelling production rates of over 8.0mboe/d by YE15, which we expect to be driven by North American horizontal drilling, completions and waterflood technology, and the successful export of these to TAT’s Turkish basins.

H214 expected to increase production and capex

TAT has reported a production average of 5.4mboe/d for the first four weeks of July, realising an encouraging increase over Q214 published rates of 5.0mboe/d. Having spudded 15 wells year to date, we find TransAtlantic is on track to drill a targeted 33 wells in FY14, aided by a recently announced increase in capex to US$100-110m from previous guidance of US$89m, with the additional capex expected to be funded by cash on hand, operational cash flow and available credit lines.

South-east Turkey oil to lead the charge

We expect the Molla and Selmo areas in Turkey’s south-east to deliver the biggest production gains in H214, with Molla’s forecast guidance pointing to an increase in net production of over 1.0mbbl/d in 2013, driven by recently spudded Bahar wells. Meanwhile, company guidance points to developments in the Selmo area to increase net production by over 475bbl/d, with these driven by horizontal wells that continue to target the Middle Sinan Dolomite (MSD) zone.

Thrace gas taking a back seat in 2014-15

While lower returns on gas projects in Turkey have led to an underspend in gas development in the Thrace basin, we expect flat gas production volumes into 2015, with plans for H214 entailing two horizontal wells and five vertical wells, based on new 3D seismic, along with 15 shallow well recompletions.

Valuation: A rising tide of volumes and cash flow

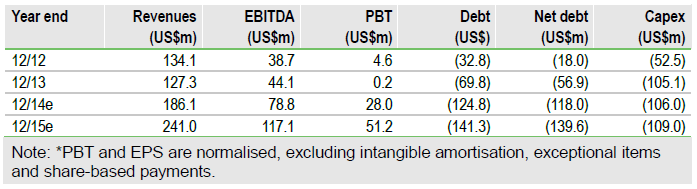

We have now reduced our EBITDA forecasts to better reflect costs in Turkey. Our valuation models result in a core NAV of US$11.9 per share, based on assumptions that exclude potential oil volumes from waterflood pilot projects. Share price catalysts are likely to include further evidence of the successful application of North American drilling techniques in Turkey and deep gas production in Bulgaria.

To Read the Entire Report Please Click on the pdf File Below