“The best bond values today will not be the best bond values next year and will certainly not be the best bond values until maturity.” – Sidney Homer, January 1973, Salomon Brothers study

Sidney Homer’s statement from a study published 44 years ago still rings as true today, when the 10-year US Treasury bond is yielding 2.2%, as it did in January 1973, when the yield stood at 6.4% and was heading much higher over the next eight years.

Cumberland Advisors practices total-return bond management in most accounts. We have the freedom to manage the durations and maturities of bonds in the portfolio over an interest-rate cycle while remaining vigilant about monitoring credit and tailoring portfolios to clients’ needs.

We employ the Barclays (LON:BARC) Muni Index as a benchmark. If defensive bond decisions are called for, then we will employ a strategy oriented toward protecting capital while still providing tax-free income. If we believe that municipal bond interest rates are too high relative to where fair value lies, we will employ more offensive strategies that should provide some appreciation in addition to the tax-free income. We then compare our results to the benchmark, not manage to the benchmark.

Whereas with equities long-term value may often be achieved by a buy and hold strategy (think Berkshire Hathaway (NYSE:BRKa) or Apple (NASDAQ:AAPL) or other companies with long track histories of adding value), changes in bond portfolios are FREQUENTLY called for – in some cases to make strategic maturity and duration changes and in other cases to take advantage of tax-loss swapping. Changes can also be made to reduce exposure to what we perceive as a deteriorating credit and to gain exposure to what we see as an improving situation. All bond prices rise and fall inversely with interest rates. But it is the RELATIVE differences in bond prices that allow us to be opportunistic. Let’s look at what differences in maturity and duration have meant in just the past year.

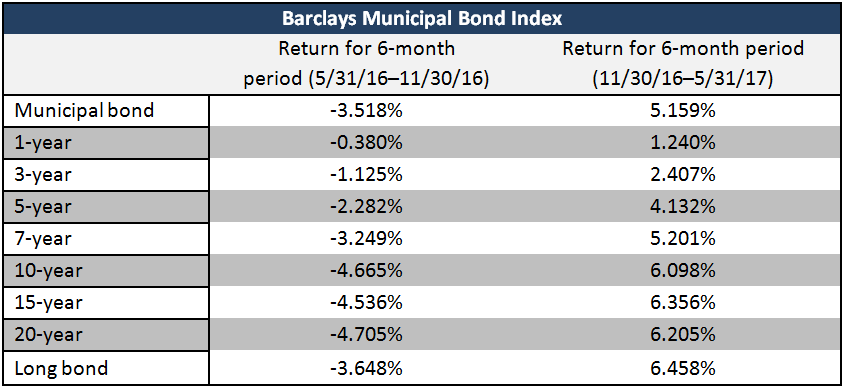

The chart below shows the total-return differences among different maturity sectors of the market in succeeding six-month periods.

The first column shows the six-month period from 5/31/16 to 11/30/16. This period encompassed the downdraft in interest rates following the Brexit vote, a slow rise in yields during the late summer and fall, and a rapid upswing in yields following the election of President Trump. The months of November and December were marked by large redemptions by municipal bond funds, which caused muni interest rates – particularly long term interest rates – to rise even more than US Treasuries did. The bond market was spooked by expectations of higher growth, tax cuts (which potentially hurt municipal bonds), infrastructure spending, and higher inflation.

The second column displays the most recent six-month period, from the end of November 2016 until the end of May 2017. This period was marked by a shift from the euphoria of President-Elect Trump to the reality of President Trump. The reality of governing is revealed in the sobering pace at which legislation is being passed, Congressional inertia in general, and the political issues that have slowed White House progress. We believed in November (and have since been backed up by the market) that this reality would result in a move back down in interest rates as the market experienced a reversion to the mean.

The chart above also shows that the differences in movements in interest rates can be VERY different, depending on where they are. Through most of last year Cumberland was reducing durations and maturities, as we felt overall interest rates were too low compared to inflation. (For example, after the Brexit vote, the 10-year US Treasury bond approached a 1.30% yield, even though CORE inflation had risen above 2%.) With the rise in rates post-US election, it is very clear that the shorter maturity/duration segment of the municipal market did appreciably better than the longer end. For example, during the 5/31–11/30/16 period, on the Barclays Muni Index the three-year total return was -1.125% versus -4.70% for the 20-year. These are clearly not perfect proxies for the short-term or longer-term parts of a “barbell” strategy, but they do point out the benefits of making strategic changes in portfolio structure in anticipation of forthcoming movements.

The last six months tell a different story. The Trump rate rise was sharp and swift. Long-maturity tax-free bonds, which had been near 3% in the middle of summer 2016, were now yielding 4% or higher as bond funds faced liquidations. And since most bond funds own intermediate and longer-term bonds, which generally yield more and help to support the bond funds’ dividends, it is that part of the market that gets trampled when funds are faced with redemptions. By moving assets from shorter-term to longer-term, which Cumberland Advisors began doing in mid-November, we positioned assets for much higher yields than were available just a few months before.

Indeed, over the past six months we have seen some of the realities of a new administration begin to materialize. The reduction in proposed marginal tax rates was less than originally anticipated. There is congressional pushback on adding too much to the budget deficit with an infrastructure spending plan, and trailing 12-month core inflation has dropped from 2.3% to 1.9% in the nearly five months since President Trump was inaugurated. As a result there has been a drop in yields and positive price returns across the muni yield curve; but, again, the chart shows us that the longer-duration/maturity part of the muni market provided superior returns. On the Barclays Muni Index, the 20-year returned 6.2% versus 2.4% for the 3-year.

Clearly, total-return management does not attempt to “call” interest rates on a dime. We always attempt to judge interest rates on a REAL, after-inflation basis. This approach can yield different results and require different strategies in the tax-free bond market than in the taxable bond market. Along with monitoring and being proactive on credit, managing durations through the interest-rate cycle can add incremental returns to portfolios during cycles of downward movement in interest rates and can protect capital in the event of rising interest rates.