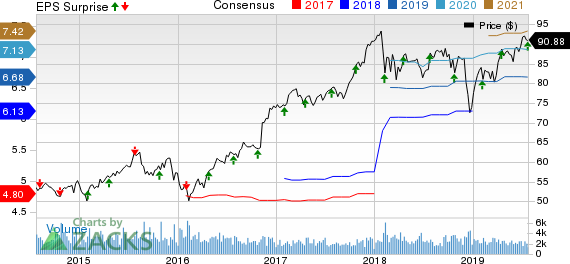

Torchmark Corporation’s (NYSE:TMK) second-quarter 2019 net operating income of $1.67 per share beat the Zacks Consensus Estimate by 1.2%. The bottom line also improved 10.6% year over year on the back of higher premiums from the Life and Health segments.

Behind the Headlines

Torchmark reported total premium revenues of $897.5 million, up 5% year over year. This upside was primarily driven by higher premiums from Life and Health Insurance businesses.

Net investment income increased 4% year over year to $227 million.

The company’s operating revenues of $1.1 billion grew 4.8% from the year-ago quarter. This top-line improvement was driven by growth in Life and Health Insurance premiums along with higher net investment income. Additionally, the top line was above the Zacks Consensus Estimate by 0.6%.

Excess investment income, a measure of profitability, climbed 7% year over year to $64.6 million.

Torchmark’s total insurance underwriting income grew 6% year over year to $178 million. Improvement in Life Insurance underwriting margins resulted in this uptrend. However, higher administrative expenses partially offset this upside.

Administrative expenses ascended 7% year over year to $59 million.

Total benefits and expenses rose 5.1% year over year to $901 million.

Segmental Update

Premium revenues at Torchmark’s Life Insurance operations increased 5% year over year to $631 million, banking on higher premiums written by distribution channels like American Income Agency, Global Life Direct Response and LNL Agency. While American Income Agency grew 7%, Global Life Direct Response was up 4% and LNL Agency inched up 3%. Life Insurance underwriting income improved 9% year over year to $175 million. Net sales at the Life Insurance segment were 1% higher on a year-over-year basis.

Health insurance premium revenues rose 6% year over year to $266.3 million. Underwriting income of $60 million increased 1% year over year. Net health sales grew 14% year over year.

Annuity underwriting margins declined 7.8% year over year to $2.4 million.

Financial Update

Shareholders’ equity as of Jun 30, 2019 increased 20.3% year over year to $6.7 billion.

Torchmark reported book value per share (excluding net unrealized gains on fixed maturities) of $46.43, up 10.3% year over year.

As of Jun 30, 2019, operating return on equity (excluding net unrealized gains on fixed maturities) was 14.6%, unchanged from the prior-year quarter’s figure.

Business Update

Torchmark also announced that its name will be changed to Globe Life Inc. effective Aug 8, 2019.

Share Repurchase and Dividend Update

In the second quarter, Torchmark repurchased 979.2 million shares for a total cost of $85 million.

Guidance

For 2019, Torchmark raised its net operating income outlook to the range of $6.67-$6.77, up from the previous projection of $6.61-$6.75 per share.

Zacks Rank

Torchmark currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported second-quarter results so far, the bottom-line figures of The Progressive Corporation (NYSE:PGR) and RLI Corp. (NYSE:RLI) ) beat the respective Zacks Consensus Estimate for earnings. However, The Travelers Companies, Inc.’s (NYSE:TRV) metric missed the same.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Torchmark Corporation (TMK): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Original post

Zacks Investment Research