– Mark Twain

Who needs Warren Buffett to drop some sage investment knowledge on us when we’ve got Mark Twain?

Truth is, many of us make investment decisions based on faulty premises all the time. And we pay the price, too. That’s why, each Monday, we’re committed to doing our part to stop the madness.

So, in honor of Myth-Busting Monday, I’m tackling three pesky myths about dividend investing with a little help from some charts:

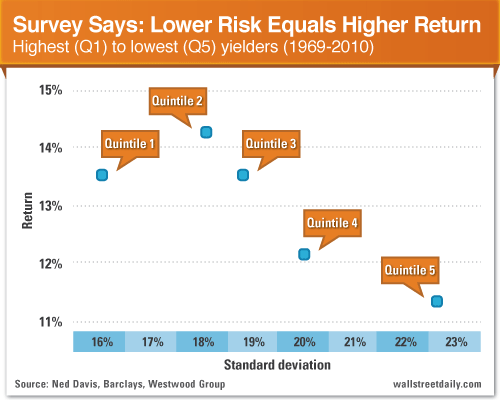

Dividend Myth #1: Lower Volatility = Lower Returns

Boring. That’s the quintessential gripe about dividend investments.

It stems from the fact that dividend stocks tend to be much less volatile than non-dividend-paying stocks. And, therefore, they must generate lower returns.

But don’t be fooled. The notion that lower volatility (i.e. – risk) leads to lower returns just ain’t so!

If we look at the performance of the 1,000 largest companies by market cap over the last 50 years, the quintile that includes low and non-dividend payers exhibits the greatest volatility. No big surprise there.

However, the top performer is quintile 2, which includes above-average dividend payers.

So, once again, we’ve proven that higher risk does not equal higher returns. To the contrary, lower risk often results in higher returns.

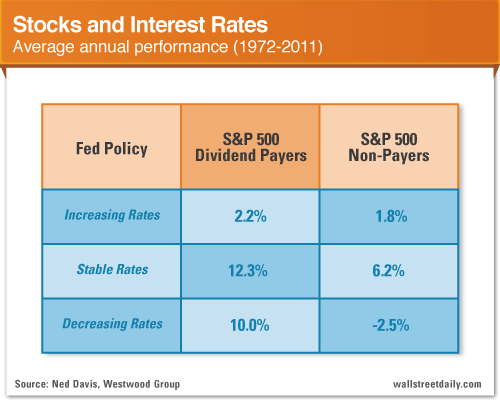

Dividend Myth #2: Dividend Stocks Tank When Interest Rates Rise

I know what you’re thinking right now…

Ok, Lou. So dividend stocks offer superior returns over long periods of time with less volatility. In the here and now, though, they must represent a terrible investment. After all, interest rates are destined to rise, and surely dividends can’t increase fast enough to keep up.

Au contraire, mon frère!

Although it sounds logical that dividend investments wouldn’t be able to compete in an increasing interest rate environment, the data tells an entirely different story.

Since 1972, dividend payers outpaced non-dividend payers by almost half a percentage point per year when interest rates were increasing. So much for higher rates eroding the attractiveness of dividend stocks.

What’s more, during periods of stable interest rates, like we’re experiencing now, dividend stocks tend to trounce their non-dividend-paying counterparts. They rise an average of 12.3% per year – versus 6.2% for non-dividend payers – according to Ned Davis Research.

In other words, right now is the perfect time to invest in dividend stocks. So what are you waiting for?

Sorry. I didn’t mean to get you all excited. Especially as you need to take heed of this final myth before you rush out and load up your portfolio with dividend stocks…

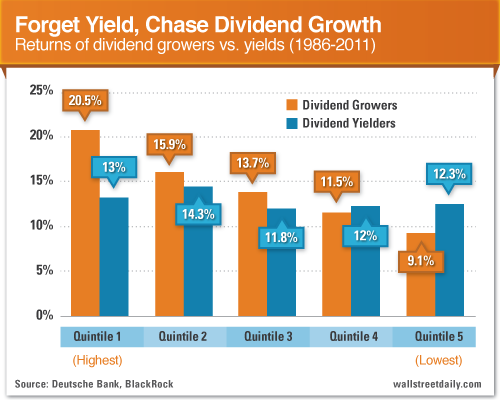

Dividend Myth #3: It’s All About Yield

It’s been said that man cannot live on bread alone. Well, investors cannot live on yield alone; they need growth, too.

So when you start looking for potential dividend investments, don’t flock immediately to the highest yielders. For one thing, high yield is often a sign of weakness, not strength.

Most of the companies that sport the highest yields do so because their stock prices have collapsed under the weight of poor fundamentals, not because management keeps increasing the dividend. Just check out Pitney Bowes (PBI) and Windstream (WIN) for proof.

Most importantly, the highest-yielding stocks are not the best performers. Not even close. That distinction belongs to stocks with the highest dividend growth rates.

Since 1986, stocks with the highest dividend growth rates in the S&P 500 Index returned far more than the highest yielders – 20.5% versus 13%.

So forget about chasing yield - chase dividend growth, instead.

Bottom line: Dividend stocks might be boring. But they’re not underperformers by any stretch. Not even during rising interest rate environments. So do your portfolio some good and load up on top-quality dividend growers.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Three Charts, Three Busted Dividend Myths

Published 02/25/2013, 06:03 AM

Updated 05/14/2017, 06:45 AM

Three Charts, Three Busted Dividend Myths

“It ain’t what we don’t know that gets us in trouble. It’s what we do know that just ain’t so.”

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.