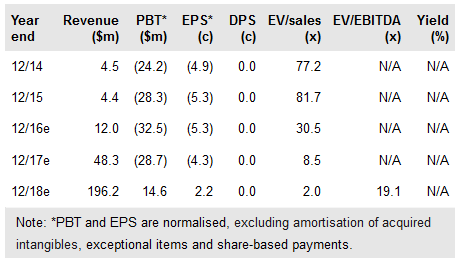

Thin Film Electronics ASA (OL:THIN) has announced plans to commence R2R production by end-2017 and also plans to move to a larger plant in the US in 2017 to accommodate the line. We see the news as supportive of our NOK7.52 DCF valuation because of the prospects for greater efficiencies from the new plant. Nevertheless, we expect THIN to have to further de-bottleneck its existing sheet-based plant in 2016/17 in order to meet product demand, particularly for NFC OpenSense. In addition, property lease costs are expected to rise in 2017 with the opening of the new facility, leading us to increase our cash burn forecasts for 2016 and 2017 by $13m. Thinfilm’s Q116 earnings reflected the hiatus in EAS unit production in the first quarter, but were otherwise in line with expectations.

First quarter above all about the future

Thinfilm’s Q116 revenues halved to $811k from the Q415 level, due to lower Xerox (NYSE:XRX) tech transfer fees and a hiatus in sales of EAS tags as the company undertook a product modification at the client’s request. EBITDA losses dropped from $8.8m in Q415 to $8.2m, being boosted in both quarters by high materials costs arising from running the plant 24/7 for yield, design and product development work. The long-term picture remains upbeat after a slew of new partnership and collaboration agreements and the securing of $42m in equity funding from Woodford IM in Q116. THIN delivered its first shipment of NFC OpenSense tags to Jones Packaging in Q116 and is also on track to increase plant capacity to 40m OpenSense equivalent (OSE) units in Q216 and launch sensor labels later in the year.

To read the entire report Please click on the pdf File Below