The Fed's plan to normalize its balance sheet will begin to be put in place from next month. This is passive QT or Quantitative Tightening - call it QT1 if you want... the opposite of quantitative easing. I outlined their decision to implement passive QT earlier this week. It may be some time before we know the true impact of passive QT, and this is new territory for the Fed - there's never been an environment with a true parallel to this one. So it's worth paying attention then when you see the AUM (assets under management) charts for ETF products that invest in two key asset classes which have historically shown great sensitivity to US monetary policy: yield product and emerging market equities.

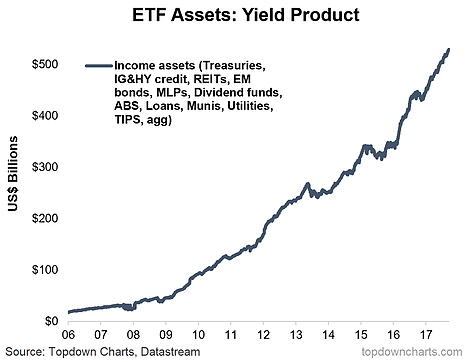

For clarity, yield product - in this analysis - includes government bonds, securitised debt, bank loans, corporate bonds, and also some yield focused equities such as MLPs, REITs, and Utilities. The run up in the chart is remarkable and is about the purest display of the great search for yield as you can get. Should QT catalyze a rise in bond yields it will put many of these assets at risk of capital loss - a potential nasty surprise for investors who were just looking to get a little extra income out of their investments!

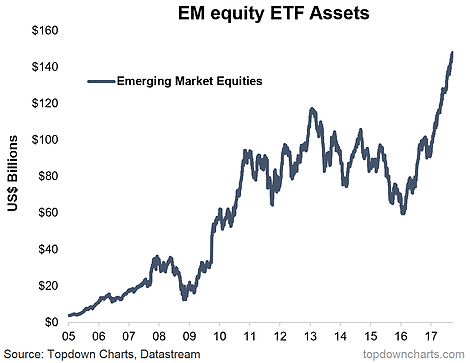

Similarly emerging markets had been a key beneficiary of US quantitative easing, so now that the Fed is tightening, the incredible near-vertical movement in emerging market equity ETF assets under management is going to come under increasing scrutiny. It may take some time before QT puts the squeeze on emerging markets, but either way, the rapid rise in EM assets shows extreme optimism and FOMO.

The search for yield, as expressed in income oriented ETFs. Near exponential growth since QE was started.

After the market bottom in early 2016 emerging market ETF assets have seen near-vertical growth.