The fundadmental backdrop is likely to be volatile: the Italian election is coming back into view; U.S. “sequestration” is in place; and Tuesday’s beginning of China’s annual National People’s Congress. These issues will dominate the headlines in the short-term, but longer-term -- the euro-zone recession, the likely decline in corporate profitability and the Fed’s tapering of QE-4 will serve as headwinds.

STRATEGY

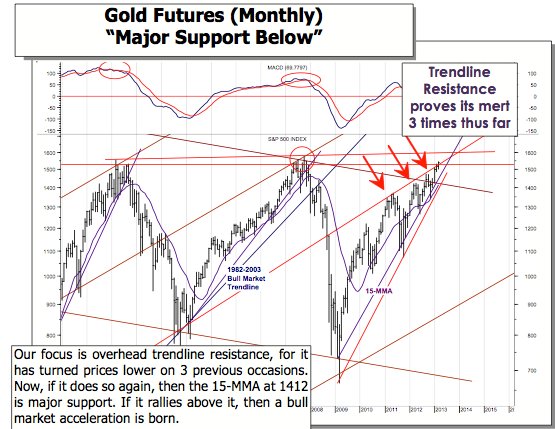

The S&P 500 remains above the 160-wma long-term sup- port level at 1281; and the standard 200-dma support level at 1412. Collectively, with the breakout above the Sept-2012 highs at 1475 has run into major overhead resistance, and has found “rough sledding” over the past several days. This, coupled with our models rolling over suggest this is a topping process, but it is still too early to definitively confirm.

CAPITAL MARKET COMMENTARY

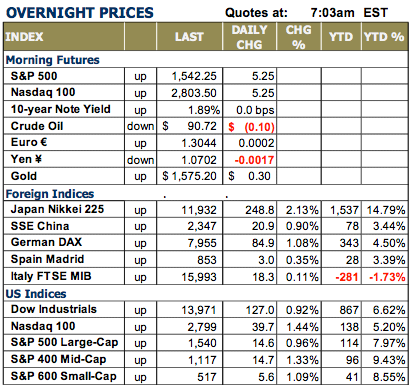

GREEN IS THE PRIMARY COLOR AGAIN THIS MORNING as both Asian and European bourses are higher after yesterday’s sharp moves higher in all the world markets. However, this morning’s moves aren’t as strong, with Germany’s DAX being the world leader at this point...higher by +1.0% as there is very little news out of the euro zone. But what was released was of the negative sort, with final 4Q GDP falling by -0.9% year/year. This was well known by the markets, and therefore not considered market mov- ing. But having said this, we think it very interesting to con- sider the two charts on page 2, which is the German DAX and the euro-zone GDP chart; they are charts in a “discon- nect”, for while the German DAX is very near its all-time highs of 2000 and 2008, the euro-zone economy has been mired in negative growth for the past four quarters. We’ll wonder aloud what will happen once growth will return to the euro zone...will the DAX move lower. Or will new highs follow very quickly. Our thoughts are that a correction is warranted; and then a move to new highs...simply a tac- tical vs. strategic viewpoint.

ON THE US ECONOMIC FRONT, there are a number of reports out this morning of interest. First, the MBA Mortgage Applications Index rose rather strongly; both purchase and refinancing components were strong. The 30-year mortgage rate was 3.70%, which is lower than the previous week’s 3.77%. Once interest rates start to move higher in earnest, then we’re likely to see those “fence sitters” move quickly to buy homes and to refinance. This remains a positive at this juncture.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Rhodes Report: March, 6

Published 03/06/2013, 11:27 AM

Updated 07/09/2023, 06:31 AM

The Rhodes Report: March, 6

FORECAST STOCKS

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.