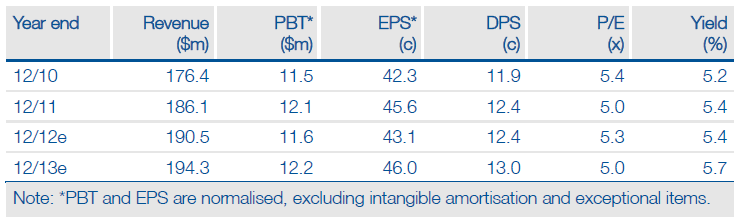

Quarto’s (QRT.L) interim results showed a good performance, with revenues up 1% and adjusted operating profit ahead by 6%, despite the well-publicised difficulties of both the book retail sector and the underlying malaise in consumer markets. We are maintaining our full-year forecasts, which make no presumptions of underlying recovery. The balance sheet (which does not reflect the full value of revenue-generating assets) continues to improve. The shares remain on a substantial discount to the international publishing sector and carry a premium yield.

Book Publishing leads the charge

The overall revenue growth figure of 1% (to $73.2m) is an amalgam of the Co-Edition Publishing sales, which fell by 5.4% and growth in the Book Publishing segment of 3.5%. The former reflects the lack of confidence in commissioning of new titles by potential licensees at the end of 2010, although the level of reprints remained good. In both segments, the individual imprints had varying performance. Frances Lincoln, bought last August, is performing well and will bring further opportunities to combine resource with other group imprints. Revenues and profits are heavily weighted to H2, but the trailing 12-month figures give us confidence in our current forecasts.

Digital revenues climb – but more slowly

Growth in sales of Quarto’s eBooks slowed in Q212, but digital revenues nevertheless showed gains of 87% to account for 2.2% of sales in the first half. This reflects the large number of backlist titles converted into eBooks over the last 18-24 months. With only new titles now being added, this growth is likely to continue to slow and is unlikely to reach the proportion of sales achieved by publishers of fiction and non-fiction narrative text.

We await further news on the timing of the Special Meeting called in July to remove Laurence Orbach (the Chairman, CEO and largest shareholder) as a director and to elect Tim Chadwick.

Valuation: Deep discount persist

Our arguments on valuation are well rehearsed. Banking facilities were refinanced earlier in the year and the further reduction in net debt of $2.5m (to $87.8m) on the prior year, despite the $6.9m spend on Frances Lincoln, should reassure the market on the group’s debt position. The balance sheet is conservatively stated and does not reflect the full value of the backlist, which generated 64% of Book Publishing sales in FY11. Given the underlying trading environment, the interim dividend has been held at 3.35p (the FY11 final dividend was increased), giving a covered, and premium, yield.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Quarto Group Interim Results: Deep Discounts Persist

Published 08/16/2012, 08:39 AM

Updated 07/09/2023, 06:31 AM

The Quarto Group Interim Results: Deep Discounts Persist

Good H1 result in difficult markets

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.