As we’ve been showing you for the last few weeks, right now is the time for investors like you to make a fortune in legal marijuana.

But there’s a major question you still need to answer:

What exactly should you invest in?

After all, from “penny pot stocks” to huge publicly-traded pharmaceutical companies, there are plenty of ways to invest in cannabis.

So today, we'll look at your main options.

And then we’ll show the one perfect pot investment.

Penny Pot Stocks

The first way to cash in on legal cannabis will be familiar to you:

You could invest in “penny” pot stocks.

People are making a ton of money on these stocks right now. For example, look at CV Sciences Inc. (OTC:CVSI).

CVSI develops synthetic versions of Cannabidiol — that’s the chemical in marijuana known for its medicinal properties.

In just two years, this stock shot up from $2 to $147, a gain of more than 7,000%.

That’s like turning $1,000 into $70,000, or $10,000 into $700,000.

There’s just one problem: penny stocks are dangerously volatile!

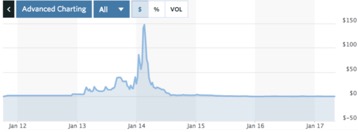

To show you what I mean, just take a look at CV Sciences’ stock chart:

As you can see, after reaching a peak of $147, CVSI cratered…

Today it trades at just $0.24.

“Blue-Chip” Pot Stocks

OK, so how about something less risky?

For example, look at GW Pharmaceuticals PLC (NASDAQ:GWPH).

This company is the “blue chip” of the cannabis sector. It’s known for a cannabis product called Sativex that helps treat multiple sclerosis.

GWPH currently trades at about $112. So if you got in around 2013, when it was trading in the $10 range, you’d have a ten-bagger on your hands.

Unfortunately, as the Motley Fool reported, “… it's probably safe to say that this high-flying stock is going to have trouble pushing much higher.”

Maybe it goes up 10% from here. Or maybe it has a good run and goes up 20% or 30%.

But legal cannabis is one of the fastest-growing sectors in the U.S. And globally, it’s estimated that this market could soon reach $500 billion.

When you have a once or twice-in-a-lifetime opportunity to get into a sector like this, you shouldn’t be shooting for gains of 20% or 30%...

You should be looking for ways to earn 10x, 20x, 100x your money, or even more!

The Perfect Pot Investment

Which brings us to the third and final way to cash in on legal cannabis:

Private pot start-ups.

Now this is how you maximize your upside:

By getting in on the ground floor — by getting into the right cannabis companies when their shares are still incredibly cheap — you can virtually lock in your profits, no matter what the company’s stock does after it goes public.

Take CV Sciences, for example:

Remember: this stock exploded in value — rising from $2 to $147 — but then it collapsed to just $0.24. So if you’d invested at the IPO and held on, you’d be looking at a 90% loss right now.

But if you’d invested in CVSI when it was still private, you’d currently be sitting on a gain of 480%. And if you’d sold your private shares when the stock was at its peak, you could have earned 2,940x your money!

That’s like turning $500 into $1.47 million — with one investment.

And that is why private cannabis start-ups are the “perfect pot investment.”