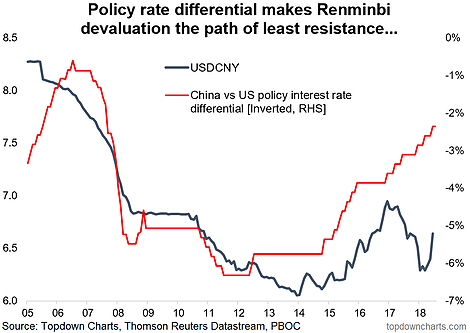

Today's chart actually comes from a video we released yesterday: "Renminbi Devaluation Risk in Focus". It shows the USDCNY exchange rate against the monetary policy interest rate differential for China (People's Bank of China) and the USA (US Federal Reserve).

The key point with this chart is that policy rate differentials point to a weakening CNY relative to USD. Indeed, as stimulus tailwinds have turned to headwinds in China, export growth has rolled over, and signs of a slowdown in the property market show up, it would be entirely reasonable to expect a weaker Chinese yuan simply on the back of the macroeconomic outlook.

Add to that the policy rate picture in today's chart, then throw in the whole trade war and geopolitical aspect and it seems clear that the path of least resistance for the USDCNY is up—possibly towards 7 or beyond. As China's economic influence grows it's important to be mindful of developments like this. Indeed, the move in the USDCNY in 2015 triggered a global stock market correction...and that begs the question of when will markets start reacting to the current move?