The flood of Q1 earnings announcements continues this week, with almost one thousand companies reporting results, including 159 S&P 500 members. By the end of this week, we will have seen Q1 results from 72% of the index’s total membership.

But with results from more than half of the index’s total market capitalization already out, we have a pretty good sense of how weak this earnings actually has been. We knew that growth will be difficult following the massive revisions to estimates in the run up to the start of the Q1 earnings season. But despite those sharp revisions to estimates ahead of this reporting cycle, companies are struggling to beat revenue estimates.

At this stage in the Q1 reporting cycle, the ratio of companies beating revenue estimates is the lowest that we have seen in the recent past. The headwinds aren’t new – the strong US dollar, global growth issues and Energy sector weakness – we heard about all of them in the Q4 earnings season as well.

More on the aggregate earnings picture emerging from the already-released Q1 results a little later, but let’s briefly touch on the Tech sector’s results. A couple of standout performances aside, the Tech sector’s Q1 results have been fairly weak relative to what we have been seeing from the sector in other recent reporting periods. Growth rates are weak as is the case with other sectors except Finance, fewer companies are able to beat the sharply lowered estimates and expectations for the current period are coming down.

Before we dig into the results already on the books, let’s pinpoint the key earnings reports coming out this week

- Monday – Apple (NASDAQ:AAPL) is the key report today, expected to report $2.18 per share on $56.8 billion in revenues vs. $1.66 per share on $45.6 billion in revenues in the March 2104 quarter. Earnings ESP, or Expected Surprise Prediction, our proprietary leading indicator of positive earnings surprises, is showing Apple beating estimates on Monday. While the Tech sector’s Q1 earnings growth is currently in the negative territory, Apple’s estimated $12.6 billion in earnings on Monday will push the growth rate into positive territory.

- Tuesday –On a very busy day with more than 200 companies reporting results, including 40 S&P 500 members, the notable ones are Pfizer Inc (NYSE:PFE), Merck (NYSE:MRK), Ford and United Parcel Service Inc (NYSE:UPS), just to name a few.

- Wednesday – On another very busy day with more than 250 companies reporting results (including 43 S&P 500 members), the more notable reports include Mastercard Incorporated (NYSE:MA), International Paper Company (NYSE:IP), and Eaton Corporation PLC (NYSE:ETN). With positive Earnings ESP and Zacks Rank #3 (Hold), MasterCard and International Paper are highly likely to come out with positive surprises on Wednesday.

- Thursday – Today is the busiest reporting day of the Q1 earnings season thus far, with more than 350 companies reporting results, including 53 S&P 500 members. We have a bunch of Energy and Media companies reporting results today, the more notable ones being Exxon Mobil Corporation (NYSE:XOM), ConocoPhillips (NYSE:COP), and Viacom B Inc (NASDAQ:VIAB).

- The Exxon report will spotlight how much of a drag the Energy sector’s woes have been on the aggregate earnings picture, with the company’s total earnings expected to be down an estimated $5.7 billion from the year-earlier level (down -62.3%). Please note that Exxon carries an outsized weight in the Energy sector, bringing in roughly 30% of the sector’s total earnings in a typical quarter. Of the major sectors/companies, Apple is the only that carries a comparable weight in the Technology – it will be bringing in roughly 27% of the Tech sector’s earnings in Q1.

- Friday – We have 13 S&P 500 members reporting results on May 1st, the notable ones being Chevron (NYSE:CVX) and CVS Health Corp (NYSE:CVS).

2015 Q1 Earnings Scorecard

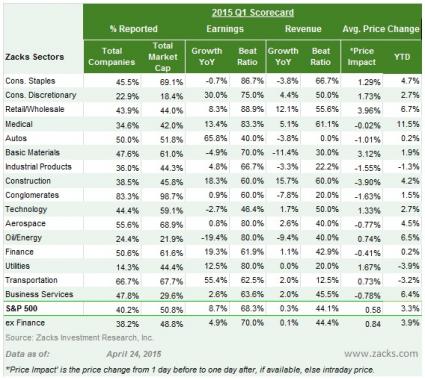

As of April 24th, we have seen Q1 result from 201 S&P 500 members that combined account for 50.8% of the index’s total market capitalization. Total earnings for these companies are up +8.7% on +0.3% revenue gains, with 68.3% beating EPS estimates and 44.1% coming ahead of revenue expectations.

Figure 1 below shows the current Scorecard for the 201 index members that have reported results. Please note that the second-last column (Price Impact) tries to capture how the stock price has moved in response to the earning release. As the small note at the bottom of the table explains the price change is from the day before the earnings announcement to the day after. If we are looking at a stock that has reported that morning, then the day before price is compared to the intraday price on the release date.

Figure 1: 2015 Q1 Scorecard (as of 4/24/2015)

Please note that the second-last column (Price Impact) in the Scorecard table above tries to capture how the stock price has moved in response to the earning release. As the small note at the bottom of the table explains the price change is from the day before the earnings announcement to the day after. If we are looking at a stock that has reported that morning, then the day before price is compared to the intraday price on the release date.

Putting Q1 Results in Context

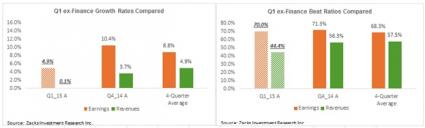

Figure 2 below shows the comparison of the results thus far with what we have been seeing from the same group of 201 companies in other recent quarters.

Figure 2: 2015 Q1 Results Compared

The left-hand side chart compares the earnings and revenue growth rates for these 201 S&P 500 members with what these same companies reported in the preceding quarter and the average growth rates for these companies in the preceding four quarters (the 4-quarter average is through 2014 Q4). The right-hand side chart does the same comparison for these 201 S&P 500 members, but compares only the earnings and beat ratios.

Here are the takeaways from looking at this chart

- The earnings growth rate (+8.7%) is notably better compared to other recent quarters.

- The revenue growth rate (+0.3%) is below what we saw from this group of companies in Q4 (+2.8%) as well as in the 4-quarter average (+4.1%).

- The earnings beat ratio is about in-line with the recent past.

- The revenue beat ratio has improved in the last few days, but is notably below what these same companies reported in the preceding as well as 4-quarter average.

The Finance Effect

Total earnings for the 61.6% of the Finance sector’s market cap that has reported results are up +19.3% on +1.1% higher revenues, with 61.9% beating EPS estimates and 42.9% coming ahead of top-line expectations. This is better growth performance than we have seen from this group of Finance sector companies in other recent quarters.

Figure 3 below compares the Finance sector results thus far with what we have been seeing from the same group of companies in other recent quarters.

Figure 3: Finance Sector Q1 Results Compared

Please keep in mind that a big part of the +19.3% earnings growth for the sector at this stage is thanks to easy comparisons for Bank of America (NYSE:BAC) (BAC). Exclude Bank of America and the earnings growth rate drops to +9.5%. But even this +9.5% growth rate compares favorably to what we have been seeing from this group in other recent quarters.

The right-hand side chart above shows the Finance sector’s EPS and revenue beat ratios is very interesting. We have the same weak revenue surprises in Finance as elsewhere in the index. But even the EPS beat ratio is lower than what we saw from the same group in 2014 Q4 and just about in-line with the 4-quarter average.

Bottom line, the Finance sector’s strong numbers didn’t come as a surprise to investors; they were already priced in. No doubt the ‘Price Impact’ column in the Scorecard table above shows that the stock-price impact of the earnings announcements has been negative, at least at this stage.

Comparing the ex-Finance Results

Given this discussion of Finance sector results, it would probably make sense to look at the results thus far on an ex-Finance basis. Figure 4 below recasts the earlier Figure 2 on an ex-Finance basis.

Figure 4: Q1 Results Outside of Finance compared

Comparing Figure 4 with Figure 2 shows -

- That the earnings and revenue growth rates outside of Finance are weaker than what we have been seeing in other recent quarters.

- That the earnings beat ratio is about where it has been in other recent quarters, but the revenue beat ratio is notably weak.

The Composite Picture for Q1

Figure 5 below presents the composite summary picture for Q1 contrasted with what companies actually reported in the 2014 Q4 earnings season. What this means is that the data below is presenting Q1 as a whole, combining the actual results from the 201 S&P 500 members that have reported results with estimates from the still-to-come 299 companies.

Figure 5 – The Composite Summary Picture

As you can see in the above summary table, total Q1 earnings are expected to be down -0.4% from the same period last year on -5.1% lower revenues, with Finance as a big boost and Energy as major drag on the growth rate. Excluding the Finance sector, total earnings in Q1 would be down -4.5% on -5.6% lower revenues. Excluding Energy, total earnings for the remainder of the S&P 500 index would be up a decent enough +8.3% on +1.5%. Among the major sectors, Transportation, and Autos are big growth contributors this quarter, with Transportation earnings expected to be up +37.9% and Autos earnings up +27.8%. Finance up +16.9%, Medical up +13.5%.

We should keep in mind however that a small number of companies are accounting for most of the growth in Finance and Medical. We mentioned earlier how easy comparisons for Bank of America was helping the Finance sector’s growth picture. Gilead Sciences (NASDAQ:GILD) (GILD - Analyst Report) and Actavis (NYSE:ACT) (ACT) are playing a similar role in the Medical sector.

Will Q1 be the Low Point for the Year?

We haven’t had much earnings growth lately and the growth rate for Q1 is expected to turn negative. Not only is the growth rate for Q1 so low, but the overall level of total earnings for the S&P 500 index are also expected to be the lowest in two years. This will be a material change from the last two quarters when aggregate earnings for the index reached all-time record levels.

The chart below shows the earnings totals for 2015 Q1 (shaded orange bar - $259.1 billion) contrasted with the actual earnings for the preceding four quarters as well estimates for the following three quarters. The hopes are that Q1 will be the low point for the year, with aggregate earnings moving back into record territory towards the end of the year. Recent history tells otherwise. If history is our guide, then the likely result will be revisions to those lofty estimates in the coming days.

Note: For a complete analysis of 2015 Q1 estimates, please check out our weekly Earnings Trends report.

| Here is a list of the 949 companies reporting this week, including 159 S&P 500 members. | ||||||

| Company | Ticker | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time |

| ROPER INDS INC | ROP | 1.52 | 1.46 | 3.35 | Monday | BTO |

| LABORATORY CP | LH | 1.65 | 1.51 | 1.23 | Monday | BTO |

| RESTAURANT BRND | QSR | 0.14 | N/A | -965.38 | Monday | BTO |

| OPUS BANK | OPB | 0.34 | 0.45 | 11.76 | Monday | BTO |

| PRECISION DRILL | PDS | 0.02 | 0.32 | -18.18 | Monday | BTO |

| TENNECO INC | TEN | 0.87 | 0.91 | 3.96 | Monday | BTO |

| TENNANT CO | TNC | 0.26 | 0.31 | 12.05 | Monday | BTO |

| INC RESRCH HLDG | INCR | 0.26 | N/A | 14.29 | Monday | BTO |

| MERCURY GENL CP | MCY | 0.7 | 0.77 | -133.33 | Monday | BTO |

| OLD NATL BCP | ONB | 0.24 | 0.26 | 0 | Monday | BTO |

| SILICOM LIMITED | SILC | 0.52 | 0.55 | 35.29 | Monday | BTO |

| SCORPIO TANKERS | STNG | 0.24 | 0.01 | -7.69 | Monday | BTO |

| SYNALLOY CORP | SYNL | 0.31 | 0.25 | -4.55 | Monday | BTO |

| PLANTRONICS INC | PLT | 0.48 | 0.64 | -1.49 | Monday | BTO |

| ACCURIDE CORP | ACW | 0.02 | -0.07 | -66.67 | Monday | BTO |

| SOHU.COM INC | SOHU | -0.82 | -1.33 | -13.04 | Monday | BTO |

| HAEMONETICS CP | HAE | 0.51 | 0.46 | 3.92 | Monday | BTO |

| SUN BANCORP/NJ | SNBC | 0.28 | -0.1 | -33.33 | Monday | BTO |

| CHANGYOU.COM | CYOU | 0.54 | -0.37 | 162.5 | Monday | BTO |

| OSI SYSTEMS INC | OSIS | 0.8 | 0.7 | 3.23 | Monday | BTO |

| POPULAR INC | BPOP | 0.65 | 0.83 | -14.58 | Monday | BTO |

| PLUM CREEK TMBR | PCL | 0.22 | 0.17 | 11.76 | Monday | AMC |

| CH ROBINSON WWD | CHRW | 0.74 | 0.63 | 1.32 | Monday | AMC |

| UNIVL HLTH SVCS | UHS | 1.57 | 1.36 | 0 | Monday | AMC |

| BOSTON PPTYS | BXP | 1.24 | 1.2 | 0 | Monday | AMC |

| AVALONBAY CMMTY | AVB | 1.83 | 1.63 | -0.56 | Monday | AMC |

| HARTFORD FIN SV | HIG | 0.99 | 1.18 | 3.23 | Monday | AMC |

| GENL GRWTH PPTY | GGP | 0.32 | 0.31 | 0 | Monday | AMC |

| Apple Inc (NASDAQ:AAPL) | AAPL | 2.18 | 1.66 | 17.69 | Monday | AMC |

| MDC PTNRS INC | MDCA | -0.08 | 0 | -173.91 | Monday | AMC |

| CRANE CO | CR | 1.01 | 1.05 | 0 | Monday | AMC |

| CTS CORP | CTS | 0.25 | 0.19 | -14.29 | Monday | AMC |

| MSA SAFETY INC | MSA | 0.52 | 0.39 | 28.77 | Monday | AMC |

| QTS REALTY TRST | QTS | 0.5 | 0.47 | 1.85 | Monday | AMC |

| BERKLEY (WR) CP | WRB | 0.76 | 1 | -15.12 | Monday | AMC |

| CHURCHILL DOWNS | CHDN | -0.13 | -0.04 | -120 | Monday | AMC |

| AGREE RLTY CORP | ADC | 0.57 | 0.54 | -3.33 | Monday | AMC |

| AMER FINL GROUP | AFG | 1.17 | 1 | 4.65 | Monday | AMC |

| AH BELO CORP | AHC | N/A | -0.18 | N/A | Monday | AMC |

| AMKOR TECH INC | AMKR | 0.1 | 0.09 | 192.31 | Monday | AMC |

| BRIXMOR PPTY GP | BRX | 0.48 | 0.44 | -2.27 | Monday | AMC |

| COMPASS MINERLS | CMP | 1.86 | 1.49 | 23.96 | Monday | AMC |

| DANAOS CORP | DAC | 0.22 | 0.06 | 40 | Monday | AMC |

| DIGIMARC CORP | DMRC | -0.53 | -0.29 | 15.79 | Monday | AMC |

| HOMESTREET INC | HMST | 0.4 | 0.15 | 46.43 | Monday | AMC |

| HERSHA HOSPTLY | HT | 0.05 | 0.06 | 7.69 | Monday | AMC |

| INDEP BANK GRP | IBTX | 0.6 | 0.39 | 10.34 | Monday | AMC |

| INNOPHOS HLDGS | IPHS | 0.65 | 0.64 | -13.33 | Monday | AMC |

| J&J SNACK FOODS | JJSF | 0.76 | 0.72 | -14.29 | Monday | AMC |

| JONES LANG LASL | JLL | 0.49 | 0.39 | 11.98 | Monday | AMC |

| MERCHANTS BANCS | MBVT | 0.55 | 0.54 | -25 | Monday | AMC |

| NATL INTERST CP | NATL | 0.43 | 0.39 | -4.17 | Monday | AMC |

| OWENS & MINOR | OMI | 0.44 | 0.44 | -3.92 | Monday | AMC |

| ORCHID ISLAND | ORC | N/A | 0.71 | N/A | Monday | AMC |

| OVERSTOCK.COM | OSTK | 0.2 | 0.16 | -76 | Monday | AMC |

| RENT-A-CENTER | RCII | 0.5 | 0.57 | -20.63 | Monday | AMC |

| EVEREST RE LTD | RE | 5.55 | 5.93 | 28.17 | Monday | AMC |

| STONEGATE BANK | SGBK | 0.4 | 0.21 | 28.95 | Monday | AMC |

| SEASPAN CORP | SSW | 0.24 | 0.47 | -3.57 | Monday | AMC |

| SWIFT TRANSPORT | SWFT | 0.28 | 0.12 | 14.58 | Monday | AMC |

| CONTAINER STORE | TCS | 0.31 | 0.22 | 0 | Monday | AMC |

| WASTE CONNCTION | WCN | 0.46 | 0.44 | 4.08 | Monday | AMC |

| WABASH NATIONAL | WNC | 0.17 | 0.12 | 12.5 | Monday | AMC |

| BARRICK GOLD CP | ABX | 0.1 | 0.2 | 25 | Monday | AMC |

| AMER CAP AGENCY | AGNC | 0.69 | 0.71 | 24.32 | Monday | AMC |

| AMER CAMPUS CTY | ACC | 0.67 | 0.66 | 2.94 | Monday | AMC |

| ALEXANDRIA REAL | ARE | 1.26 | 1.17 | -0.81 | Monday | AMC |

| BARRACUDA NTWRK | CUDA | 0 | 0 | -250 | Monday | AMC |

| OLIN CORP | OLN | 0.25 | 0.4 | 13.64 | Monday | AMC |

| SS&C TECHNOLOGS | SSNC | 0.57 | 0.52 | 0 | Monday | AMC |

| BERKSHIRE HILLS | BHLB | 0.48 | 0.42 | 2.13 | Monday | AMC |

| PMC-SIERRA INC | PMCS | 0.06 | 0.06 | 0 | Monday | AMC |

| FIRST INTST MT | FIBK | 0.47 | 0.48 | 8.16 | Monday | AMC |

| HEARTLAND FINCL | HTLF | 0.56 | 0.36 | 12.28 | Monday | AMC |

| PARTNERRE LTD | PRE | 2.52 | 3.43 | 24.86 | Monday | AMC |

| UDR INC | UDR | 0.41 | 0.36 | 0 | Monday | AMC |

| RUDOLPH TECH | RTEC | 0.08 | 0.01 | 233.33 | Monday | AMC |

| CADENCE DESIGN | CDNS | 0.11 | 0.16 | 33.33 | Monday | AMC |

| GIGOPTIX INC | GIG | -0.05 | -0.05 | 100 | Monday | AMC |

| ALLISON TRANSMN | ALSN | 0.65 | 0.55 | 116.67 | Monday | AMC |

| SILICON MOTION | SIMO | 0.38 | 0.12 | 9.38 | Monday | AMC |

| ARLINGTON ASSET | AI | 1.18 | 1.14 | 18.26 | Monday | AMC |

| CANON INC ADR | CAJ | 0.4 | 0.41 | -32.08 | Monday | N/A |

| TOKYO ELECTRON | TOELY | N/A | 0.23 | N/A | Monday | N/A |

| KYOCERA CP ADR | KYO | N/A | 0.51 | N/A | Monday | N/A |

| JACOBS ENGIN GR | JEC | 0.79 | 0.82 | -1.28 | Tuesday | BTO |

| CUMMINS INC | CMI | 2.13 | 1.83 | 2.4 | Tuesday | BTO |

| WHIRLPOOL CORP | WHR | 2.49 | 2.2 | 11.04 | Tuesday | BTO |

| AFFIL MANAGERS | AMG | 2.91 | 2.48 | 1.72 | Tuesday | BTO |

| BRISTOL-MYERS | BMY | 0.5 | 0.46 | 15 | Tuesday | BTO |

| CONSOL ENERGY | CNX | 0.11 | 0.53 | 25 | Tuesday | BTO |

| COACH INC | COH | 0.35 | 0.68 | 10.77 | Tuesday | BTO |

| ECOLAB INC | ECL | 0.81 | 0.74 | 0 | Tuesday | BTO |

| FORD MOTOR CO | F | 0.25 | 0.25 | 18.18 | Tuesday | BTO |

| CORNING INC | GLW | 0.33 | 0.31 | 18.42 | Tuesday | BTO |

| MASCO | MAS | 0.2 | 0.15 | 20 | Tuesday | BTO |

| NATL OILWELL VR | NOV | 1.11 | 1.4 | 15 | Tuesday | BTO |

| PARKER HANNIFIN | PH | 2.01 | 1.88 | 18.71 | Tuesday | BTO |

| TEXTRON INC | TXT | 0.49 | 0.36 | 6.76 | Tuesday | BTO |

| UTD PARCEL SRVC | UPS | 1.09 | 0.98 | 0 | Tuesday | BTO |

| WATERS CORP | WAT | 1.02 | 0.92 | 5.29 | Tuesday | BTO |

| WYNDHAM WORLDWD | WYN | 0.93 | 0.78 | 4.65 | Tuesday | BTO |

| BOSTON SCIENTIF | BSX | 0.21 | 0.2 | 4.76 | Tuesday | BTO |

| MCGRAW HILL FIN | MHFI | 1 | 0.89 | 4.4 | Tuesday | BTO |

| Pfizer Inc (NYSE:PFE) | PFE | 0.5 | 0.57 | 1.89 | Tuesday | BTO |

| MERCK & CO INC | MRK | 0.75 | 0.88 | 2.35 | Tuesday | BTO |

| HOSPIRA INC | HSP | 0.51 | 0.6 | 29.27 | Tuesday | BTO |

| ENTERGY CORP | ETR | 1.32 | 2.29 | -9.64 | Tuesday | BTO |

| AETNA INC-NEW | AET | 1.96 | 1.98 | 0 | Tuesday | BTO |

| AGL RESOURCES | GAS | 1.49 | 1.37 | -16.46 | Tuesday | BTO |

| VALERO ENERGY | VLO | 1.76 | 1.54 | 51.24 | Tuesday | BTO |

| GRUPO FIN SANTR | BSMX | 0.19 | 0.18 | -5 | Tuesday | BTO |

| KONINKLIJKE PHL | PHG | N/A | 0.21 | N/A | Tuesday | BTO |

| TRANSALTA CORP | TAC | 0.03 | 0.15 | 18.18 | Tuesday | BTO |

| ANIXTER INTL | AXE | 1.07 | 1.44 | -12.03 | Tuesday | BTO |

| ATLAS COP-ADR A | ATLKY | 0.31 | 0.35 | -10.81 | Tuesday | BTO |

| CASTLE (AM) &CO | CAS | -0.43 | -0.67 | -234.69 | Tuesday | BTO |

| DAIMLER AG | DDAIF | N/A | 1.33 | N/A | Tuesday | BTO |

| FLAGSTAR BANCP | FBC | 0.14 | -1.51 | -53.33 | Tuesday | BTO |

| IDEXX LABS INC | IDXX | 0.98 | 0.89 | 18.75 | Tuesday | BTO |

| PRGX GLOBAL INC | PRGX | -0.07 | -0.12 | -233.33 | Tuesday | BTO |

| SELECT INCOME | SIR | 0.67 | 0.73 | -2.99 | Tuesday | BTO |

| TRIMAS CORP | TRS | 0.43 | 0.43 | 0 | Tuesday | BTO |

| WOLVERINE WORLD | WWW | 0.35 | 0.38 | 0 | Tuesday | BTO |

| OSHKOSH CORP | OSK | 0.77 | 0.8 | 24.24 | Tuesday | BTO |

| CIT GROUP | CIT | 0.79 | 0.55 | 20.21 | Tuesday | BTO |

| CIRCOR INTL | CIR | 0.64 | 0.78 | 2.86 | Tuesday | BTO |

| DEL FRISCOS RST | DFRG | 0.22 | 0.2 | -14.63 | Tuesday | BTO |

| FRANKLIN ELEC | FELE | 0.34 | 0.35 | 3.33 | Tuesday | BTO |

| AIXTRON AG-ADR | AIXG | -0.17 | -0.15 | N/A | Tuesday | BTO |

| COMP TASK | CTG | 0.08 | 0.19 | 23.53 | Tuesday | BTO |

| HEIDRICK & STRG | HSII | 0.02 | -0.04 | -63.64 | Tuesday | BTO |

| BRF-BRASIL FOOD | BRFS | 0.17 | 0.16 | 8.11 | Tuesday | BTO |

| ACTIVE POWER | ACPW | -0.17 | -0.19 | 40 | Tuesday | BTO |

| AGCO CORP | AGCO | 0.29 | 1.03 | 81.54 | Tuesday | BTO |

| AK STEEL HLDG | AKS | -0.24 | -0.4 | 133.33 | Tuesday | BTO |

| ALLY FINANCIAL | ALLY | 0.42 | 0.33 | 2.56 | Tuesday | BTO |

| CIBER INC | CBR | 0.04 | 0.05 | 600 | Tuesday | BTO |

| CAPELLA EDUCATN | CPLA | 0.82 | 0.7 | 7.61 | Tuesday | BTO |

| CRYOLIFE INC | CRY | N/A | 0.04 | N/A | Tuesday | BTO |

| ENTEGRIS INC | ENTG | 0.17 | 0.12 | -5.56 | Tuesday | BTO |

| FIRST COMW FINL | FCF | 0.15 | 0.13 | -20 | Tuesday | BTO |

| 1800FLOWERS.COM | FLWS | -0.19 | -0.02 | 1.22 | Tuesday | BTO |

| FIRSTMERIT CORP | FMER | 0.33 | 0.31 | 0 | Tuesday | BTO |

| GROUP 1 AUTO | GPI | 1.38 | 1.19 | 27.48 | Tuesday | BTO |

| GREAT WSTRN BCP | GWB | 0.34 | N/A | 8.7 | Tuesday | BTO |

| II-VI INCORP | IIVI | 0.2 | 0.2 | 50 | Tuesday | BTO |

| INTREPID POTASH | IPI | 0.05 | -0.01 | 250 | Tuesday | BTO |

| K12 INC | LRN | 0.38 | 0.4 | 13.79 | Tuesday | BTO |

| LEXMARK INTL | LXK | 0.79 | 0.92 | -3.48 | Tuesday | BTO |

| MIMEDX GRP INC | MDXG | 0.03 | -0.01 | 0 | Tuesday | BTO |

| NEOGENOMICS INC | NEO | -0.02 | 0 | 100 | Tuesday | BTO |

| CORP OFFICE PTY | OFC | 0.46 | 0.48 | 2.08 | Tuesday | BTO |

| PENSKE AUTO GRP | PAG | 0.82 | 0.73 | -1.25 | Tuesday | BTO |

| PORTLAND GEN EL | POR | 0.73 | 0.73 | 5.77 | Tuesday | BTO |

| PROVIDENT FINL | PROV | 0.26 | 0.14 | 8.7 | Tuesday | BTO |

| SCORPIO BULKERS | SALT | -0.1 | -0.08 | 0 | Tuesday | BTO |

| BANCO SANTAN SA | SAN | N/A | 0.16 | N/A | Tuesday | BTO |

| SENSATA TECHNOL | ST | 0.65 | 0.56 | 9.62 | Tuesday | BTO |

| SUPERVALU INC | SVU | 0.21 | 0.18 | 28.57 | Tuesday | BTO |

| T-MOBILE US INC | TMUS | -0.07 | -0.19 | 33.33 | Tuesday | BTO |

| VASCO DATA SEC | VDSI | 0.18 | 0.13 | 60 | Tuesday | BTO |

| SIRIUS XM HLDGS | SIRI | 0.03 | 0.02 | 0 | Tuesday | BTO |

| UTD THERAPEUTIC | UTHR | 2.35 | 2.64 | 19.18 | Tuesday | BTO |

| CARBONITE INC | CARB | -0.14 | -0.03 | -12.5 | Tuesday | BTO |

| BP (LONDON:BP) PLC | BP | 0.24 | 1.04 | -9.76 | Tuesday | BTO |

| AUDIOCODES LTD | AUDC | 0.03 | 0.01 | 33.33 | Tuesday | BTO |

| FIRSTSERVICE CP | FSRV | 0.19 | 0.02 | -0.9 | Tuesday | BTO |

| TWIN DISC | TWIN | 0.13 | 0 | 73.68 | Tuesday | BTO |

| YANDEX NV-A | YNDX | 0.14 | 0.2 | 105 | Tuesday | BTO |

| IPG PHOTONICS | IPGP | 0.99 | 0.77 | 0 | Tuesday | BTO |

| RADCOM LTD | RDCM | 0.14 | 0.01 | 200 | Tuesday | BTO |

| WADDELL&REED -A | WDR | 0.82 | 0.88 | 10.23 | Tuesday | BTO |

| TAL EDUCATN-ADR | XRS | 0.16 | 0.21 | -7.14 | Tuesday | BTO |

| CENTENE CORP | CNC | 0.48 | 0.4 | 2.35 | Tuesday | BTO |

| JetBlue Airways (NASDAQ:JBLU) | JBLU | 0.39 | 0.01 | 13.04 | Tuesday | BTO |

| NAVIGANT CONSLT | NCI | 0.15 | 0.2 | 40 | Tuesday | BTO |

| MERGE HEALTHCAR | MRGE | N/A | 0.03 | N/A | Tuesday | BTO |

| ICON PLC | ICLR | 0.81 | 0.57 | 14.47 | Tuesday | BTO |

| SANTANDER CNSMR | SC | 0.68 | 0.44 | 23.21 | Tuesday | BTO |

| SERVICEMASTR GH | SERV | 0.26 | -0.2 | 4.55 | Tuesday | BTO |

| GENWORTH FINL | GNW | 0.26 | 0.39 | -1033.33 | Tuesday | AMC |

| OWENS-ILLINOIS | OI | 0.42 | 0.62 | 0 | Tuesday | AMC |

| WESTERN DIGITAL | WDC | 1.92 | 1.94 | 7.62 | Tuesday | AMC |

| EXPRESS SCRIPTS | ESRX | 1.1 | 0.99 | 0.72 | Tuesday | AMC |

| KRAFT FOODS GRP | KRFT | 0.81 | 0.78 | 16.44 | Tuesday | AMC |

| WYNN RESRTS LTD | WYNN | 1.36 | 2.32 | -16.67 | Tuesday | AMC |

| AKAMAI TECH | AKAM | 0.51 | 0.47 | 5.66 | Tuesday | AMC |

| RANGE RESOURCES | RRC | 0.04 | 0.4 | 113.64 | Tuesday | AMC |

| AFLAC INC | AFL | 1.55 | 1.69 | 0 | Tuesday | AMC |

| TOTAL SYS SVC | TSS | 0.43 | 0.35 | 10 | Tuesday | AMC |

| EDISON INTL | EIX | 0.78 | 0.9 | 26.19 | Tuesday | AMC |

| EQUITY RESIDENT | EQR | 0.8 | 0.71 | 3.61 | Tuesday | AMC |

| TECO ENERGY | TE | 0.28 | 0.23 | -9.52 | Tuesday | AMC |

| CINCINNATI FINL | CINF | 0.74 | 0.47 | 12.66 | Tuesday | AMC |

| GRANA Y MONTERO | GRAM | 0.15 | 0.22 | -20 | Tuesday | AMC |

| NOVADAQ TEC INC | NVDQ | -0.09 | -0.08 | -11.11 | Tuesday | AMC |

| REGIONAL MANAGE | RM | 0.36 | 0.36 | -31.25 | Tuesday | AMC |

| ARTISAN PTNR AM | APAM | 0.68 | 0.78 | -1.3 | Tuesday | AMC |

| CLECO CORP | CNL | 0.39 | 0.42 | 1.69 | Tuesday | AMC |

| EXACTECH INC | EXAC | 0.31 | 0.3 | 5.88 | Tuesday | AMC |

| FEI COMPANY | FEIC | 0.6 | 0.61 | -4.85 | Tuesday | AMC |

| PENN RE INV TR | PEI | 0.39 | 0.4 | 0 | Tuesday | AMC |

| TANGER FACT OUT | SKT | 0.49 | 0.43 | 23.26 | Tuesday | AMC |

| UMB FINL CORP | UMBF | 0.7 | 0.52 | -22.37 | Tuesday | AMC |

| IAC/INTERACTIV | IACI | 0.24 | 0.52 | 20 | Tuesday | AMC |

| DDR CORP | DDR | 0.3 | 0.28 | 0 | Tuesday | AMC |

| RENASANT CORP | RNST | 0.48 | 0.43 | 0 | Tuesday | AMC |

| DYNAMIC MATLS | BOOM | 0.03 | 0.12 | -64.71 | Tuesday | AMC |

| ENDESA-CHILE | EOC | 0.24 | 0.24 | 8.97 | Tuesday | AMC |

| AEGION CORP | AEGN | 0.14 | 0.13 | 20 | Tuesday | AMC |

| ALLIANCE HLDGS | AHGP | 1.16 | 1.13 | 1.71 | Tuesday | AMC |

| ATLANTIC TELE-N | ATNI | 0.73 | 0.49 | 51.72 | Tuesday | AMC |

| YAMANA GOLD INC | AUY | 0 | 0.02 | -166.67 | Tuesday | AMC |

| BARRETT BUS SVS | BBSI | -0.86 | -0.5 | 12.5 | Tuesday | AMC |

| BIG 5 SPORTING | BGFV | 0.11 | 0.1 | 18.75 | Tuesday | AMC |

| BALLARD PWR SYS | BLDP | 0.14 | -0.03 | -50 | Tuesday | AMC |

| FIRST BUSEY-A | BUSE | 0.1 | 0.09 | -20 | Tuesday | AMC |

| BUFFALO WLD WNG | BWLD | 1.66 | 1.49 | -1.83 | Tuesday | AMC |

| CBL&ASSOC PPTYS | CBL | 0.53 | 0.52 | 3.08 | Tuesday | AMC |

| COSTAMARE INC | CMRE | 0.32 | 0.35 | 10.81 | Tuesday | AMC |

| CAPSTONE MINING | CSFFF | -0.02 | -0.01 | 100 | Tuesday | AMC |

| EPR PROPERTIES | EPR | 1.01 | 1 | 8.65 | Tuesday | AMC |

| EPIZYME INC | EPZM | -0.99 | -0.22 | 18.52 | Tuesday | AMC |

| FARO TECH INC | FARO | 0.13 | 0.29 | 4.92 | Tuesday | AMC |

| FRANKLIN ST PPT | FSP | 0.27 | 0.29 | 0 | Tuesday | AMC |

| HELEN OF TROY | HELE | 1.22 | 0.84 | 42 | Tuesday | AMC |

| HIGHWOODS PPTYS | HIW | 0.72 | 0.66 | 0 | Tuesday | AMC |

| HURON CONSLT GP | HURN | 0.59 | 1.1 | 1.37 | Tuesday | AMC |

| NANOMETRICS INC | NANO | 0.05 | 0.09 | 14.29 | Tuesday | AMC |

| NATL COMMERCE | NCOM | 0.29 | N/A | N/A | Tuesday | AMC |

| NCR CORP-NEW | NCR | 0.39 | 0.5 | 10 | Tuesday | AMC |

| PANERA BREAD CO | PNRA | 1.44 | 1.55 | 2.75 | Tuesday | AMC |

| SMART&FINAL STR | SFS | 0.08 | N/A | N/A | Tuesday | AMC |

| US SILICA HOLDI | SLCA | 0.45 | 0.37 | 0 | Tuesday | AMC |

| TAHOE RESOURCES | TAHO | 0.13 | 0.17 | -53.33 | Tuesday | AMC |

| WILLIS GP HLDGS | WSH | 1.39 | 1.36 | 2.22 | Tuesday | AMC |

| UTD STATES STL | X | 0.26 | 0.34 | 104.49 | Tuesday | AMC |

| ULTIMATE SOFTWR | ULTI | 0.27 | 0.24 | 13.89 | Tuesday | AMC |

| BIOMED RLTY TR | BMR | 0.37 | 0.38 | 0 | Tuesday | AMC |

| CLIFFS NATURAL | CLF | -0.19 | -0.68 | 566.67 | Tuesday | AMC |

| MUELLER WATER | MWA | 0.08 | 0.07 | -25 | Tuesday | AMC |

| OPEN TEXT CORP | OTEX | 0.82 | 0.82 | -5.05 | Tuesday | AMC |

| TRUSTMARK CP | TRMK | 0.39 | 0.43 | -4.55 | Tuesday | AMC |

| WEINGARTEN RLTY | WRI | 0.52 | 0.49 | 2 | Tuesday | AMC |

| CORP EXEC BRD | CEB | 0.58 | 0.47 | 22.68 | Tuesday | AMC |

| XOOM CORP | XOOM | -0.04 | 0.01 | 350 | Tuesday | AMC |

| APPLD MICRO CIR | AMCC | -0.14 | -0.03 | 0 | Tuesday | AMC |

| ALLIANCE RES | ARLP | 0.98 | 1.1 | -0.84 | Tuesday | AMC |

| CALIX INC | CALX | -0.12 | -0.11 | -14.29 | Tuesday | AMC |

| DHT HOLDINGS | DHT | 0.22 | -0.01 | 287.5 | Tuesday | AMC |

| KFORCE INC | KFRC | 0.18 | 0.19 | -3.12 | Tuesday | AMC |

| MERCURY SYSTEMS | MRCY | 0.13 | 0.09 | 125 | Tuesday | AMC |

| MA-COM TECH SOL | MTSI | 0.35 | 0.26 | 0 | Tuesday | AMC |

| RINGCENTRAL INC | RNG | -0.17 | -0.2 | 0 | Tuesday | AMC |

| SOLARWINDS INC | SWI | 0.36 | 0.31 | 0 | Tuesday | AMC |

| WESBANCO INC | WSBC | 0.58 | 0.56 | -1.67 | Tuesday | AMC |

| GREEN PLAINS | GPRE | 0.21 | 1.04 | 10.31 | Tuesday | AMC |

| LOGMEIN INC | LOGM | 0.07 | 0.08 | 38.46 | Tuesday | AMC |

| ASPEN TECH INC | AZPN | 0.28 | 0.25 | 25.93 | Tuesday | AMC |

| PS BUSINESS PKS | PSB | 1.12 | 1.22 | 3.42 | Tuesday | AMC |

| RPX CORP | RPXC | 0.31 | 0.18 | 0 | Tuesday | AMC |

| CHEMED CORP | CHE | 1.35 | 1.27 | 6.06 | Tuesday | AMC |

| EPIQ SYS INC | EPIQ | 0 | 0.13 | N/A | Tuesday | AMC |

| HARMONIC INC | HLIT | 0 | 0 | 0 | Tuesday | AMC |

| NATL INSTRS CP | NATI | 0.17 | 0.17 | 20 | Tuesday | AMC |

| PERICOM SEMICON | PSEM | 0.13 | 0.07 | 58.33 | Tuesday | AMC |

| RADISYS CORP | RSYS | 0.01 | -0.18 | -125 | Tuesday | AMC |

| EXCO RESOURCES | XCO | -0.08 | 0.05 | -100 | Tuesday | AMC |

| STEPAN CO | SCL | 0.68 | 0.56 | 8.57 | Tuesday | AMC |

| SMITH MICRO SOF | SMSI | 0 | -0.09 | 100 | Tuesday | AMC |

| AMER ASSETS TR | AAT | 0.42 | 0.39 | 2.44 | Tuesday | AMC |

| ARCH CAP GP LTD | ACGL | 1.1 | 1.2 | 8.49 | Tuesday | AMC |

| EMPIRE STATE RE | ESRT | 0.19 | 0.17 | 10 | Tuesday | AMC |

| GOPRO INC-A | GPRO | 0.08 | 0.09 | 37.1 | Tuesday | AMC |

| KAISER ALUMINUM | KALU | 1.03 | 0.72 | 1.19 | Tuesday | AMC |

| MICROSTRATEGY | MSTR | 1.08 | -0.57 | 57.64 | Tuesday | AMC |

| TEMPUR SEALY | TPX | 0.48 | 0.53 | 2.38 | Tuesday | AMC |

| TWITTER INC | TWTR | -0.21 | -0.22 | 28.57 | Tuesday | AMC |

| VERISK ANALYTIC | VRSK | 0.61 | 0.55 | 3.17 | Tuesday | AMC |

| ACADIA HEALTHCR | ACHC | 0.41 | 0.28 | 0 | Tuesday | AMC |

| APOLLO COMMERCL | ARI | 0.44 | 0.36 | -4.35 | Tuesday | AMC |

| BLACKHAWK NETWK | HAWK | 0.16 | 0.02 | 1.89 | Tuesday | AMC |

| INTERNAP NETWRK | INAP | -0.15 | -0.18 | 0 | Tuesday | AMC |

| INPHI CORP | IPHI | 0.05 | -0.01 | 180 | Tuesday | AMC |

| OMEGA HLTHCARE | OHI | 0.69 | 0.68 | -4.23 | Tuesday | AMC |

| SEACOAST BKNG A | SBCF | 0.16 | 0.09 | -8.33 | Tuesday | AMC |

| BLACKSTONE MRTG | BXMT | 0.49 | 0.34 | 0 | Tuesday | AMC |

| CELADON GROUP | CGI | 0.31 | 0.15 | 20 | Tuesday | AMC |

| BLACKHAWK NET-B | HAWKB | 0.21 | 0.01 | 0.93 | Tuesday | AMC |

| LEMAITRE VASCLR | LMAT | 0.05 | 0.02 | 57.14 | Tuesday | AMC |

| HCC INS HLDGS | HCC | 0.9 | 0.94 | -1.87 | Tuesday | AMC |

| CIRRUS LOGIC | CRUS | 0.34 | 0.32 | 45.9 | Tuesday | AMC |

| NTT DOCOMO -ADR | DCM | N/A | 0.08 | N/A | Tuesday | N/A |

| ORANGE-ADR | ORAN | N/A | N/A | N/A | Tuesday | N/A |

| KB FINL GRP-ADR | KB | N/A | 0.94 | N/A | Tuesday | N/A |

| STANDARD CHARTR | SCBFF | N/A | N/A | N/A | Tuesday | N/A |

| MIDSOUTH BANCRP | MSL | 0.34 | 0.33 | -18.42 | Tuesday | N/A |

| ADT CORP | ADT | 0.5 | 0.49 | 4.08 | Wednesday | BTO |

| AMETEK INC | AME | 0.63 | 0.57 | 1.61 | Wednesday | BTO |

| AVERY DENNISON | AVY | 0.7 | 0.65 | 12.5 | Wednesday | BTO |

| Goodyear (NASDAQ:GT) | GT | 0.45 | 0.56 | 1.72 | Wednesday | BTO |

| NORFOLK SOUTHRN | NSC | 1 | 1.17 | 0 | Wednesday | BTO |

| PRAXAIR INC | PX | 1.43 | 1.51 | 0 | Wednesday | BTO |

| SOUTHERN CO | SO | 0.59 | 0.66 | -2.56 | Wednesday | BTO |

| HESS CORP | HES | -1.05 | 1.38 | -37.93 | Wednesday | BTO |

| MEADWESTVACO CP | MWV | 0.27 | 0.23 | 4.55 | Wednesday | BTO |

| FRANKLIN RESOUR | BEN | 0.86 | 0.89 | -2.15 | Wednesday | BTO |

| EATON CORP PLC | ETN | 0.98 | 1.01 | 5.83 | Wednesday | BTO |

| GARMIN LTD | GRMN | 0.58 | 0.55 | 7.69 | Wednesday | BTO |

| HUDSON CITY BCP | HCBK | 0.03 | 0.09 | 60 | Wednesday | BTO |

| STARWOOD HOTELS | HOT | 0.57 | 0.63 | 25.97 | Wednesday | BTO |

| INTL PAPER | IP | 0.77 | 0.61 | -11.67 | Wednesday | BTO |

| PG&E CORP | PCG | 0.69 | 0.54 | -1.85 | Wednesday | BTO |

| MASTERCARD INC | MA | 0.79 | 0.73 | 7.46 | Wednesday | BTO |

| Time Warner Inc (NYSE:TWX) | TWX | 1.09 | 0.91 | 4.26 | Wednesday | BTO |

| MONDELEZ INTL | MDLZ | 0.37 | 0.39 | 9.3 | Wednesday | BTO |

| NORTHROP GRUMMN | NOC | 2.26 | 2.31 | 1.8 | Wednesday | BTO |

| WASTE MGMT-NEW | WM | 0.49 | 0.49 | 9.84 | Wednesday | BTO |

| EXELON CORP | EXC | 0.67 | 0.62 | -5.88 | Wednesday | BTO |

| CBRE GROUP INC | CBG | 0.25 | 0.25 | -1.45 | Wednesday | BTO |

| NEXTERA ENERGY | NEE | 1.28 | 1.26 | -0.96 | Wednesday | BTO |

| ANTHEM INC | ANTM | 2.69 | 2.3 | 0.58 | Wednesday | BTO |

| HUMANA INC NEW | HUM | 2.54 | 2.35 | -6.03 | Wednesday | BTO |

| LEVEL 3 COMM | LVLT | 0.33 | 0.47 | 6.06 | Wednesday | BTO |

| GENL DYNAMICS | GD | 1.94 | 1.71 | 4.29 | Wednesday | BTO |

| BARCLAY PLC-ADR | BCS | N/A | 0.37 | 14.29 | Wednesday | BTO |

| FEDERAL MOGUL-A | FDML | 0.18 | 0.31 | -46.15 | Wednesday | BTO |

| FRANKS INTL NV | FI | 0.23 | 0.27 | -9.68 | Wednesday | BTO |

| LUMBER LIQUIDAT | LL | 0.16 | 0.49 | -15.79 | Wednesday | BTO |

| UNIVL TRUCKLOAD | UACL | 0.27 | 0.27 | -12.5 | Wednesday | BTO |

| UNVL STAINLESS | USAP | 0.01 | 0.05 | 0 | Wednesday | BTO |

| WCI COMMUNITIES | WCIC | 0.16 | 0.06 | 64.52 | Wednesday | BTO |

| Coca Cola (NYSE:KOF) | KOF | 0.59 | 0.85 | -20.97 | Wednesday | BTO |

| ABB LTD-ADR | ABB | 0.22 | 0.24 | -2.86 | Wednesday | BTO |

| CTC MEDIA INC | CTCM | N/A | 0.2 | N/A | Wednesday | BTO |

| DELHAIZE-LE | DEG | N/A | 0.3 | N/A | Wednesday | BTO |

| LINN CO LLC | LNCO | -0.1 | -0.15 | 296 | Wednesday | BTO |

| ISTAR FINL INC | STAR | -0.16 | -0.31 | 14.29 | Wednesday | BTO |

| SUBSEA 7 SA | SUBCY | N/A | 0.41 | N/A | Wednesday | BTO |

| Thomson Reuters (NYSE:TRI) | TRI | 0.46 | 0.46 | -10.42 | Wednesday | BTO |

| SPEEDWAY MOTORS | TRK | 0.03 | 0.03 | 33.33 | Wednesday | BTO |

| WEX INC | WEX | 0.93 | 1.02 | -12.62 | Wednesday | BTO |

| BOK FINL CORP | BOKF | 1.04 | 1.11 | -13.08 | Wednesday | BTO |

| O2MICRO INT LTD | OIIM | -0.14 | -0.1 | -76.92 | Wednesday | BTO |

| ACCO BRANDS CP | ACCO | -0.06 | -0.05 | 2.86 | Wednesday | BTO |

| AMEDISYS INC | AMED | 0.2 | -0.07 | 0 | Wednesday | BTO |

| Brunswick Corp (NYSE:BC) | BC | 0.61 | 0.6 | 22.22 | Wednesday | BTO |

| BGC PARTNRS INC | BGCP | 0.18 | 0.15 | -5.26 | Wednesday | BTO |

| CAMECO CORP | CCJ | 0.14 | 0.08 | 44.83 | Wednesday | BTO |

| CENTL EUR MEDIA | CETV | N/A | -0.27 | N/A | Wednesday | BTO |

| CAPITOL FEDL FN | CFFN | 0.15 | 0.14 | 0 | Wednesday | BTO |

| CARLYLE GROUP | CG | 0.57 | 0.85 | 36.59 | Wednesday | BTO |

| CARTERS INC | CRI | 0.74 | 0.73 | 3.94 | Wednesday | BTO |

| DHI GROUP INC | DHX | 0.09 | 0.08 | -7.69 | Wednesday | BTO |

| DIXIE GRP INC | DXYN | -0.02 | -0.2 | -300 | Wednesday | BTO |

| EDUCATION RLTY | EDR | 0.48 | 0.51 | 3.45 | Wednesday | BTO |

| FIAT CHRYSLER | FCAU | 0.06 | N/A | 14.71 | Wednesday | BTO |

| FELCOR LODGING | FCH | 0.1 | 0.03 | 50 | Wednesday | BTO |

| CEDAR FAIR | FUN | -1.23 | -1.51 | 25 | Wednesday | BTO |

| HERCULES OFFSHR | HERO | -0.38 | 0.22 | 34.29 | Wednesday | BTO |

| Hilton Worldwide (NYSE:HLT) | HLT | 0.12 | 0.12 | -5.56 | Wednesday | BTO |

| INTERDIGITL INC | IDCC | 0.77 | -0.05 | 0 | Wednesday | BTO |

| MARINE PRODUCTS | MPX | 0.07 | 0.05 | -16.67 | Wednesday | BTO |

| NORSK HYDRO ADR | NHYDY | N/A | 0.03 | N/A | Wednesday | BTO |

| New York (NYSE:NYCB) | NYCB | 0.26 | 0.26 | 18.52 | Wednesday | BTO |

| QUINTILES TRANS | Q | 0.71 | 0.68 | 4.48 | Wednesday | BTO |

| RPC INC | RES | 0.12 | 0.18 | 12.5 | Wednesday | BTO |

| SPIRIT AIRLINES | SAVE | 0.96 | 0.52 | 3.9 | Wednesday | BTO |

| SILGAN HOLDINGS | SLGN | 0.54 | 0.53 | 3.57 | Wednesday | BTO |

| SILICONWARE-ADR | SPIL | N/A | 0.11 | N/A | Wednesday | BTO |

| THOMSON REUT-TS | T.TRI | 0.56 | 0.5 | -6.9 | Wednesday | BTO |