There is an old saying on Wall Street that I will paraphrase as: the news is always best at the top and worst at the bottom. That is because good news drives buyers in and bad news generally causes widespread selling and/or panic as sentiment reaches extremes. Once all of the band wagon investors have either jumped on or stepped off a trend, the price begins to reverse course.

This axiom is more of an observation of investor behavior rather than an actionable trigger for calling tops and bottoms. However, I am reminded of this logic when I look at the situation in emerging market countries and even more so with Brazil.

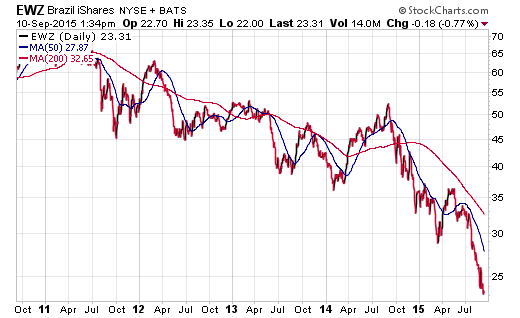

Last night Standard & Poor’s downgraded Brazil’s credit rating to junk status in a move that is shocking to no one that has looked at a chart of the iShares MSCI Brazil Capped ETF (NYSE:EWZ). This ETF tracks a diversified basket of large and mid-cap stocks domiciled in Brazil and has fallen more than 50% over the last year. In fact, EWZ has been in a long-term downtrend since it peaked back in 2011.

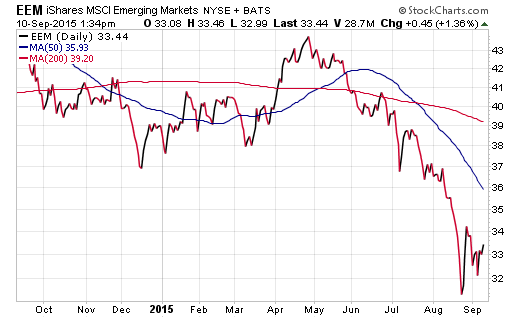

Some of the more recent and ferocious selling in Brazil may be prompted by the issues stemming from the route in Chinese stocks alongside other lesser known emerging market countries. The broad-based iShares MSCI Emerging Market ETF (NYSE:EEM) fell 30% from its April 2015 peak to the August low. In addition, this ETF is trailing only the SPDR S&P 500 ETF (NYSE:SPY) in net year-to-date outflows with over $7.2 billion in investor redemption’s.

Yet despite the continued deluge of negative headlines concerning these overseas markets, we are actually seeing some constructive price action over the last several weeks. EEM has managed to establish one higher low in September and shake off the latest round of Brazil downgrades. In addition, the sideways action in the U.S. dollar index may embolden some investors look for value overseas.

Whether you are a bull or a bear on emerging market indexes, this is certainly an area that is worth monitoring through the remainder of 2015. There will likely be profitable opportunities for both sides moving forward.

The Bottom Line

I have no idea if this moment will mark THE low in emerging markets or if this is simply a brief respite in the path to further selling. Bad news can always get worse.

If there is one thing I have learned over the years, it’s that the markets can stay irrational for much longer than you can stay solvent.

Nevertheless, keep in mind that some of the worst news headlines have actually sparked some of the biggest inflection points over the history of investing. That is why it pays to be flexible and maintain a counter-intuitive mindset when others are fearful.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.