Europe’s banking system has been on the ropes for years.

It’s a little known fact that the largest recipients of US bailouts were in fact foreign banks based in Europe. Also bear in mind that the biggest beneficiaries of QE 2 were European banks. Things got so bad in mid-2012 that the whole system lurched towards collapse. The only thing that pulled the EU back from the brink was Mario Draghi’s promise of unlimited bond buying (a promise and nothing more as the EU has yet to do any of this).

However, these efforts, like all cover‐ups, will not last. Indeed, by the look of things, Europe’s banking system is breaking down again…

Greece’s four largest banks need to boost their capital by 27.5 billion euros ($36.3 billion) after taking losses from the country’s debt swap earlier this year, the largest sovereign restructuring in history.

National Bank of Greece SA, the country’s biggest lender, needs to raise 9.8 billion euros, according to an e-‐mailed report by the Athens-‐based Bank of Greece (TELL) today. Eurobank Ergasias SA (EUROB) needs 5.8 billion euros, Alpha Bank (ALPHA) needs 4.6 billion euros and Piraeus Bank SA (TPEIR) needs 7.3 billion euros, according to the report. Total recapitalization needs for the country’s banking sector amount to 40.5 billion euros, the report said.

source: bloomberg.

The above articles tell us point blank that Europe’s banking crisis is neither fixed nor even close to over. However, the numbers need some perspective: sure, €27.5 billion sounds like a lot of money, but just how big is it relative to Greece’s banks.

The entire capital base of the Greek banking system is only €22 billion.

By saying that Greek banks need €27.5 billion Greece is essentially admitting that is needs to recapitalize its entire banking system. Also, you should know that Greek banks are still sitting on €46.8 billion in bad loans.

There is a word for a banking system with a capital base of €22 billion and bad loans of €46.8. It’s INSOLVENT.

We get other signs that Europe is ready to fall back into the abyss from recent revelations concerning Spain’s sovereign bonds.

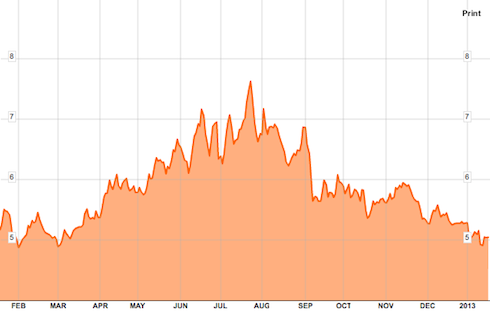

In July 2012, Spain’s ten year bond yield hit 8% even though Spain had already been granted a €100 billion bailout by the EU and the ECB had also promised to provide unlimited bond buying.

As a point of reference, remember that any yield over 7% is GAME OVER as far as funding your debt.

Then, starting in August 2012, Spain’s ten-‐year bond yields magically began to fall. Since that time, they’ve plunged to just 5%.

The reason for this drop in yields?

It’s not that Spain’s finances improved (its Debt to GDP ratio hit 85% this year and is on track to reach 90% by the end of 2013). Nor is it that Spain’s economy is recovering (unemployment reached a new record in 3Q12).

It’s not also that investors are less worried about Spain and have decided to buy Spanish debt (Spain just staged a terrible bond rally in early December).

So why were Spanish yields falling?

Spain has been using up its Social Security fund to buy its own debt.

Spain has been quietly tapping the country’s richest piggy bank, the Social Security Reserve Fund, as a buyer of last resort for Spanish government bonds, raising questions about the fund’s role as guarantor of future pension payouts.

Now the scarcely noticed borrowing spree, carried out amid a prolonged economic crisis, is about to end, because there is little left to take. At least 90% of the €65 billion ($85.7 billion) fund has been invested in increasingly risky Spanish debt, according to official figures, and the government has begun withdrawing cash for emergency payments.

Source: Wall Street Journal

This is precisely what we mean when we say the system was rigged in the second half of 2012. Spain, a country that is totally bankrupt and likely heading for its own version of the Arab Spring (things are so bad that Spaniards have begun self-‐ immolating just as they did in Tunisia right before that country suffered a societal breakdown) managed to fool the world into believing that things had improved by raiding its social security fund to buy its own debt.

As we said at the beginning of this issue, the rigging that occurred in the second half of 2012 was simply staggering. But it will end. Our view is that we have perhaps another month or so left at the most before things begin to get ugly again.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Great Systemic Rig Of 2012 Is Ending

Published 01/18/2013, 01:19 AM

Updated 07/09/2023, 06:31 AM

The Great Systemic Rig Of 2012 Is Ending

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.