Keeping up with beta, much less beating it, isn’t getting any easier in 2021. That, at least, is the ongoing message in our trio of proprietary portfolio strategies that add various flavors of risk management to a game plan that targets a globally diversified set of assets.

Looking beyond recent history still suggests that our risk management offers value, at least in part. But for the year-to-date (and over the trailing one-year period), value-add is still missing from the raw performance numbers.

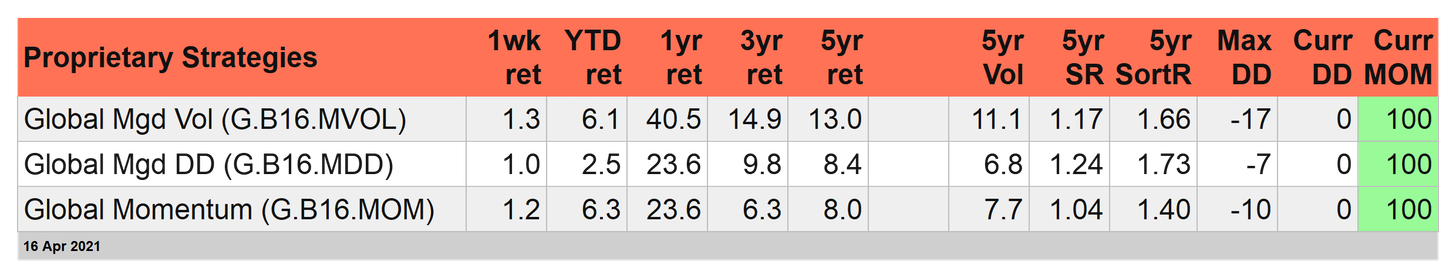

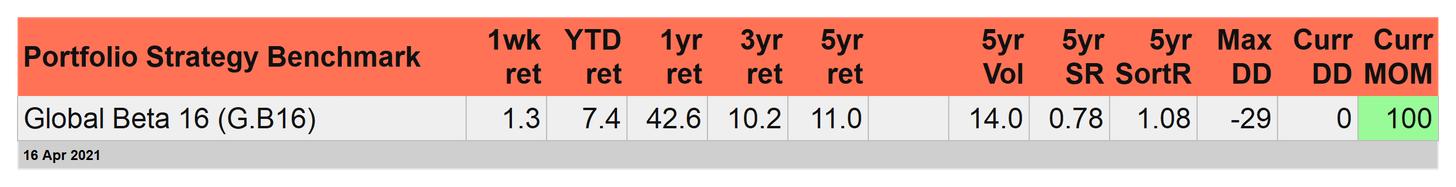

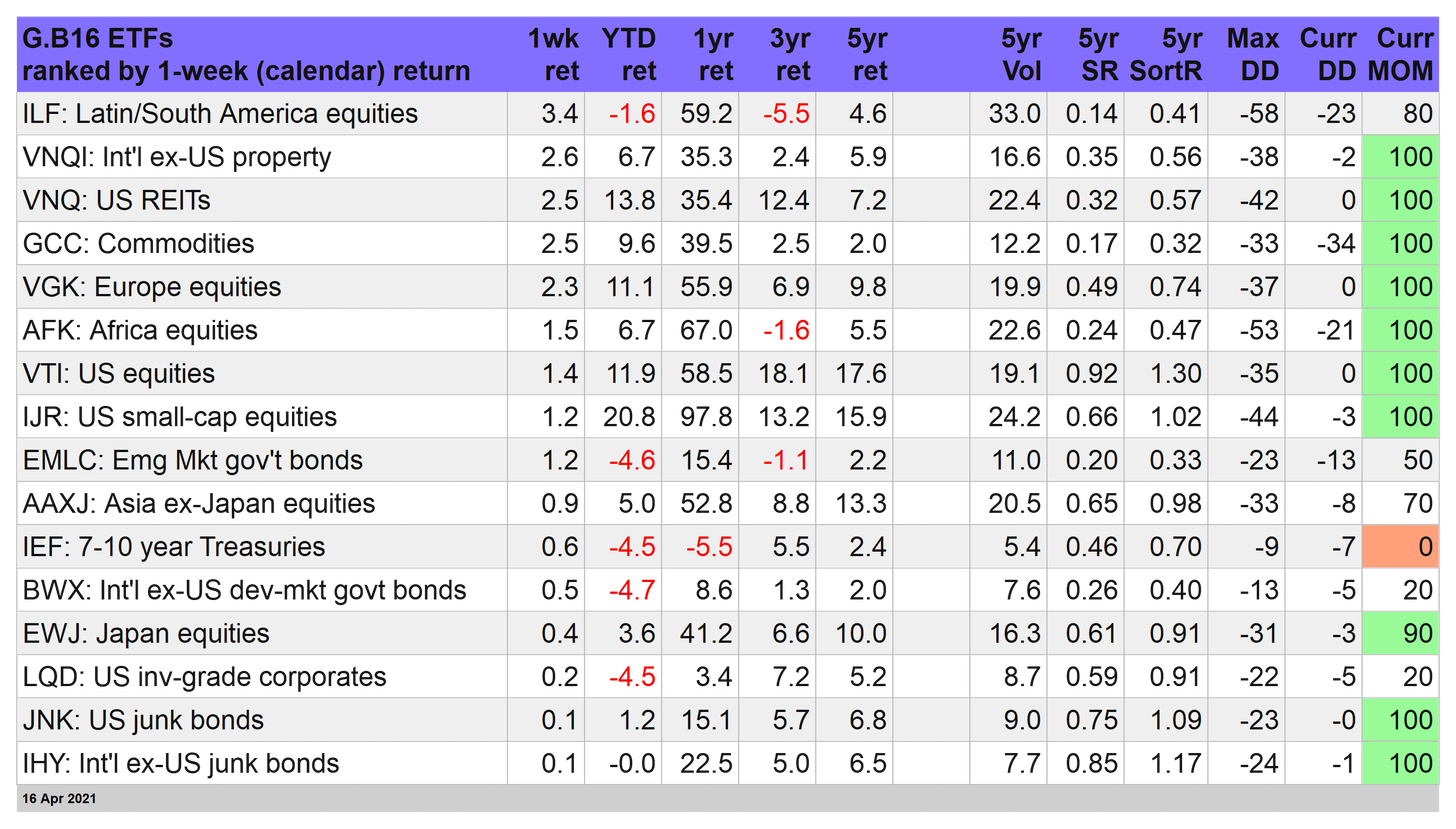

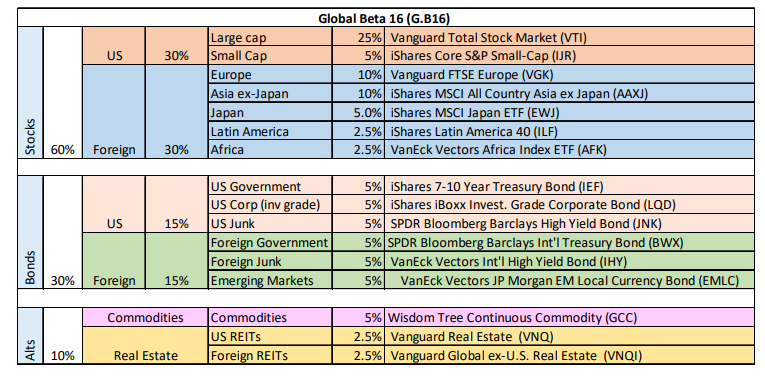

That includes results from last week’s horse race (through Apr. 16), which delivered a 1.3% gain for the benchmark—Global Beta 16 (G.B16)—which owns all of the 16 ETFs in our global opportunity set and rebalances every Dec. 31 to the weights shown in the table at the end of this article. One of our three risk-managed strategies (all of which use the same 16-fund opportunity set) managed to match G.B16’s gain last week; the other two were in G.B16’s rear-view mirror. For details on strategy rules and risk metrics in the tables below, please see this summary

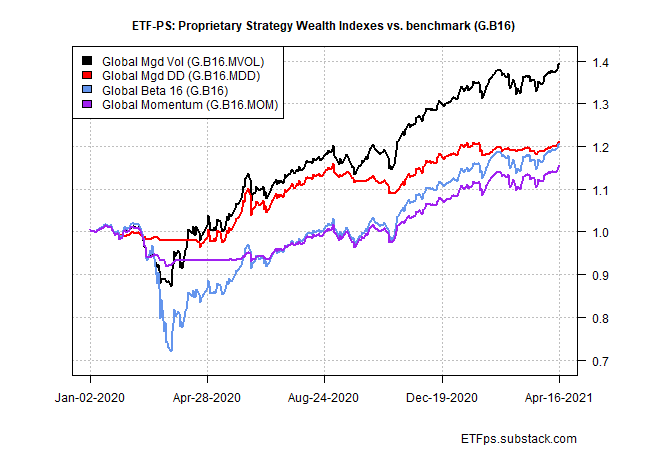

Note that for the 3- and 5-year windows, only Global Managed Volatility (G.B16.MVOL) enjoys a performance edge over the benchmark. But after factoring in risk (or at least certain types of risk), all three prop strategies compare favorably since 2016. Sharpe ratios, for example, are substantially higher vs. G.B16. The deepest drawdowns are also relatively mild vs. G.B16’s maximum 29% peak-to-trough slide in the past five years.

If we torture the data further, and use a Jan. 1, 2020 start date—just ahead of the pandemic’s start—the results also look encouraging for the prop strategies in terms of minimizing the loss during the coronavirus crash.

Of course, the encouraging results have to be weighed against the higher turnover in the three risk-managed strategies. Pick your poison.

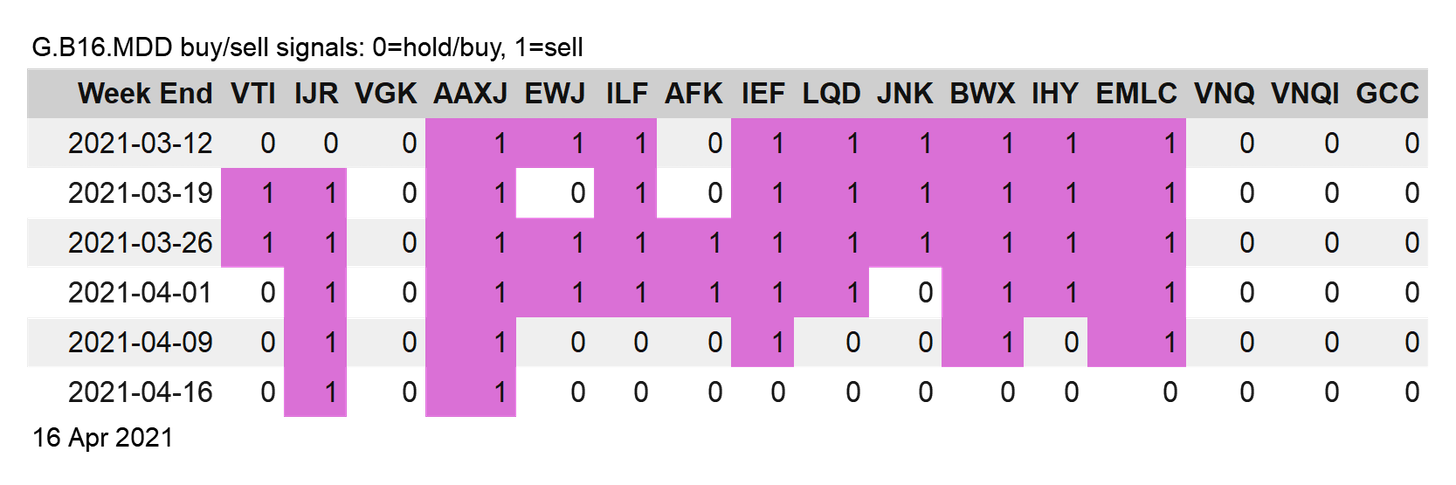

Speaking of turnover, there’s a bit more of it in Global Managed Drawdown (G.B16.MDD), which shifted to risk-on for three more funds at last week’s close.

That leaves just two funds in risk-off: US small-cap stocks—iShares Core S&P Small-Cap ETF (NYSE:IJR) and Asia ex-Japan—iShares MSCI All Country Asia ex Japan ETF (NASDAQ:AAXJ), as shown in the table below.

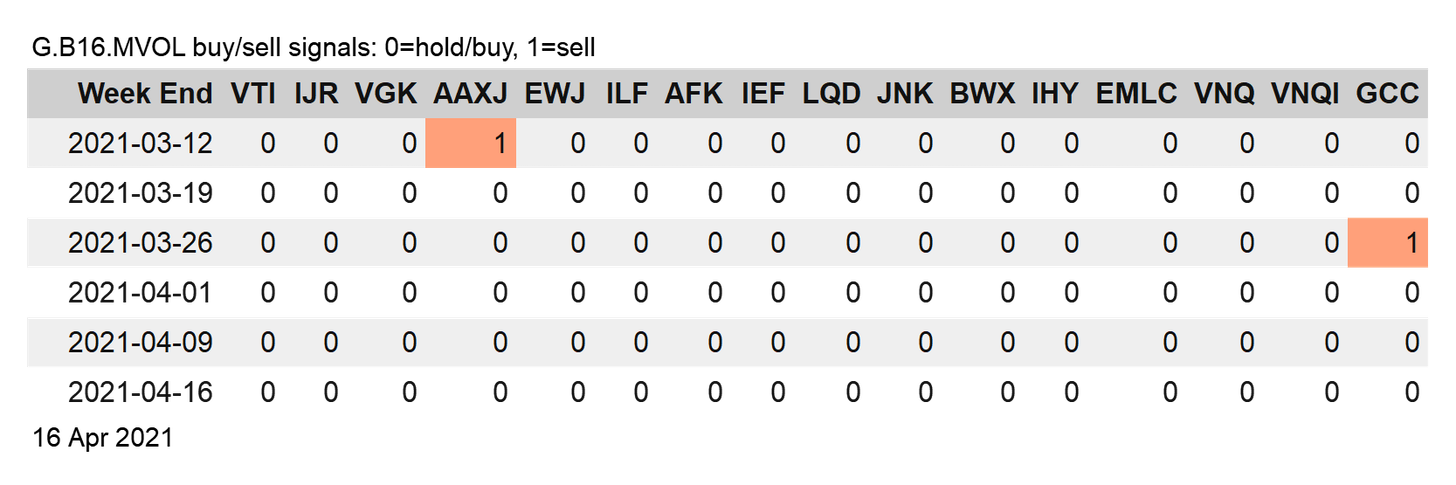

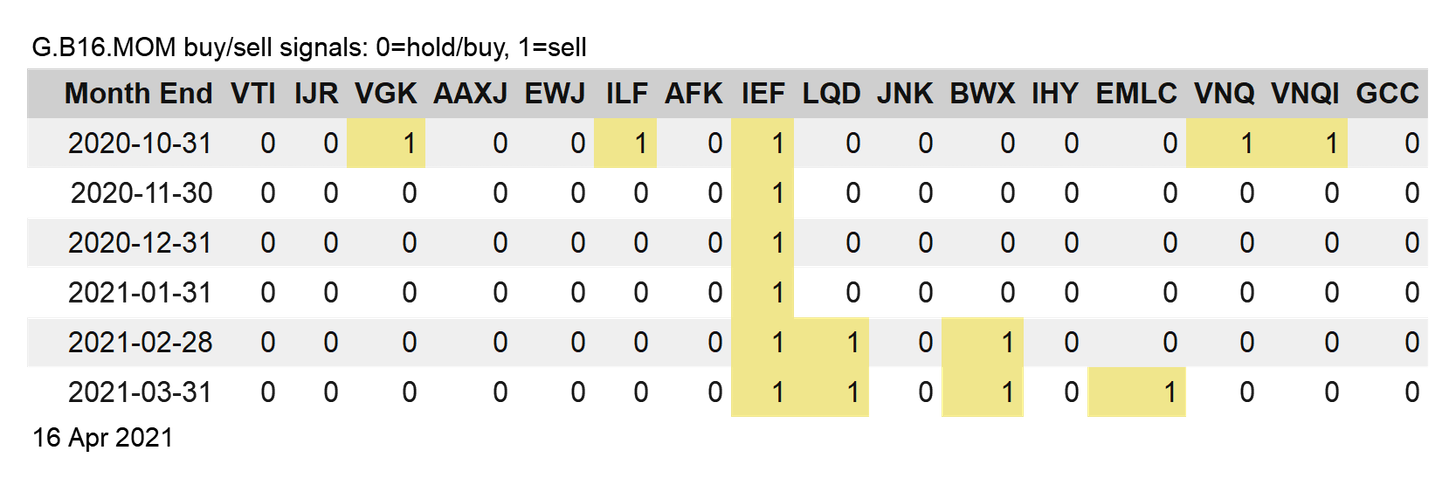

Meanwhile, G.B16.MVOL continues with an all-out risk-on profile for the funds while Global Managed Momentum (G.B16.MOM), per its rules, is only rebalanced (if at all) on a month-end basis and is currently at three-quarters risk-on, as of the Mar. 31 rebalancing.