“Davidson” submits:

Rising 10-Year Treasury rates tell an interesting story.

Rhetoric raises tension N.Korea/US… and the 10yr Treasury rate rises signaling investors are shifting towards higher return investments. This is a sign that investors are shifting towards believing Democratic principles likely to successfully confront autocratic threats.

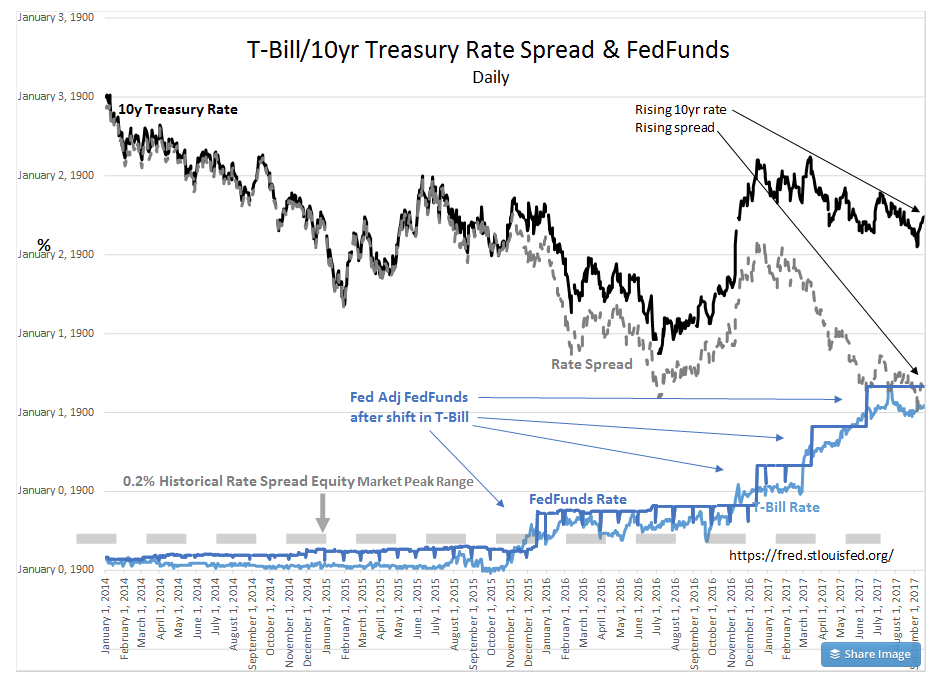

The 10yr Treasury rate(BLACK LINE) and T-Bill/10yr Treasury rate spread(DASHED GRAY LINE) fell 1 month ago as investors feared No Korea. The spread fell to 1.02% or 102bps. Today, as the US has responded strongly and imposes even more comprehensive sanctions with China, No Korea’s ally, onboard, the 10yr Treasury rate has risen to 2.27% bringing the spread vs the T-Bill to 1.27% or 127bps.

This market response which can only be monitored through the daily detail is positive for equities.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.