Shares of TG Therapeutics, Inc. (NASDAQ:TGTX) rose 30.3% after it announced the positive first clinical data from its once-daily, oral, BTK inhibitor, TG-1701, as a single agent and as a triple therapy in combination with ublituximab (TG-1101), its novel glycoengineered anti-CD20 monoclonal antibody, and umbralisib (TGR-1202), its oral, dual inhibitor of PI3K delta and CK1 epsilon, in patients with relapsed/refractory non-Hodgkin’s lymphoma (NHL) and chronic lymphocytic leukemia (CLL).

In the study, TG-1701 demonstrated superior selectivity for BTK compared to ibrutinib in an in vitro whole kinome screening. The data showed that the proprietary triplet of U2 plus TG-1701 induced 86% overall response rate(ORR) (6 of 7) among patients with relapsed/refractory NHL and CLL at the lowest dose of TG-1701 tested.

The study also showed that single-agent TG-1701 induced responses at multiple dose levels (including the lowest dose tested) across multiple B-cell diseases. The candidate demonstrated an encouraging safety profile to date, with dose escalation continuing for the combination with U2.

The company will continue the dose escalation of TG-1701 in the combination arm and identify the optimal dose for this therapy.

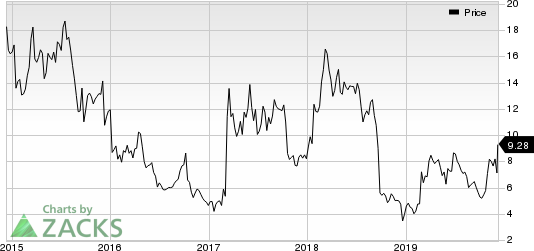

Shares of the company have skyrocketed 126.4% compared with the industry’s growth of 13.3%.

Separately, the company announced the triple therapy data from the phase I/II study of ublituximab in combination with venetoclax in patients with relapsed/refractory CLL. The data showed 100% ORR in relapsed/refractory CLL patients treated with U2 (umbralisib + ublituximab) plus venetoclax at cycle 7. The data also showed that 100% of patients (n=9) achieved undetectable minimal residual disease (MRD) in the peripheral blood after 12 months of therapy, and 78% achieved undetectable MRD in the bone marrow and stopped all therapy.

Data from both studies were presented at the 61st American Society of Hematology (ASH) Annual Meeting and Exposition.

Zacks Rank & Stocks to Consider

TG Therapeutics currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the biotech sector are Alkermes Plc. (NASDAQ:ALKS) , Anika Therapeutics Inc. (NASDAQ:ANIK) and Innoviva Inc. (NASDAQ:INVA) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ earnings per share estimates have increased from 36 cents to 52 cents for 2019 in the past 60 days. The company delivered a positive earnings surprise in the trailing four quarters by 236.80%, on average.

Anika’s earnings per share estimates have increased from $1.75 to $2.03 for 2019 and from $1.38 to $1.62 for 2020 in the past 60 days. The company delivered a positive earnings surprise in the trailing four quarters by 53.31%, on average.

Innoviva’s earnings per share estimates have increased from $1.71 to $2.03 for 2019 and from $1.07 to $1.34 for 2020 in the past 60 days.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%. This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

TG Therapeutics, Inc. (TGTX): Free Stock Analysis Report

Alkermes plc (ALKS): Free Stock Analysis Report

Innoviva, Inc. (INVA): Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK): Free Stock Analysis Report

Original post

Zacks Investment Research