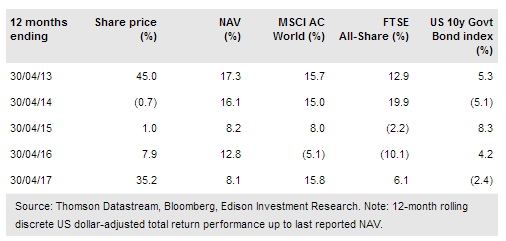

Tetragon Financial Group Ltd (AS:TFG) achieved an 8.5% NAV total return in 2016, with positive contributions from all asset classes. Tender offers totalling US$150m considerably enhanced returns, with shares repurchased at a substantial discount to NAV. While still wider than average among peers, Tetragon’s share price discount to NAV narrowed by c 10 points over the year, reflecting its 32.7% share price total return. The 2016 dividend was raised by 3.9% to US$0.6725, equating to a 5.3% yield. April 2017 marked Tetragon’s 10th anniversary and its performance since launch compares favourably to peers, with an 11.3% pa NAV total return to end-April 2017.

Steady progress made in 2016 and Q117

All asset classes contributed positively during 2016, with notable contributions from US CLO investments, equity and credit hedge funds, and direct equity and credit investments. Investment income and gains net of expenses contributed c 7% to Tetragon’s 8.5% NAV total return for the year, while tender offers totalling US$150m contributed c 7%, outweighing a c 5% negative effect from factors which increased Tetragon’s fully diluted share count over the year. TFG Asset Management’s AUM grew by US$2.4bn to US$19.5bn during the year. NAV total return was 1.4% in Q117, with positive returns from all asset classes except equity and credit hedge funds, where one fund recorded a negative contribution after expenses. TFG Asset Management’s AUM increased to US$19.8bn during the quarter.

To read the entire report Please click on the pdf File Below