In an effort to recapture its momentum in the fast growing cybersecurity market, Symantec Corporation (NASDAQ:SYMC) is all set to acquire Blue Coat, Inc., a leading web security solution provider, from private equity firm Bain Capital.

As per a definitive agreement signed by the two companies, Symantec will pay a total cash consideration of $4.65 billion for the transaction. Both the companies have obtained board approval and expect to close the deal in the third quarter of 2016.

Blue Coat is a privately owned company, which was founded in 1996 as CacheFlow. The company’s security solutions allow organizations to protect their web gateways from cyber-attacks. In Dec 2011, the company was acquired by private equity investment firm, Thoma Bravo, for $1.3 billion followed by the Mar 2015 takeover by Bain Capital for $2.4 billion.

At present, the company’s Cloud Generation Security solutions are used by a worldwide customer base of over 15,000.

How Symantec will Gain from the Transaction

Addition of Blue Coat is expected to enhance Symantec’s capabilities significantly. As per Symantec, the acquisition will not only provide economies of scale and bolster its existing portfolio but will also provide necessary resources to develop solutions to “protect large customers and individual consumers against insider threats and sophisticated cybercriminals”.

Apart from this, the deal will also provide direct access to Blue Coat’s huge customer base, thereby boosting the combined company’s revenues. Symantec revealed that the combined entity’s revenues would have been $4.4 billion in fiscal 2016 as against $3.6 billion it reported as a standalone company.

Moreover, the transaction is anticipated to help Symantec realize approximately $150 million of cost synergies by the end of fiscal 2018. This will be in addition to cost savings of $400 million under its previously announced cost-efficiency program.

The Blue Coat acquisition will also end Symantec’s search for a new Chief Executive Officer (CEO). The company has been looking for the new CEO ever since Mike Brown announced his intension of stepping down from his post following dismal fourth-quarter fiscal 2016 results. The current CEO of Blue Boat, Greg Clark, will assume the position of the CEO of the combined company once the deal is successfully completed.

The transaction has made way for further finances too. Bain Capital has agreed to purchase $750 million worth of noncallable and unsecured convertible notes in Symantec at an initial conversion price of $20.41. Moreover, private equity firm Silver Lake has decided to double its investment in the company to $1 billion by buying $500 million worth of 2% convertible notes due 2021.

In Conclusion

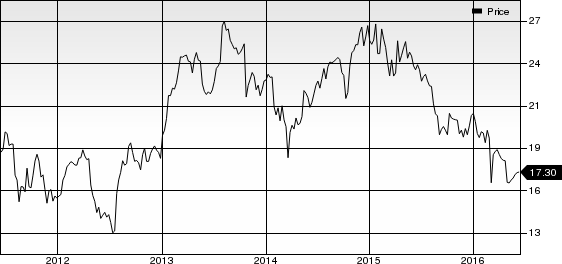

Of late, Symantec’s top and bottom line has been under pressure due to persistent weakness in PC sales, which hurt its core Norton Anti-virus software business. Apart from this, intensifying competition from Palo-Alto Networks (NYSE:PANW) , FireEye Inc. (NASDAQ:FEYE) and Check Point Software (NASDAQ:CHKP) has been eroding its market share in the enterprise segment.

As a result, the company has been aggressively restructuring its business. In doing so, on Jan 29, the company closed the sale of its Veritas business for $7.4 billion to Carlyle Group (NASDAQ:CG). We believe that the deal provided Symantec with much needed funds to continue expanding its product portfolio as well as its presence in the fast growing markets.

With the acquisition of Blue Coat, the company will be able to reduce its dependence on the PC market and strengthen its position in the enterprise security market. Revenues from the enterprise security segment will now contribute 62% to the company’s top line.

We expect the latest acquisition to contribute to the company’s overall growth.

Currently, Symantec carries a Zacks Rank #3 (Hold).

CHECK PT SOFTW (CHKP): Free Stock Analysis Report

SYMANTEC CORP (SYMC): Free Stock Analysis Report

PALO ALTO NETWK (PANW): Free Stock Analysis Report

FIREEYE INC (FEYE): Free Stock Analysis Report

Original post

Zacks Investment Research