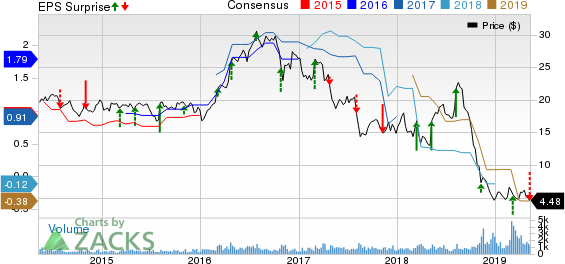

Superior Industries International, Inc. (NYSE:SUP) reported adjusted loss of 22 cents in first-quarter 2019, wider than the Zacks Consensus Estimate of loss of 15 cents. The company reported adjusted earnings per share of 15 cents in first-quarter 2018.

Net sales were $357.7 million in the reported quarter, missing the Zacks Consensus Estimate of $364 million. The reported figure was lower than $386.4 million recorded in the year-ago quarter. This quarterly decline was due to lower volume, weaker Euro and reduced aluminum prices, which were partly offset by improved product mix.

During the first quarter, the company’s wheel unit shipments declined 9.17% year over year to 5 million. This decline primarily resulted from reduced shipments in North America, with some softness in Europe. Gross profit fell to $33.1 million from $50 million in the year-ago quarter.

Selling, general and administrative expenses contracted to $14.5 million in first-quarter 2019 from $22.4 million a year ago due to reduced integration-related expenses.

Financial Details

At the end of the reported quarter, Superior Industries’ net cash provided by operating activities was $28.7 million compared with $14.4 million in the year-ago period. Capital expenditure totaled $13.4 million, marking a decrease from $22.7 million recorded in the prior-year quarter.

Outlook

Superior Industries reiterated its guidance for 2019. It projects unit shipments of 19.85-20.30 million, which are likely to drive net sales to $1.42-$1.47 billion. Value-added sales are projected to be $765-$805 million. Adjusted EBITDA is expected to be $170-$185 million. Further, capital expenditure is projected to be around $85 million while cash flow from operation is expected to be $125-$145 million.

Over the past month, shares of Superior Industries have underperformed the industry it belongs to. During that period, shares of the company have declined 6.1% against the industry’s growth of 4%.

Zacks Rank & Stocks to Consider

Superior Industries currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the auto space are AB Volvo (OTC:VLVLY) , Fox Factory Holding Corp. (NASDAQ:FOXF) and PACCAR Inc. (NASDAQ:PCAR) . While Volvo currently sports a Zacks Rank #1 (Strong Buy), Fox Factory and PACCAR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Volvo has an expected long-term growth rate of 5%. Over the past three months, shares of the company have gained 5.6%.

Fox Factory has an expected long-term growth rate of 16.4%. Over the past three months, shares of the company have gained 20.6%.

PACCAR has an expected long-term growth rate of 6.4%. Share price of the company has increased 5.6% in the past three months.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

Superior Industries International, Inc. (SUP): Free Stock Analysis Report

AB Volvo (VLVLY): Free Stock Analysis Report

Original post

Zacks Investment Research