Alphabet Inc. (NASDAQ:GOOGL) is slated to report fourth-quarter 2018 results on Feb 4.

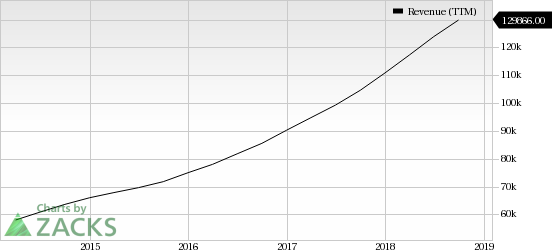

Google’s expanding ad services portfolio, robust search engine, improving search features and strategic partnerships are expected to drive its ad revenues. Moreover, Google Cloud is recording substantial revenue growth, reflecting ongoing momentum in the business.

Both the factors are expected to drive Alphabet’s results in the to-be-reported quarter.

Click here to know how the company’s overall Q4 performance is likely to be.

Strengthening Search Initiatives to Drive Ad Revenues

In the third quarter, Google generated ad revenues of $28.95 billion. Per eMarketer, Google controls almost 37.1% of the total U.S. digital advertising market. Facebook (NASDAQ:FB) , with 19.6% share, holds the second spot.

A plethora of new features namely Featured Videos, Activity Card, Collections, Enhancing Topics, Discover, Image Search, Google Lens and Pathways are aimed at enhancing the search results and modifying the feed content.

Google has introduced Discover feed specific preferences for languages and additional related content features. It is improving job search results by providing information on training programs depending on the type of job being searched and its availability.

Additionally, the company rolled out a new search engine called Dataset Search to primarily cater to the needs of scientists and data journalists.

Moreover, partnerships with the likes of Shopify (NYSE:SHOP) and Mastercard (NYSE:MA) boost Google’s capability to provide relevant user information to advertisers, which they can use to target appropriate audience.

However, the company is facing strict scrutiny from regulators over its search dominance, data privacy and data security policies. CEO Sundar Pichai was grilled by the House Judiciary Committee at Capitol Hill in December, last year.

Moreover, the Republicans were of the view that there is a significant political biasness on Google’s search platform, and hence questions were raised against its search algorithms.

The increasing regulatory scrutiny doesn’t bode well for the ad business. The Zacks Consensus Estimate for fourth-quarter total ad revenues is $32.34 billion.

Data Center Expansion to Boost Cloud Business

Per third-quarter data from Synergy Research, Google gained 1% share over the trailing four quarters in the Cloud Infrastructure Services market, which is currently dominated by Amazon (NASDAQ:AMZN) .

Google has announced plans to set up a data center in Denmark, which will be located just outside of Fredericia. This will mark the company’s fifth data center in Europe. Notably, the search giant will invest €600 million for the development of this new data center, which is likely to be an energy efficient one.

The growing number of data centers not only strengthens Google Cloud’s competitive position but also provides better storage for its vast search data, emails, photos and most importantly cloud data with advanced security.

Alphabet currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Get Free Report

Facebook, Inc. (FB): Get Free Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Get Free Report

Mastercard Incorporated (MA): Get Free Report

Original post

Zacks Investment Research