US and China “miles and miles away” from an agreement

It’s been a mixed week for markets but stocks are in the green in Europe on Friday and US futures are pointing to similar gains at the open.

Trade negotiations between the US and China continue to be a major focal point for investors, with an apparent softening of tensions since the G20 in December contributing to the improved risk appetite we’re currently seeing. The rhetoric coming from these talks has broadly been positive, but this week it has been a little mixed suggesting talks may have stalled with just over a month to go until the 90 day deadline.

Claims on Thursday by Wilbur Ross that the two sides are “miles and miles away” from an agreement with “lots and lots of issues” come on the back of speculation earlier in the week that planned preparatory talks – ahead of a meeting at the end of the month – had been cancelled. This was denied by Larry Kudlow, although that failed to kill suspicions that talks aren’t going as well as previously claimed.

USD pares gains offering support to gold

This is keeping the dollar supported throughout the week, with the greenback having previously performed well when relations have deteriorated. It is paring gains today though, off around 0.2%, but this is probably just a case of profit taking heading into the weekend and a belief that progress is still being made, regardless of any setbacks we may now be seeing.

Gold vs US Dollar Index (Purple)

That’s providing some relief for gold which has been wrestling with $1,280 throughout the week. This has been a challenge against the backdrop of a stronger dollar, which is typically a negative for gold prices. A pause in the stock market has probably helped support gold, with the rally over the last few weeks having weighed on the traditional safe haven. The two key levels here remain unchanged – $1,300 to the upside and $1,280 to the downside – heading into what could be a very turbulent week.

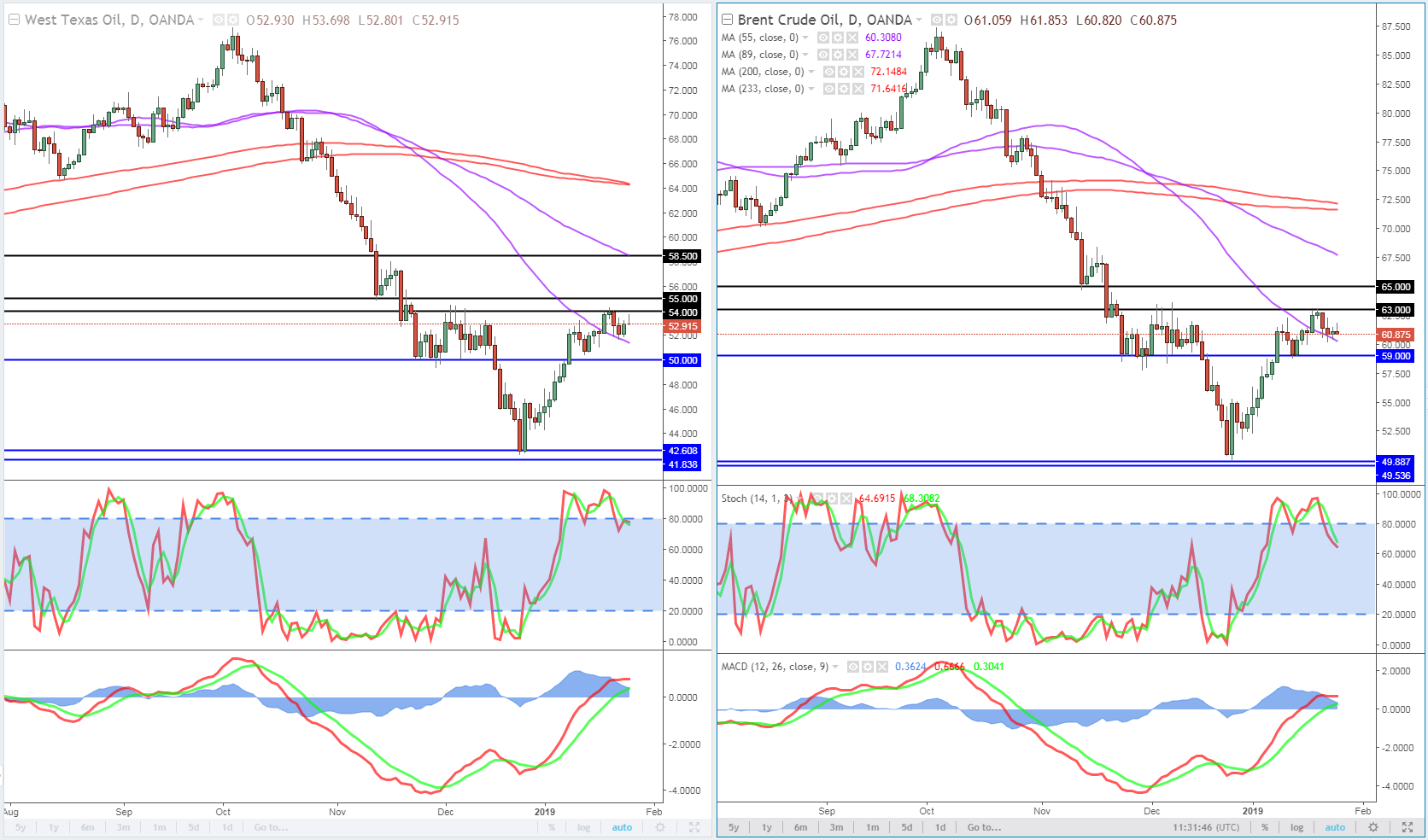

Oil pares gains after significant inventory build

Oil prices have pared gains from earlier in the European session. WTI and Brent had previously traded more than 1% higher, despite EIA having reported a large inventory build – eight million barrels – a day earlier. This comes as tensions escalate over Venezuela, with the US and others no longer recognising Nicolas Maduro as President, much to the disapproval of Russia and China. Both continue to face key resistance around $65 (Brent) and $55 (WTI), a break of which could be the catalyst for a much stronger move higher.

Oil (WTI and Brent) Daily Chart