Conventional wisdom says that rising bond prices are bad for stock prices. Rising bond prices mean falling yields, which should be good for equities. If bonds return little or no yield, then equities—despite being riskier—look more attractive.

But rising bond prices also mean that money is being attracted to the bond market and away from or out of equities. This latter piece is what makes up the conventional view. This view gets fueled in times of turmoil or uncertainty which is what's happening now due to the goings on in Ukraine.

US Treasuries have long been the place of choice to store value when any kind of global unrest occurs. It's called a flight to safety. And with the prospect of a Russian invasion in Ukraine, this enters everyone’s mind. Putin’s activities could very well be keeping a bid under US Treasuries, and may pull money out of equities in the near term. But if your view goes beyond the near term, then it is better to pay closer attention to the actual relationship between US Treasuries and equities.

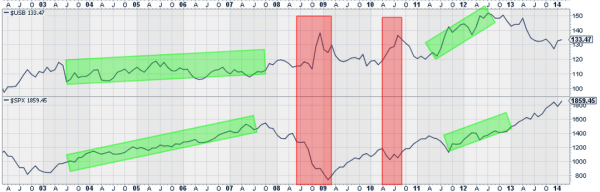

The simple chart above is a good place to start. It shows the monthly prices of both the 30 year US Treasury Bond (upper panel) and the S&P 500 (lower panel) over the last 10 years. There is indeed evidence in this chart for the conventional view. The most prominent is the red bar from 2008 into 2009, at the height of the Financial Crisis. This is easy to label as a flight to safety. There is also a red bar in 2010 corresponding to the PIIG’s (Portugal, Italy, Ireland and Greece) crisis in the eurozone. What is interesting about these two red bars is that they occurred with US Treasuries spiking quickly and the 'flight' was short lived. The second one barely had any impact on the US equity move higher. (Mental note: this occurred across the eurozone, not just one country, like Ukraine). So the conventional wisdom is not totally off base.

But perhaps more interesting are the two green boxes. These are times when equities and US Treasuries both moved higher. The most recent such instance was in 2012 took place over the course of 12 months. But looking back at the period from mid-2003 to mid-2007, there was a four year stretch when this same thing happened. That is four years of moving against the conventional wisdom.

No one can say if the current, joint move higher of equities and US Treasuries will last four years or will result in a 2008-like spike and divergence, but what is clear is that betting that equities will fall just because US Treasuries are rising is a fool's game.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.