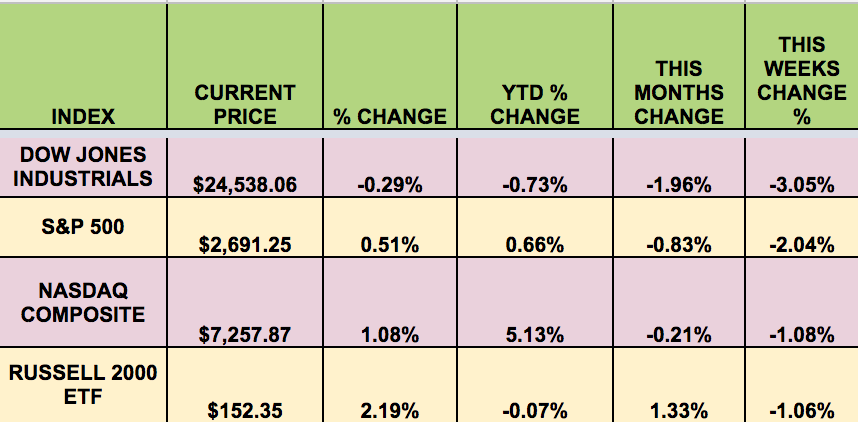

Markets: It was a rough week and month for the market, with all 4 indexes reversing and going into the red. Loweroil prices, steel tariffs, fears of global trade wars, and rising rate fears all served to dampen investor spirits.

“U.S. stocks fell sharply on Tuesday after Federal Reserve Chairman Jerome Powell’s comments on strengthening economy and inflation boosted bets the central bank would squeeze in a fourth rate hike this year.” “(Reuters)

“U.S. stocks sank sharply in another dizzying day of trading after President Donald Trump promised stiff tariffs on imported steel and aluminum, which investors feared could lead to retaliation by other countries and higher inflation. European Commission President Jean-Claude Juncker says the EU will take retaliatory action if Trump goes ahead with his plan to slap tariffs on steel and aluminum imports.

A big fear for investors has been that increasingly nationalistic governments will throw up barriers that will hurt the global economy and trade, as well as profits for U.S. exporters. The biggest U.S. company by market value, Apple (NASDAQ:AAPL), got 63 percent of its sales last fiscal year from foreign markets.

Worries about the possibility of much higher interest rates have been at the center of the market’s troubles in recent weeks. The index is coming off its worst month in two years, when concerns about higher inflation and rates helped trigger a 10 percent drop.” (Source: NY Times).

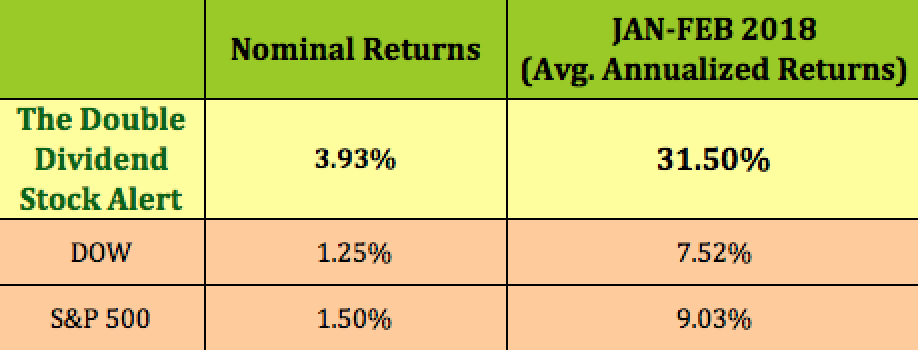

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GBDC, GNL, FDUS, GLPI.

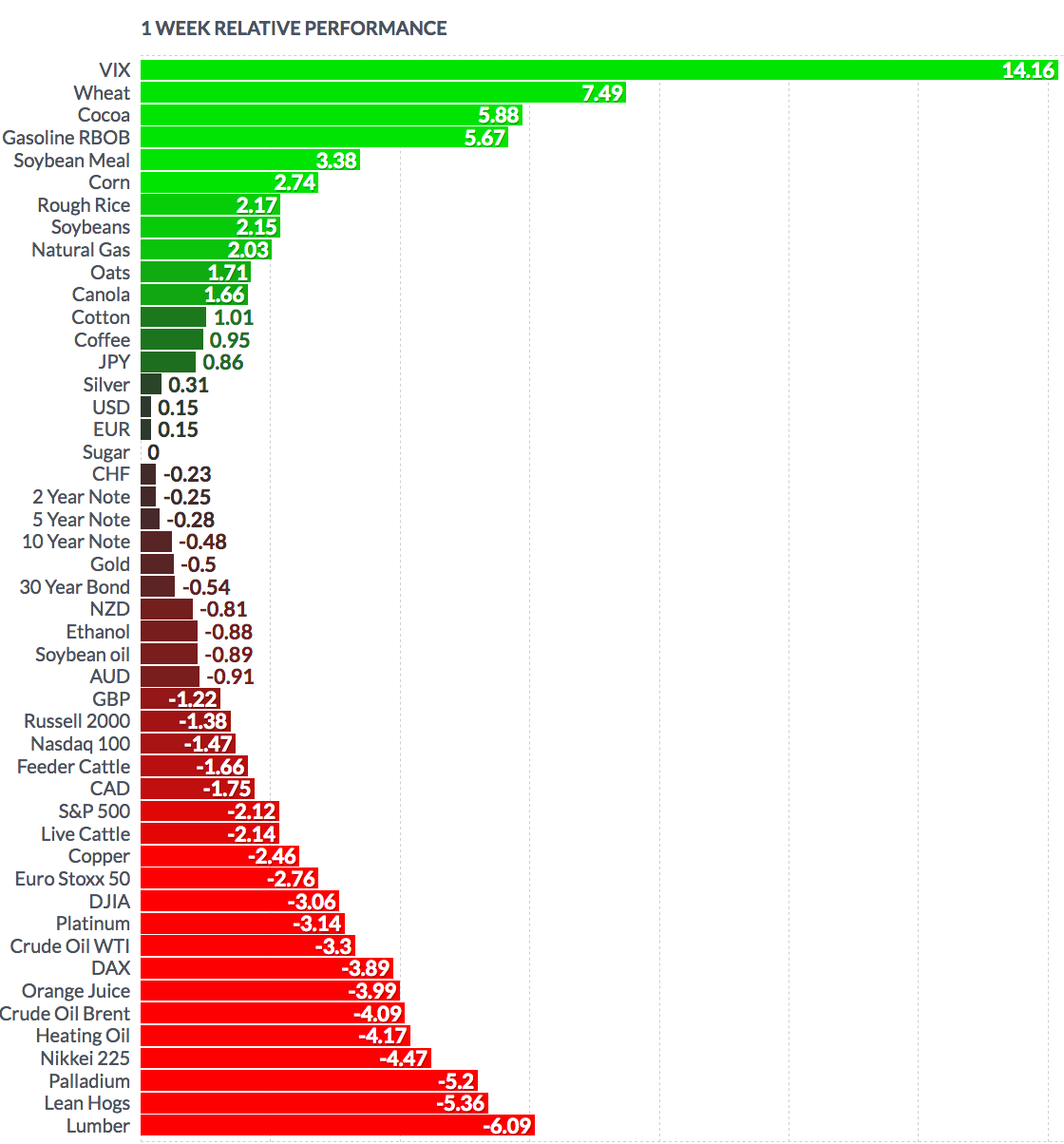

Volatility: The VIX rose 19% this week, ending at $19.59.

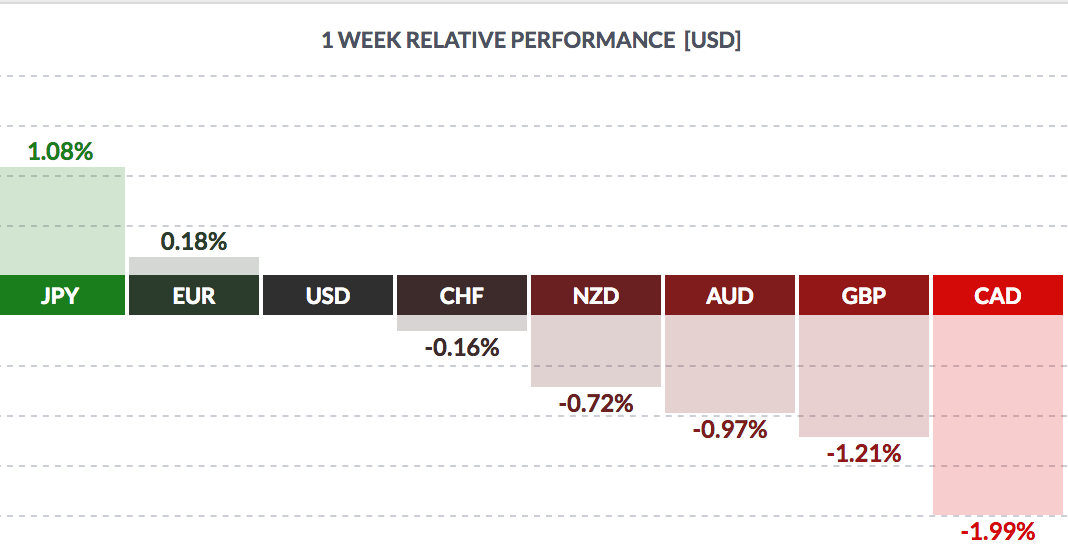

Currency: The dollar rose vs. most major currencies this week, except the yen and the euro.

Market Breadth: In a poor week for market breadth, 3 of the Dow 30 stocks rose this week, vs. 19 last week. 19% of the S&P 500 rose, vs. 69% last week.

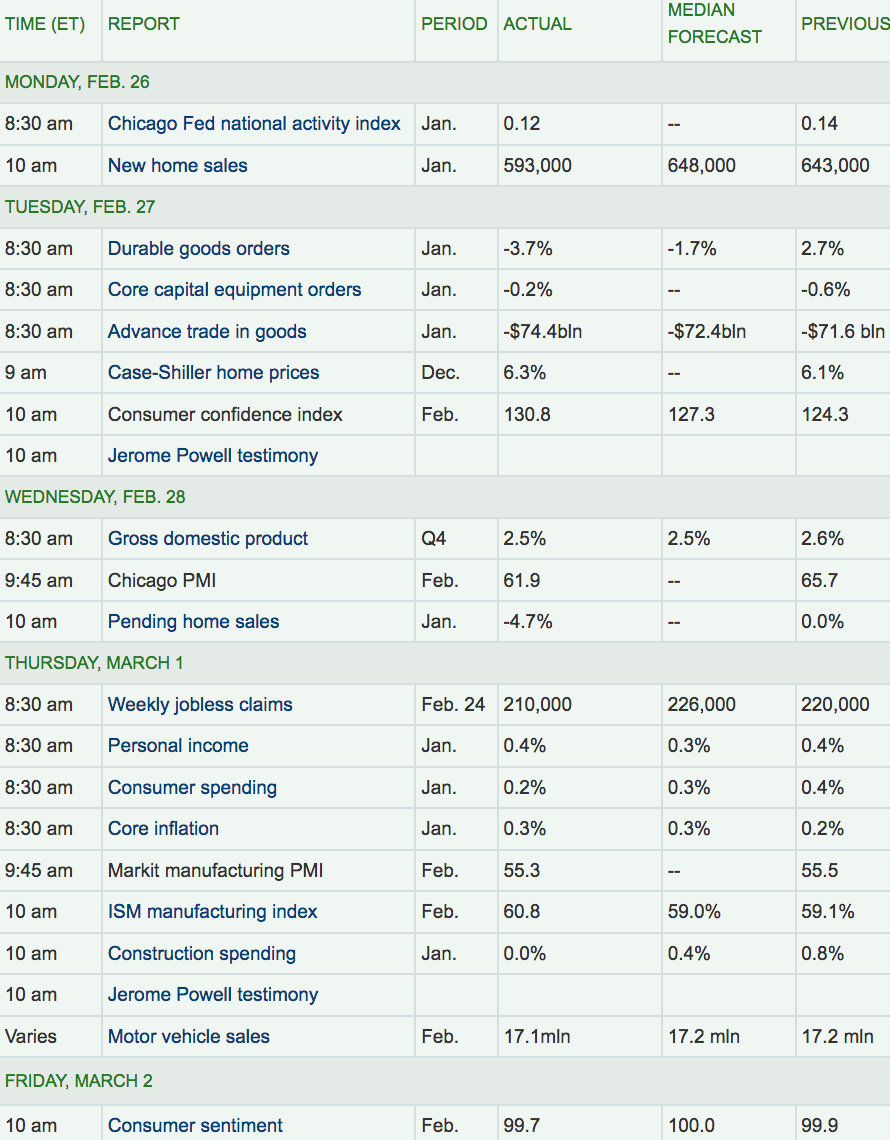

Economic News: “Sales of new U.S. single-family homes fell for a second straight month in January, weighed down by steep declines in the Northeast and South, which could raise concerns the housing market is slowing down.

The weak report from the Commerce Department on Monday came on the heels of data last week showing sales of previously owned homes dropped for a second consecutive month in January amid near record low housing inventory. A severe shortage of houses, especially on the lower end of the market, is pushing up prices and sidelining some first-time buyers.

The Commerce Department said new home sales dropped 7.8 percent to a seasonally adjusted annual rate of 593,000 units last month, the lowest level since August 2017. Economists polled by Reuters had forecast new home sales, which account for nearly 10 percent of the housing market, rising to a pace of 645,000 units last month. Sales tumbled 33.3 percent in the Northeast and plunged 14.2 percent in the South, which accounts for half of the new housing market. They rose 1.0 percent in the West and surged 15.4 percent in the Midwest.”

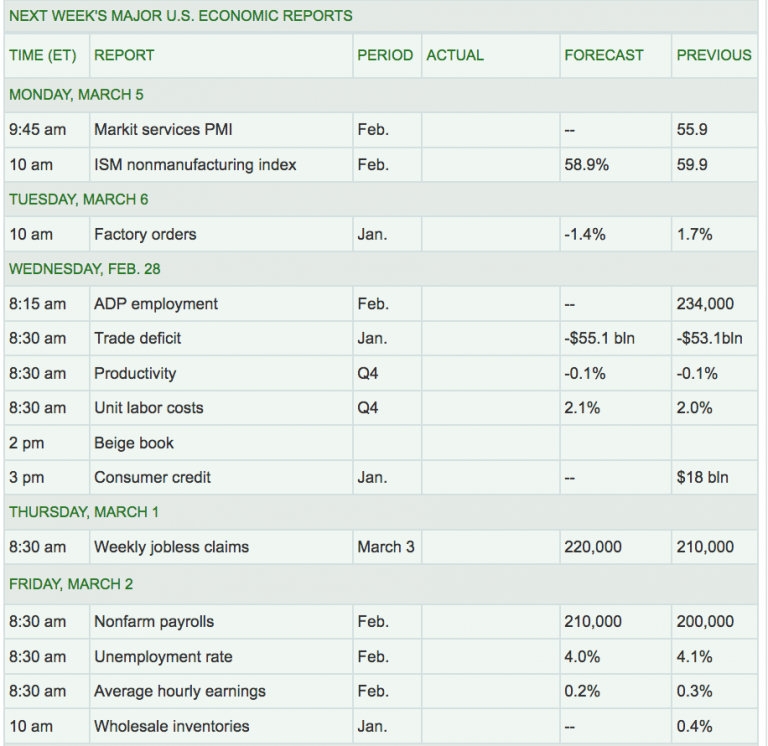

Week Ahead Highlights: The U.S. employment report for February is due out Friday Last month's report revealed surprising wage gains that sparked concerns of inflation, in turn setting off a jump in yields and a drop in stocks.

Next Week’s US Economic Reports: There will also be productivity and unit labor costs data due out on Wednesday, which could fan rate hike fears.

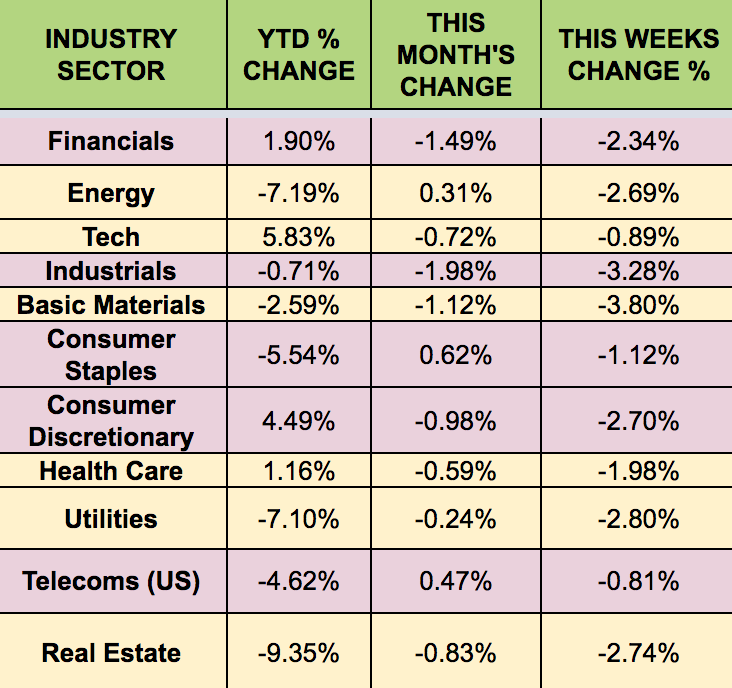

Sectors: Once again, Tech led this week, as all sectors lost ground, with Basic Materials lagging.

Futures:

Given the ongoing political situation in the country, production levels may remain volatile, Jan Edelmann, a commodities analyst at HSH Nordbank AG, said of reduced supply out of Libya.

Prices have also been supported by ongoing rhetoric from the Organization of the Petroleum Exporting Countries and its partners about its commitment to cutting crude production.

OPEC and 10 producers outside the oil cartel, including Russia, have been holding back crude output by 1.8 million barrels a day since the start of last year. The agreement, which is scheduled to last through the end of 2018, helped bolster crude prices by more than 50% in the second half of last year.

WTI crude futures lost 3.3% this week, while Natural Gas gained 2.03%.